Shares of Bharat Dynamics Ltd. rose over 3% on Wednesday after it won a contract worth Rs 4,362.23 crore for supply of armaments. The time period and terms of the contract were not released in the exchange filing.

The contract has been received from the Ministry of Defence for the Indian armed forces, the company said in the regulatory filing.

Earlier, the state-run defence manufacturer had disclosed that its order book as of September 2024 stood at Rs 18,852 crore. In addition, the company had noted that it has an order pipeline of Rs 20,000 crore that it expects to receive in the next two-three years.

Bharat Dynamics' export order position as of Sept. 30 stood at Rs 2,445 crore, as revealed earlier in an investor presentation by the company.

Bharat Dynamics Q3 Performance

Bharat Dynamics' standalone net profit had risen by 9% to Rs 147 crore in the October-December quarter, compared to Rs 135 crore in the year-ago period. Revenue from operations increased 38.3% to Rs 832 crore versus Rs 602 crore last year, as per the financial results declared last month.

On the operating side, earnings before interest, tax, depreciation and amortisation has increased nearly 7% year-on-year to Rs 127 crore. The Ebitda margin had contracted from 19.7% to 15.3%, due to a rise in material cost.

The board had also declared an interim dividend of Rs 4 per share.

Bharat Dynamics Share Price

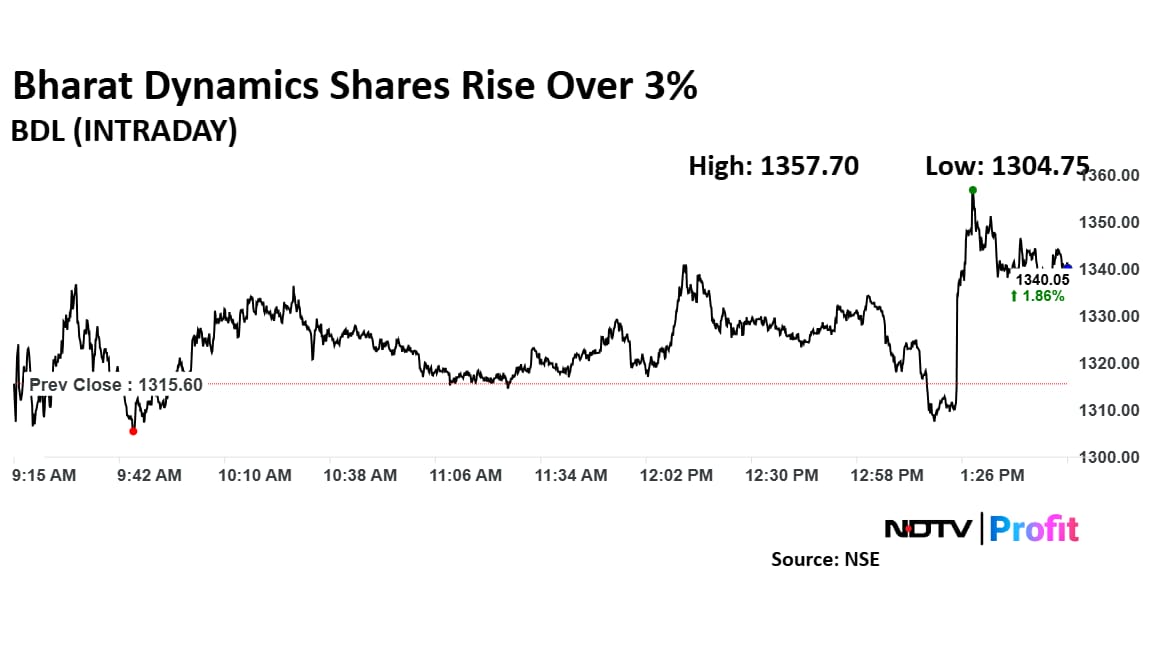

The shares of Bharat Dynamics rose as much as 3.2% on Wednesday to Rs 1,357.70 apiece on the NSE. However, it pared some of the gains to trade 2.05% higher at Rs 1,342.6, as of 1:48 p.m. This compares to a 0.62% decline in the benchmark Nifty 50 index.

The stock has risen by 55.27% in the last 12 months and by 18.39% year-to-date. The relative strength index was at 70.

Out of eight analysts tracking the company, four maintain a 'buy' rating, three recommend a 'hold,' and one suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a potential downside of 4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.