Bajaj Housing Finance Ltd.'s share price fell on Monday as the one-month lock-in period for shareholders came to an end. This development means that approximately 12.6 crore shares, representing about 1.51% of the company's outstanding equity, became eligible for trading.

While the conclusion of the lock-in period may raise concerns about potential selling pressure, it is important to note that this does not guarantee that all investors will sell their lock-in shares in the market.

The company made its stock market debut on Sept. 16, launching at an IPO price of Rs 70 per share. Following a remarkable 135% jump on its first trading day, the stock reached a post-listing high of Rs 188. However, it has since faced a downturn, closing at Rs 150 per share on Friday, maintaining its initial listing price.

The stock has risen 115% from its issue price so far.

Earlier this month, Bajaj Housing Finance reported strong growth in its Q2 business update. The company's assets under management surged 26% year-on-year, surpassing the Rs 1 lakh crore mark for the first time, with AUM totaling Rs 1.02 lakh crore as of Sept. 30, 2024. This performance is a positive indicator of the company's growth trajectory, even as investors weigh the implications of the upcoming trading eligibility.

Looking ahead, the three month lock-in period for Bajaj Housing Finance will conclude on December 12, when an additional 12.6 crore shares will again become available for trading

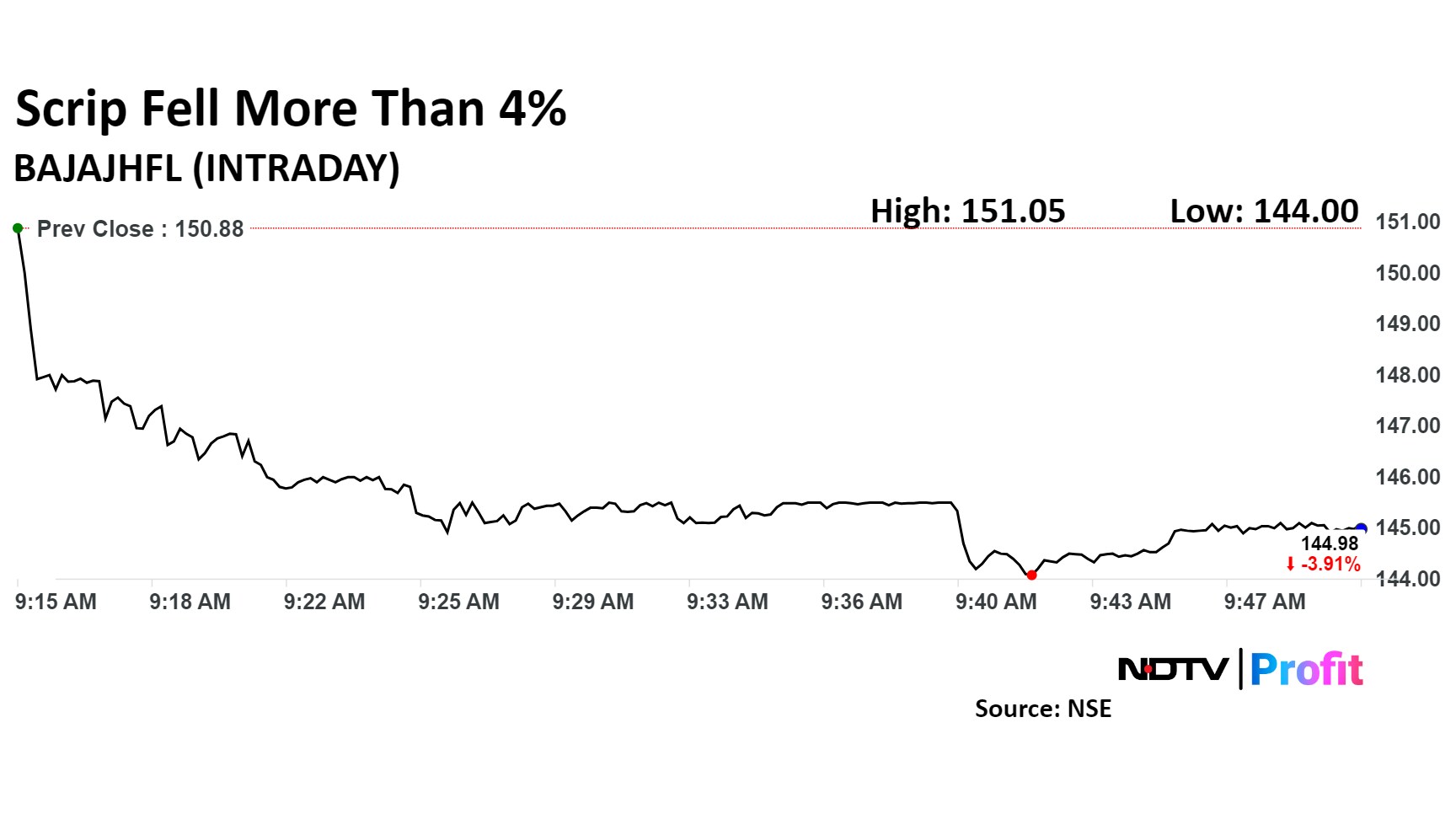

Bajaj Housing Finance Share Price Today

Share price of Bajaj Housing Finance fell as much as 4.56% to Rs 144.0 apiece. It pared losses to trade 4.24% lower at Rs 144.49 apiece, as of 09:45 a.m., compared to a 0.60% advance in the NSE Nifty 50.

The stock has fallen 12.43% in last one month. Total traded volume so far in the day stood at 0.4 times its 30-day average. The relative strength index was at 40.

Out of two analysts tracking the company, one maintains a 'buy' rating and one suggests 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 10%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.