Bharat Electronics Ltd. saw its share price rise after JPMorgan reiterated its 'overweight' rating on the stock. The brokerage highlighted BEL's strong structural growth prospects and consistent performance as key factors behind its positive outlook.

Over the past six months, BEL's stock price has decreased by 4%, but over the past year, it has increased by 30%. During these periods, BEL's stock has performed better than the Nifty 50, beating it by 6% over the past six months and by 30% over the past year. Despite a recent 20% correction from its peak, JPMorgan views this as a good entry opportunity, citing BEL's diversified and consistent play in India's defence capital expenditure.

The brokerage expects BEL's revenue, Ebitda, and profit after tax to grow at compound annual growth rates of 15%, 17%, and 16% respectively, over FY24-FY27, with an average return on equity of over 25%.

BEL is anticipated to announce orders worth Rs 12,000 by the end of March, which could act as a near-term catalyst for the stock price. As a market leader in India's defence electronics space, BEL benefits from its long-standing presence, government ownership, and strong relationships with other government entities involved in defence technology development.

BEL's core competencies in electronics and related systems development enable it to participate across all three defence forces, reducing volatility in order inflow and revenue. The company's civilian revenue, accounting for 13-15% of total revenue, allows it to tap into growing sectors such as metro rail and airports. BEL is also well-positioned to grow through export opportunities due to its technical capabilities and smaller system sizes, the brokerage noted.

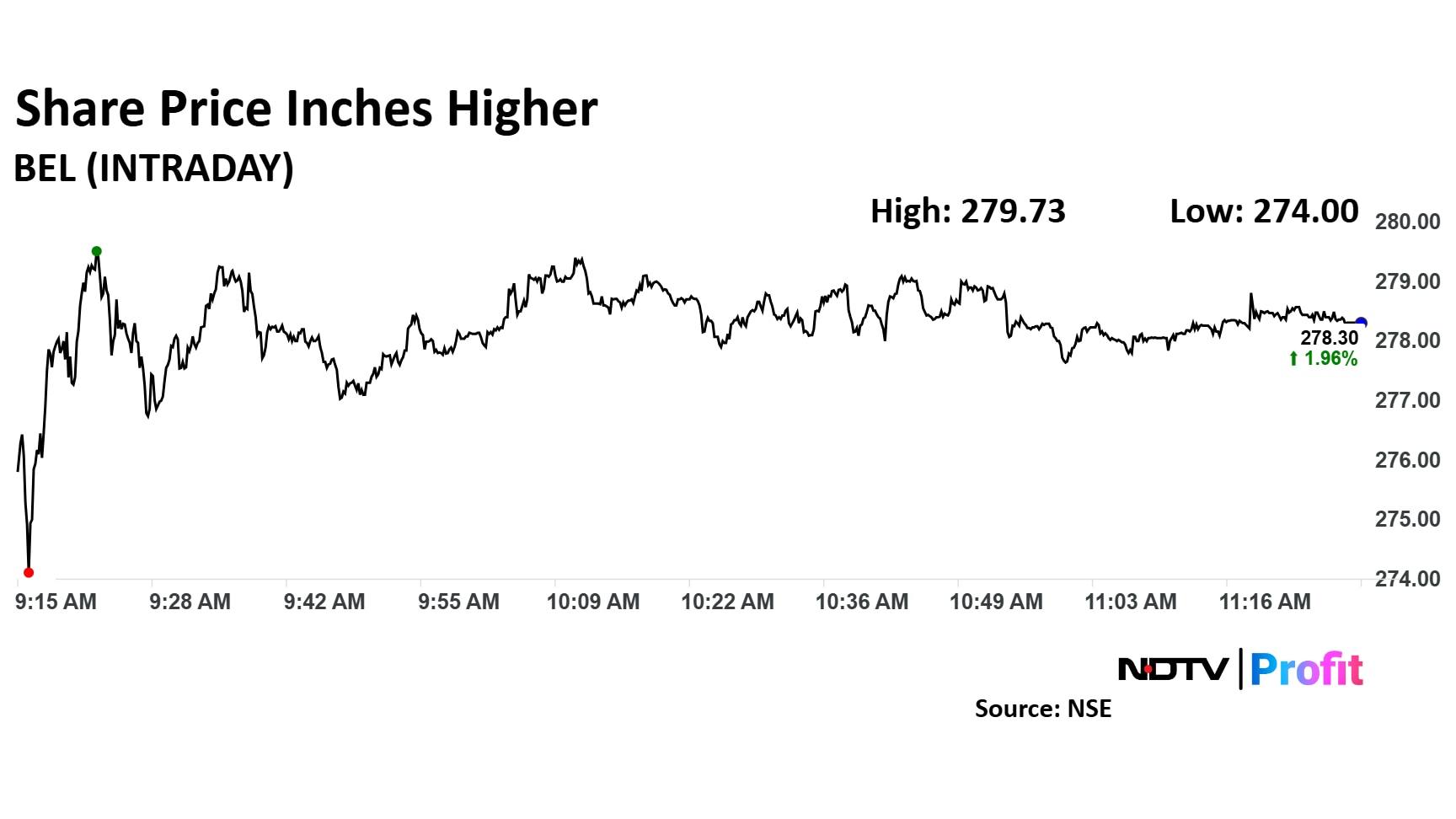

BEL Share Price

BEL share price rose as much as 2.48% to Rs 279.73 apiece. It pared gains to trade 2.02% higher at Rs 278.45 apiece, as of 11:27 a.m. This compares to a 0.26% advance in the NSE Nifty 50.

The stock has risen 29.39% in the last 12 months. The relative strength index was at 58.

Out of 26 analysts tracking the company, 23 maintain a 'buy' rating, one recommends a 'hold' and two suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 22.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.