Shares of defence PSU Bharat Electronic Ltd. are in focus on Monday, after the company posted a strong set of numbers for the September quarter in the last trading session.

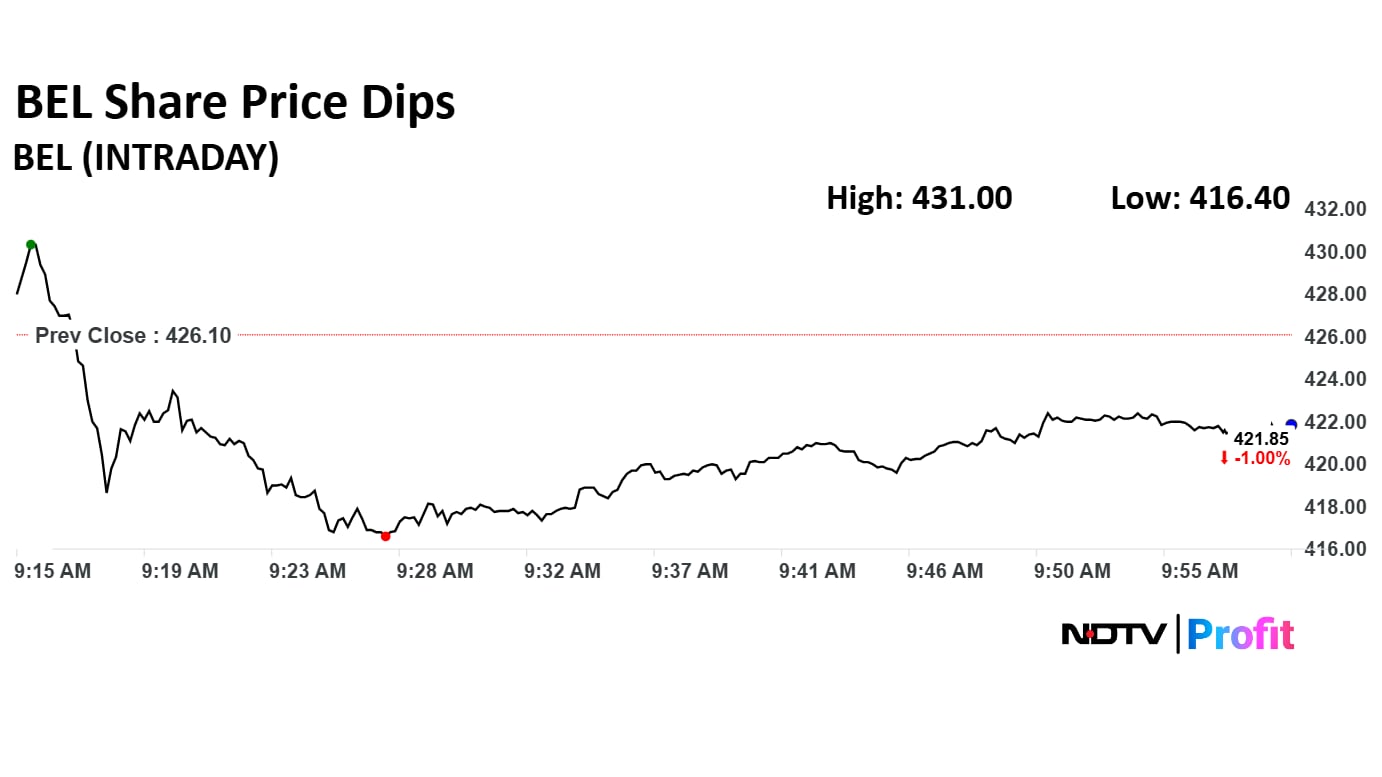

BEL's share price slipped as low as 2% in early trade on Monday, to Rs 416.40 apiece, and is now down 1.3% at Rs 420.35 apiece.

The company had reported a nearly 26% advance in net profit to Rs 1,287.77 crore in the July-September quarter, compared to Rs 1,092.45 crore in the corresponding period last year.

The bottom line was the Bloomberg analysts' consensus estimate of Rs 1,085 crore.

Post the surprised beat, Morgan Stanley maintained a bullish stance on Bharat Electronics Ltd. Robust order book and strategic pivot towards high-margin, next-generation defence products, forecasting continued earnings growth despite elevated valuations, the brokerage said in a note.

Bharat Electronics' secured revenue base from the order book, higher margin from new products, and better execution is expected to help in sustaining the earning momentum. Hence, Morgan Stanley expects the positive outlook will continue.

Jefferies also sees the company's Q2 earnings as an all-around beat, and terms BEL as the market leader in domestic defence electronics and benefits from spend across the triservices.

BEL Q2FY26 Highlights (Consolidated, YoY)

Revenue up 25.78% at Rs 5,792.09 crore versus Rs 4,604.9 crore crore (Estimate: Rs 5,439 crore).

Ebitda up 21.58% to Rs 1,702.17 crore versus Rs 1,399.95 crore (Estimate: Rs 1,425 crore).

Margin at 29.38% versus 30.4% (Estimate: 26.2%).

Net profit up 17.87% to Rs 1,287.77 crore versus Rs 1,092.45 crore (Estimate: Rs 1,085 crore).

Shares of BEL have grown 43.82% year-to-date, and 46.08% in the last 12 months. 27 out of the 32 analysts tracking the company have a 'buy' rating on the stock. Two recommend a 'hold' while three recommend 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock implies an upside of 11.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.