Balu Forge Shares Hit Lower Circuit; Extend Fall For The Fifth Session

The sharp fall came with higher trading activity on Wednesday.

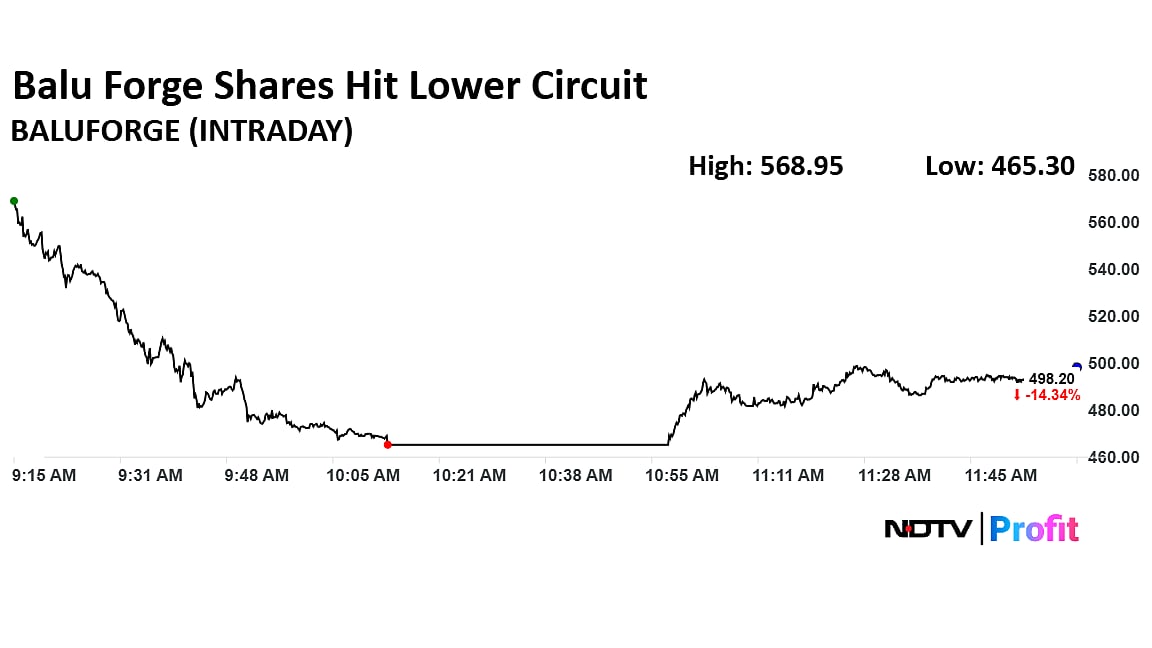

The shares of Balu Forge hit lower circuit on Wednesday, extending the fall for the fifth session. The stock hit over nine-month low as pushed the stock deeper into the downward trend.

The sharp fall came with higher trading activity on Wednesday. Close to 80.23 lakh shares changed hands on the NSE with turnover of nearly Rs 390.84 crore. The high activity comes despite no immediate sock-specific or company specific trigger. In the last five sessions the shares have fallen 18.5%.

Balu Forge's profit for the second quarter rose 35.5% to Rs 65 crore, while revenue was up 34.4% to Rs 299.5 crore. Operating income, or earnings before interest, taxes, depreciation, and amortization rose 27.6% year-on-year to Rs 82.8 crore. The Ebitda margin expanded to 27.6%.

This performance was driven by an improved value-added product mix and increased operating leverage.

Balu Forge Industries was incorporated in 1989 and is engaged in the manufacturing of fully finished and semi-finished Forged Components. It has the capacity to manufacture components conforming to both New Emission Regulations & the New Energy Vehicles. The company has a fully Integrated Forging & Machining production infrastructure with a large product portfolio ranging from 1 Kg to 1000 Kgs.

Balu Forge Share Price Today

The scrip fell as much as 20% to Rs 465.30 apiece on Wednesday, lowest level since March 18. It pared gains to trade 15.23% lower at Rs 492.75 apiece, as of 11:47 a.m. This compares to a 0.24% decline in the NSE Nifty 50 Index.

It has fallen 34.72% in the last 12 months and 20.28% year-to-date. Total traded volume so far in the day stood at 13 times its 30-day average. The relative strength index was at 39.11.

Out of six analysts tracking the company, three maintain a 'buy' rating, three recommend a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target stands at Rs 463.17 indicating an upside of 32.1%.