- Britannia Industries share price dropped sharply after CEO transition announcement

- Natarajan Venkataraman appointed interim CEO until December 15, 2025

- Rakshit Hargave will become full-time MD and CEO starting December 2025

Share price of Britannia Industries Ltd. saw a steep decline in early trade on Tuesday, after the company shifted hands from chief executive officer, Varun Berry to his incumbent, Natarajan Venkataraman.

Venkataraman hold the interim charge till Dec. 15, 2025, when Rakshit Hargave is scheduled to take over as Britannia's MD and CEO. Hargave, whose appointment was confirmed last week, had earlier served as the CEO of Birla Opus, the paints venture of Aditya Birla Group.

Berry, the departing MD and CEO, was associated with Britannia for the last 12 years. He was elevated to the top managerial position in May this year.

Hargave, who will take over the full-time MD and CEO charge in December, is seen as an industry veteran, with stints at Hindustan Unilever, Jubilant Foodworks, Nestle India and Tata Motors, apart from Birla Opus.

The transition comes at a time when Britannia's board has chalked out its strategy for the next phase of growth. The company aims to become a "global total foods company" in the coming years, according to a note issued following its board meeting on Nov. 5.

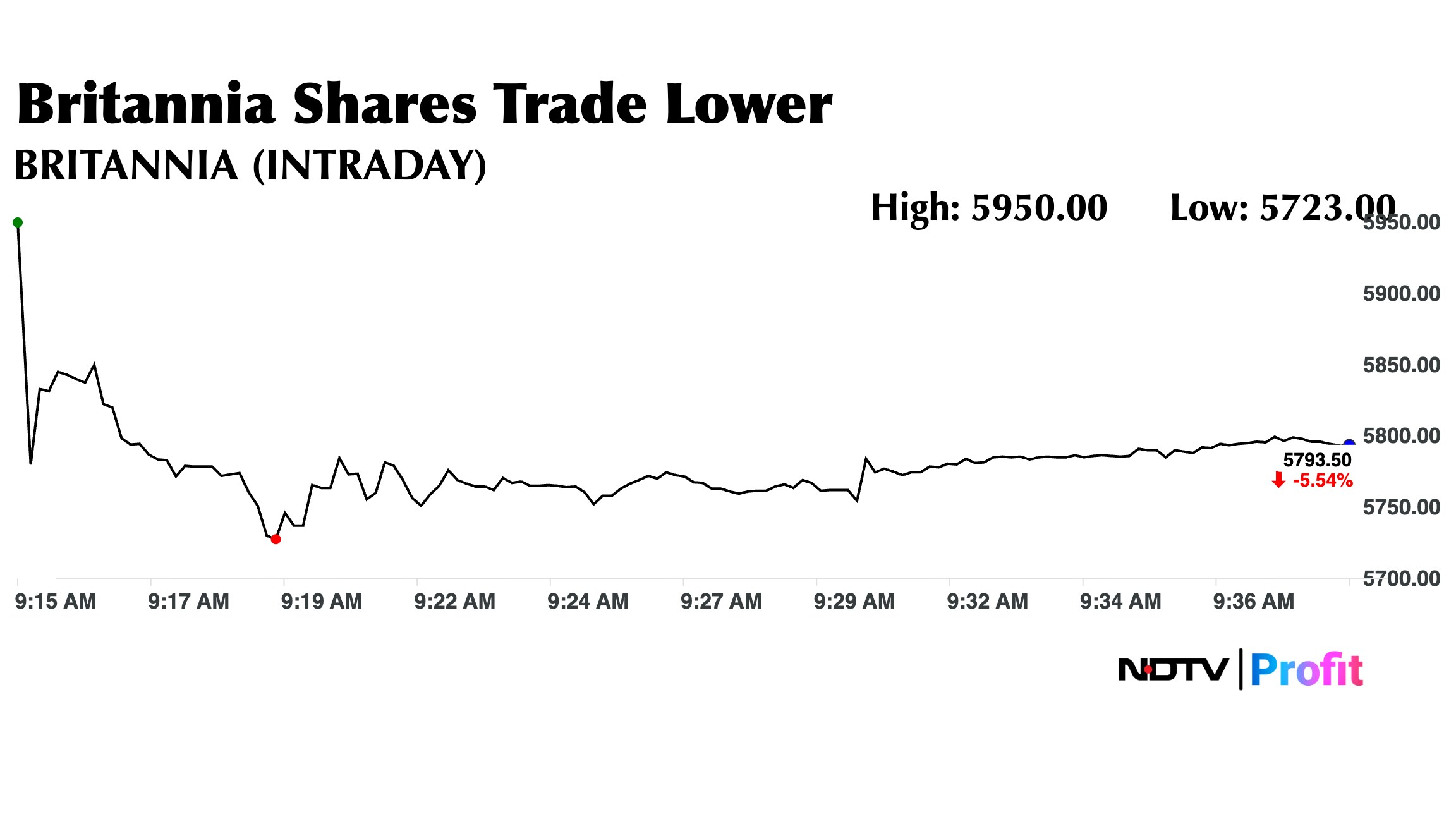

Britannia Share Price Today

The scrip fell as much as 6.7% to Rs 5,723 apiece, before paring losses to trade 4.87% lower at Rs 5,835 apiece, as of 9:45 a.m. This compares to a 0.24% decline in the NSE Nifty 50 Index.

It has risen 22.36% on a year-to-date basis, and 7.23% in the last 12 months. Total traded volume so far in the day stood at 2.89 times its 30-day average. The relative strength index was at 67.79.

Out of 40 analysts tracking the company, 28 maintain a 'buy' rating, 10 recommend a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 14.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.