The board of directors of Bank of India has approved the issue of long term infrastructure bonds for raising of funds up to Rs 20,000 crore during the current fiscal, as per an exchange filing on Thursday.

Infrastructure bonds are used to raise long term debt for infrastructural projects such as highways, bridges, tunnels and public transportation systems.

Recently, the lender had lowered its repo rate by 50 basis points, mirroring the Reserve Bank of India's jumbo rate cut, slashing it from 8.85% to 8.35%.

This development followed the RBI's shift in policy stance from 'accommodative' to 'neutral'. This change indicates a more balanced approach, suggesting that future rate cuts or hikes will be data-driven and dependent on evolving economic conditions.

Bank Of India Q4 Performance

The lender reported an increase in its net profit for the January-March quarter and improving asset quality. Its standalone net profit rose 82.5% on the year to Rs 2,626 crore in the fourth quarter from Rs 1,439 crore.

Bank of India's net interest income rose 2% on year-on-year basis to Rs 6,064 crore in the fourth quarter from Rs 5,936 crore. Operating profit advanced 37.3% on the year to Rs 4,885 crore in the fourth quarter from Rs 3,557 crore in the preceding quarter.

On a sequential basis, the net non-performing assets were at 0.82% compared to 0.85%. Gross non-performing asset was at 3.27% compared to 3.69% in the preceding quarter. Lender's provisions increased to Rs 1,338 crore from Rs 304 crore in the preceding quarter.

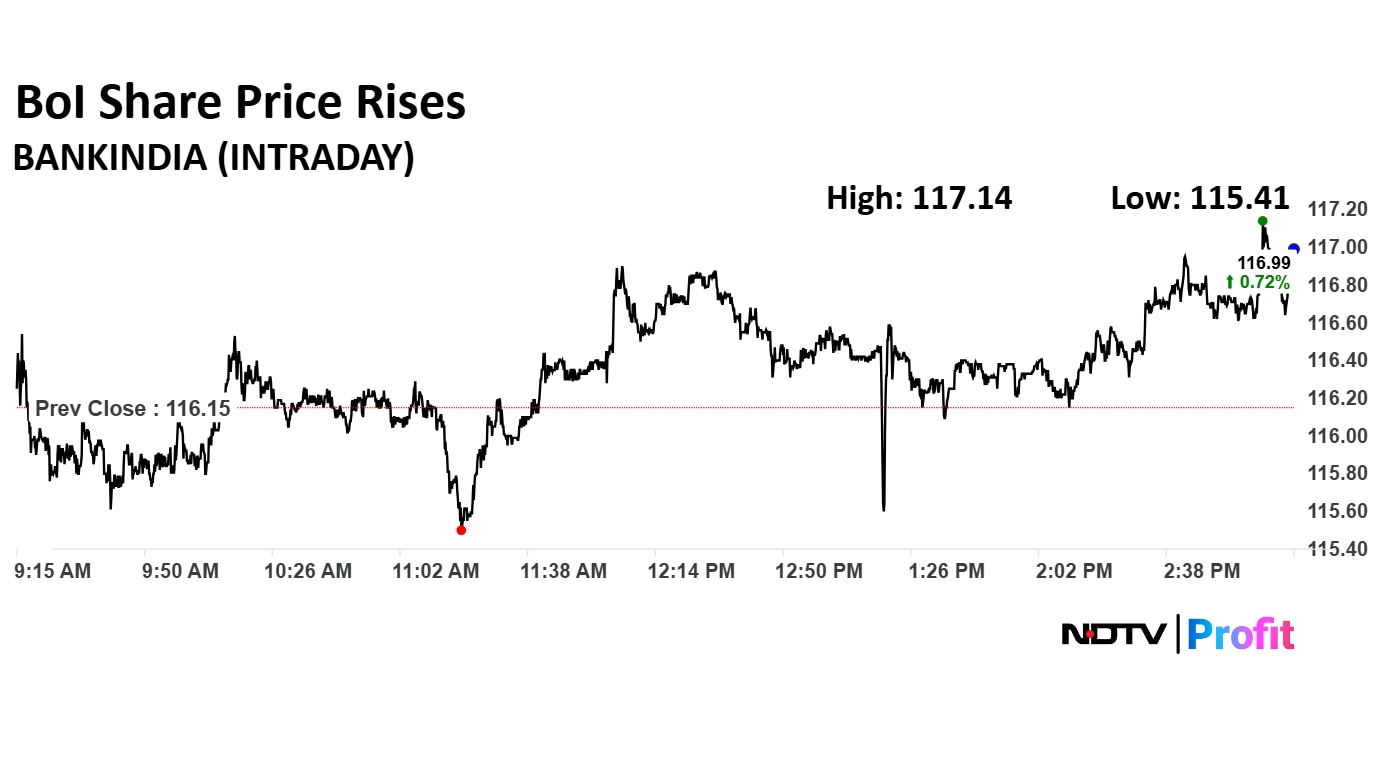

Bank Of India Share Price Today

The scrip rose as much as 0.85% to Rs 117.14 apiece. It pared gains to trade 0.47% higher at Rs 116.70 apiece, as of 03:13 p.m. This compares to a 1.18% advance in the NSE Nifty 50.

It has risen 14.65% on a year-to-date basis, but has fallen 5.67% in the last 12 months. The relative strength index was at 33.76.

Out of five analysts tracking the company, three maintain a 'buy' rating, one recommends a 'hold' and one suggests 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 1.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.