- Bank of Maharashtra shares fell nearly 2% amid ongoing offer-for-sale for retail investors

- Government plans to sell up to 6% stake, including a 1% green shoe option in the bank

- OFS was 400% subscribed for non-retail investors, prompting government to exercise green shoe

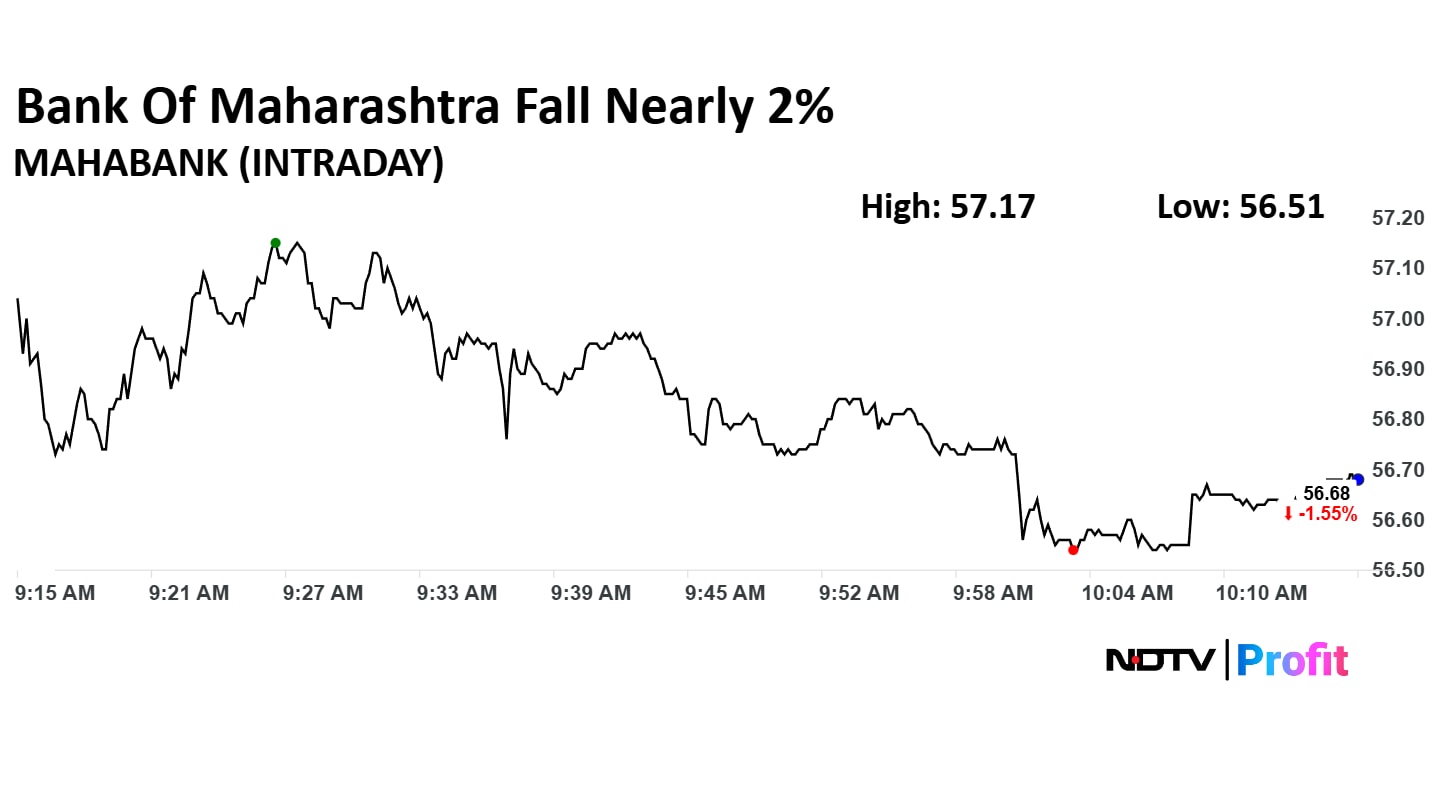

The shares of Bank of Maharashtra fell nearly 2% extending its decline for the fifth day as the offer-for-sale opens for the retail investors on Wednesday.

The government aims to sell up to 6% stake in Bank of Maharashtra via an offer-for-sale. While the government will divest 5% equity in the bank it has offered an additional 1% as a green shoe option.

The OFS was open for non-retail investors on Tuesday. According to the Department of Investment and Public Asset Management's post on X, the OFS was subscribed 400% in comparison to the base size.

"Government has decided to exercise the green shoe option," the post stated further.

The floor price has been fixed as Rs 54 per share. At the current market price, the base offer is worth about Rs 2,200 crore, and the green shoe option may fetch the government an additional amount of around Rs 400 crore.

As per the shareholding data available for the quarter ended September 2025, the Centre held 612.26 crore shares, or 79.6% stake in Bank of Maharashtra.

The remaining 156.89 crore shares, or 20.4% stake, are held by public shareholders.

The OFS will help the government to trim its stake in the state-owned lender below 75%. This would end up increasing the public shareholding above 25%, which is in accordance with the Securities and Exchange Board of India's regulations.

Bank Of Maharashtra Share Price

The scrip fell as much as 1.51% to Rs 56.70 apiece on Wednesday. It pared gains to trade 1.37% lower at Rs 56.78 apiece, as of 10:13 a.m. This compares to a 0.43% decline in the NSE Nifty 50 Index.

It has fallen 0.77% in the last 12 months and risen 8.51% year-to-date. Total traded volume so far in the day stood at 21.35 times its 30-day average. The relative strength index was at 57.14.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.