Bharat Heavy Electricals Ltd.'s share price rose 2.36% after the company announced a major order win from M.P. Power Generating Company Ltd. On Tuesday.

The order if for the development of two large-scale supercritical thermal power plants in Madhya Pradesh. The Notification of Award (NOA), received on September 29, 2025, pertains to the Engineering, Procurement and Construction (EPC) works for the 1x660 MW Amarkantak Unit 6 and 1x660 MW Satpura Unit 12 thermal power projects.

The contract was secured by BHEL through competitive open tender process. These projects will be executed over a period of 57 months from the date of award and involve comprehensive EPC responsibilities including supply of equipment, civil works, erection, and commissioning.

The total value of the contracts is estimated to be in the range of Rs 13,000 crore to Rs 15,000 crore, excluding taxes and duties. The orders have been placed by a domestic entity, and BHEL has clarified that there is no promoter or group company interest in MPPGCL. The transactions do not fall under related party deals.

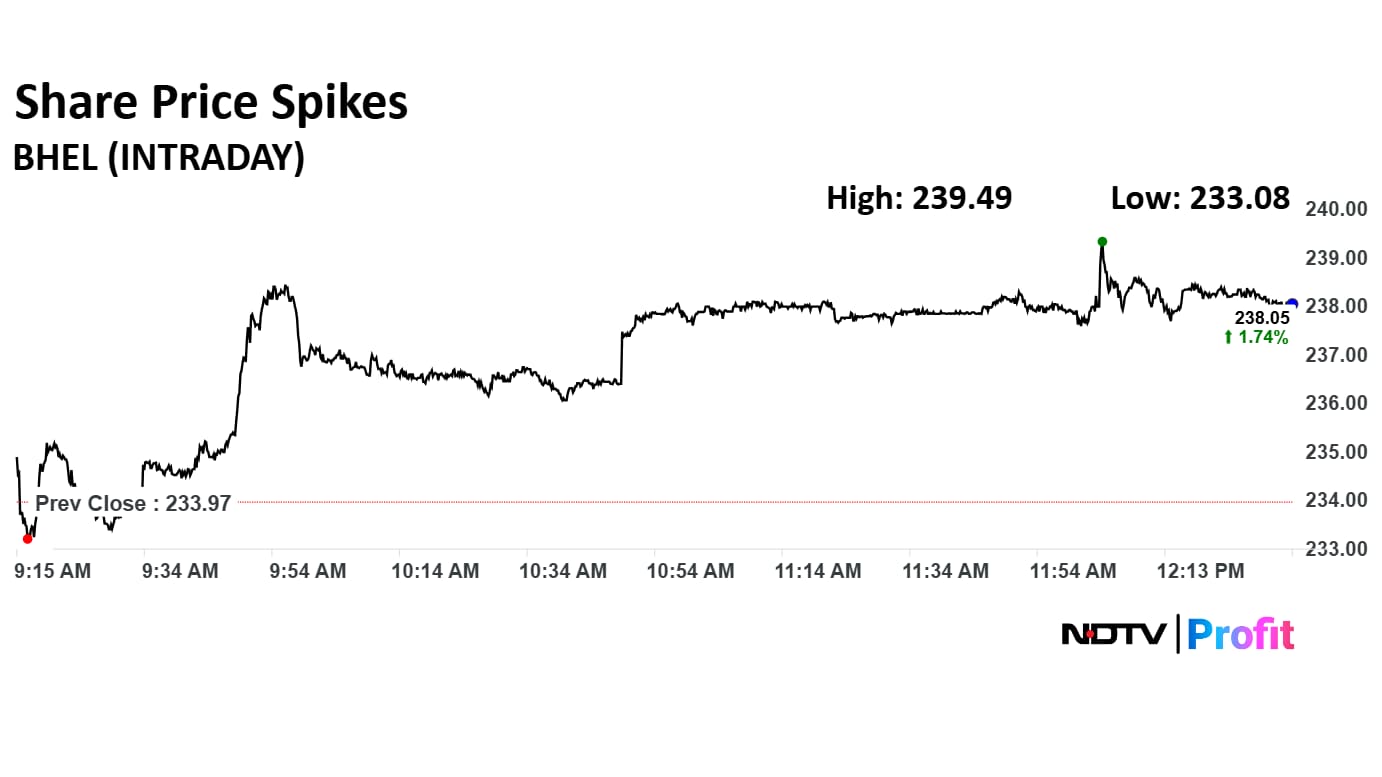

The scrip rose as much as 2.36% to Rs 239.49 apiece. It pared gains to trade 1.80% higher at Rs 239.49 apiece, as of 12:30 a.m. This compares to a 0.17% advance in the NSE Nifty 50 Index.

It has fallen 14.84% in the last 12 months. Total traded volume so far in the day stood at o.43 times its 30-day average. The relative strength index was at 60.

Out of 20 analysts tracking the company, eight maintain a 'buy' rating, three recommend a 'hold,' and nine suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 8.4%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.

.jpeg?im=FeatureCrop,algorithm=dnn,width=350,height=197)