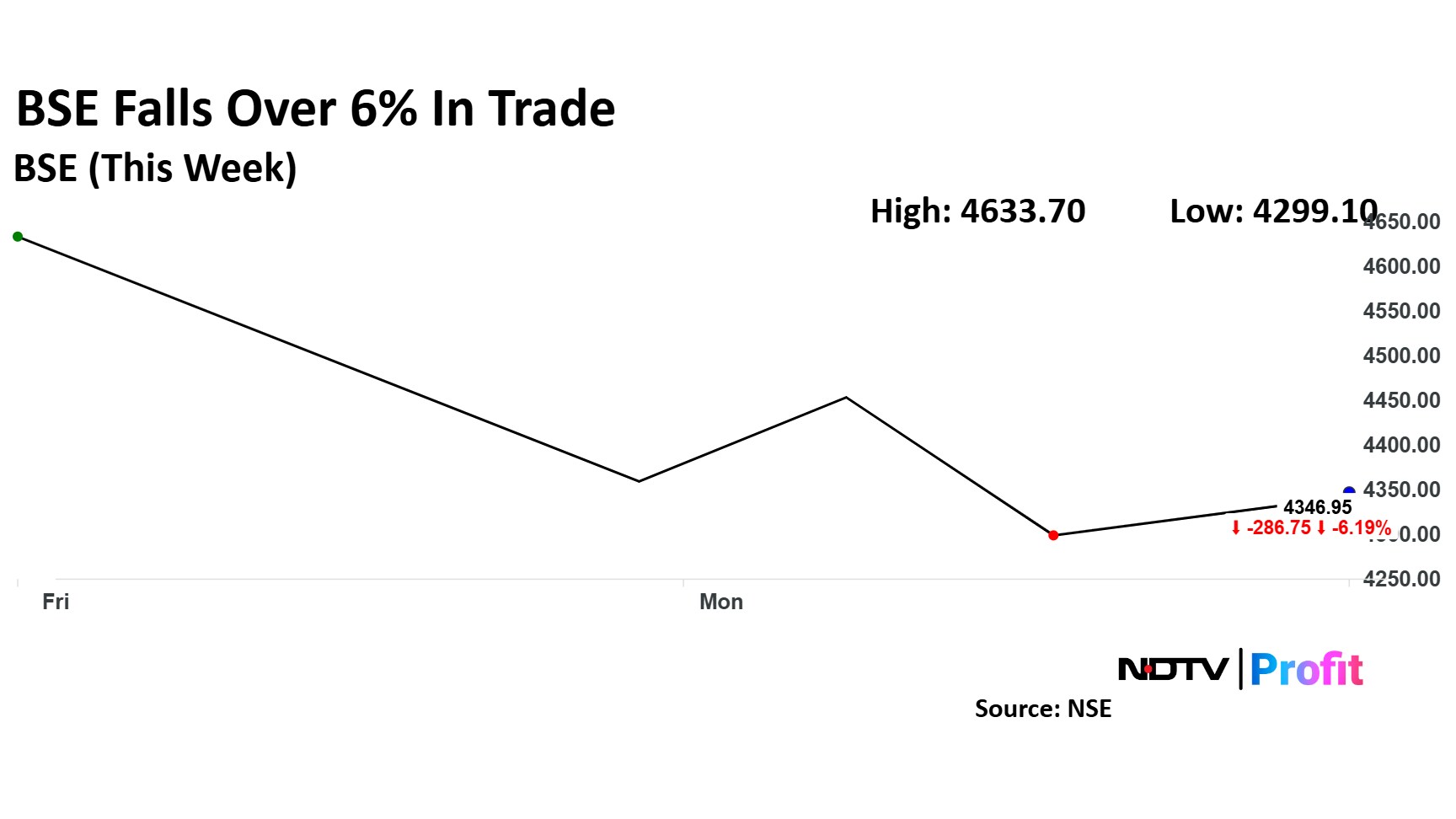

Shares of BSE Ltd. have plunged over 6% this week after NSE changed the weekly expiry date for the futures and options market. This brings a cut in BSE's gains in market share from earlier, when NSE's expiry was Thursday and BSE's was Tuesday.

This change significantly impacts BSE's potential to expand its index options market share, according to the Goldman Sachs, as it is a crucial revenue driver for the exchange. For BSE, approximately 50% of its topline is sourced from options trading.

Goldman Sachs maintained its 'neutral' rating on BSE Ltd. while trimming the target price to Rs 4,230 with a 5% potential downside. This potential share cap would act as a loss of tailwind for BSE's topline, on top of the shrinking industry volumes within options trading, the brokerage said.

BSE Share Price

BSE shares have fallen as much as 16.31% since Feb. 27. They were trading 0.37% higher at Rs 4,318.5 apiece, compared to a 0.12% advance in the benchmark Nifty 50 as of 10:39 a.m. on Thursday.

The stock has risen 87.9% in the last 12 months. Total traded volume so far in the day stood at 2.1 times its 30-day average. The relative strength index was at 33.3.

Eight of the 11 analysts tracking the stock have a 'buy' rating, two recommend a 'hold' and one suggests a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 6,153.1, implying an upside of 42%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.