.jpg?downsize=773:435)

Bharti Airtel's share price rose over 2% on Wednesday, following the announcement of an expanded partnership with Nokia to enhance its core network capabilities and accelerate the delivery of new 5G services.

The collaboration involves the deployment of Nokia's Packet Core appliance-based and Fixed Wireless Access solutions, aimed at providing a superior network experience for Airtel's growing 4G and 5G customer base.

The expanded partnership will enable Airtel to seamlessly integrate 5G and 4G technologies into a single set of servers, optimising its hardware footprint and reducing the cost per bit. Nokia's FWA solutions will provide additional capacities for home broadband and enterprise-critical application services, enhancing Airtel's ability to meet the increasing demand for data.

Airtel plans to utilise Nokia's automation framework to achieve zero-touch service launch and efficient lifecycle management for core network functions. This will allow Airtel to deliver new services faster, while reducing network operational costs. The use of Nokia's converged Packet Core solution for 5G standalone readiness will further simplify Airtel's network architecture and support its evolution towards advanced 5G capabilities.

The multi-year deal covers network automation across the majority of Airtel's service regions in India. The collaboration also includes advancing autonomous networks by leveraging GenAI for service orchestration and assurance, positioning Airtel to better address the dynamic needs of its customers.

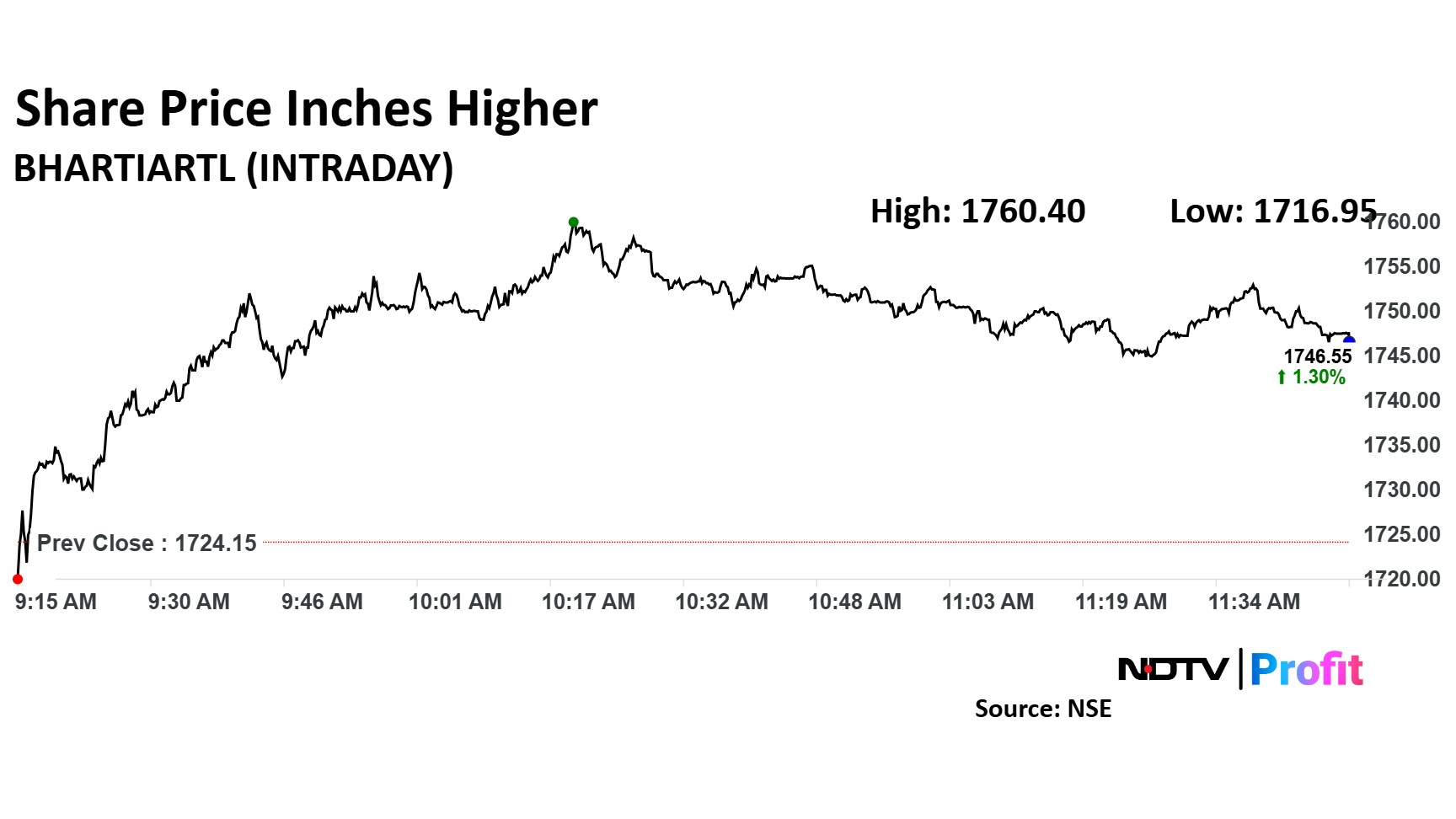

Bharti Airtel Share Price Today

Shares of Bharti Airtel rose as much as 2.10% to Rs 1,760.40 apiece. It pared gains to trade 1.35% higher at Rs 1,747.35 apiece, as of 11:48 a.m.

The stock has risen 44.62% in the last 12 months. The relative strength index was at 64.

Out of 35 analysts tracking the company, 30 maintain a 'buy' rating, three recommend a 'hold' and two suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.