.jpg?downsize=773:435)

Shares of BLS International Services Ltd. surged over 8% on Tuesday after its profit surged 70% in the first quarter of the current financial year.

The tour and travel-related services company reported a net profit of Rs 121 crore for the quarter ended June, compared to Rs 71 crore in the same quarter of the previous fiscal year, according to its stock exchange notification.

Revenue increased by 29% year-on-year for the three months ended June, reaching Rs 493 crore. The Ebitda margin for the company expanded to 27.2% from 20.7% during the same period last year.

The company's board also approved raising up to Rs 2,000 crore via qualified institutional placements or by other means.

The international travel industry continues to grow, bolstered by increased business confidence and measures that facilitate travel, as well as improved air connectivity and higher capacity, according to Shikhar Aggarwal, joint managing director.

"Consequently, this will drive a rise in visa application demand and present an opportunity to obtain additional new contracts and penetrate additional markets."

In addition, the company continues to focus on inorganic growth initiatives, wherein we will be targeting synergistic tech-enabled businesses, Aggarwal said.

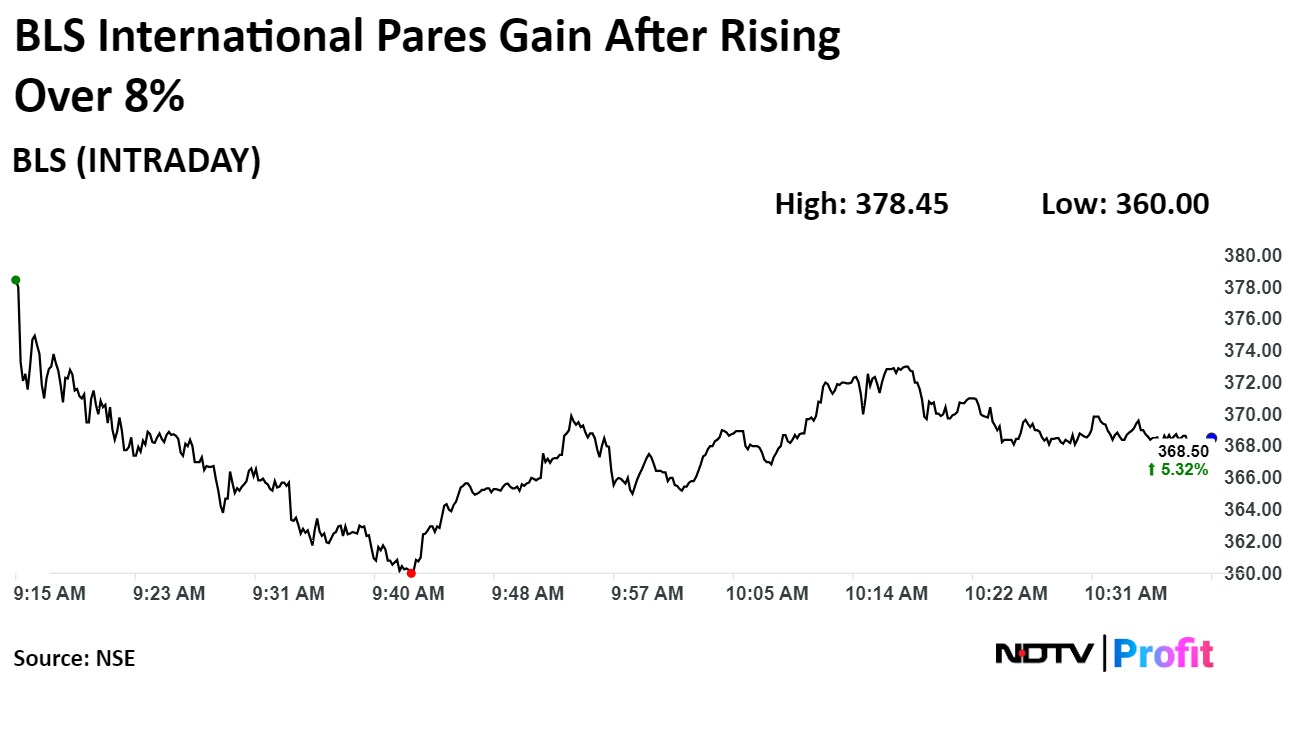

Shares of BLS International Services rose as much as 8.1% during the day to Rs 378.4 apiece on the NSE. It was trading 5.3% higher at Rs 368.5 apiece, compared to a 0.58% advance in the benchmark Nifty 50 as of 10:36 a.m.

The stock has risen 50% in the last 12 months and 15% on a year-to-date basis. The total traded volume so far in the day stood at 6.3 times its 30-day average. The relative strength index was at 56.

One analyst tracking the company have a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 39%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.