- Shares of Bharat Electronics rose after Indian Army issued Rs 30,000 crore tender for missile defence systems

- Army plans to acquire five to six regiments of Anant Shastra surface-to-air missiles for border defence

- Anant Shastra missile is developed by DRDO and co-produced by Bharat Electronics and Bharat Dynamics

Shares of Bharat Electronics Ltd. rose during early trade on Monday after media reports said the Indian Army issued a tender worth Rs 30,000 crore to buy missile defence systems.

The army will acquire five to six regiments of 'Anant Shastra' surface-to-air missiles to strengthen air defence along India's long borders with Pakistan and China, news agency ANI reported.

The missile is developed by the Defence Research and Development Organisation and will be co-produced by government-owned BEL and Bharat Dynamics Ltd. Anant Shastra, earlier known as the Quick Reaction Surface to Air Missile system, is capable of searching and tracking targets while on the move and can fire even during short halts. It has a range of around 30 kilometres.

Analysts at brokerage Motilal Oswal said the order enhances BEL's order book to more than Rs 1 lakh crore. The execution will commence primarily from fiscal 2027 onward, and the award for the QRSAM will flow through to Bharat Dynamics.

They said next-generation corvettes, electronics warfare, and follow-on orders for electronics for 97 Tejas Mk1A jets may also be in the offing.

The brokerage has a target price of Rs 490, implying a 24% potential upside.

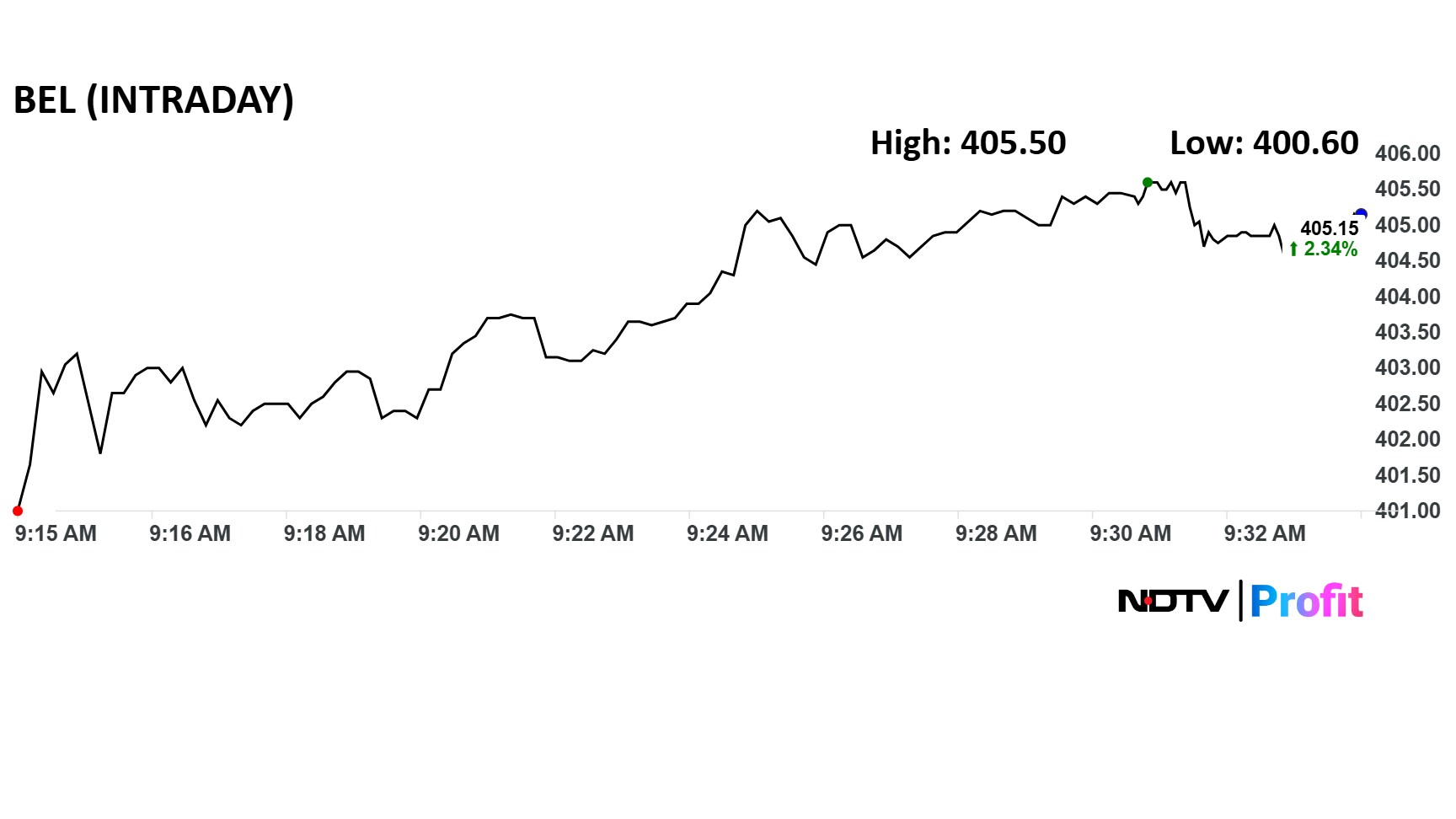

BEL Share Price Movement

Bharat Electronics' share price jumped as much as 2.85% to Rs 407.2 apiece, compared to a 0.4% surge in the benchmark Nifty 50. The relative strength index was 71. The total traded value was Rs 231 crore.

The stock has risen 38% both on a 12-month and a year-to-date basis.

Out of the 28 analysts tracking BEL, 24 have a 'buy' rating on the stock, two recommend a 'hold' and three suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price target implies a potential upside of 7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.