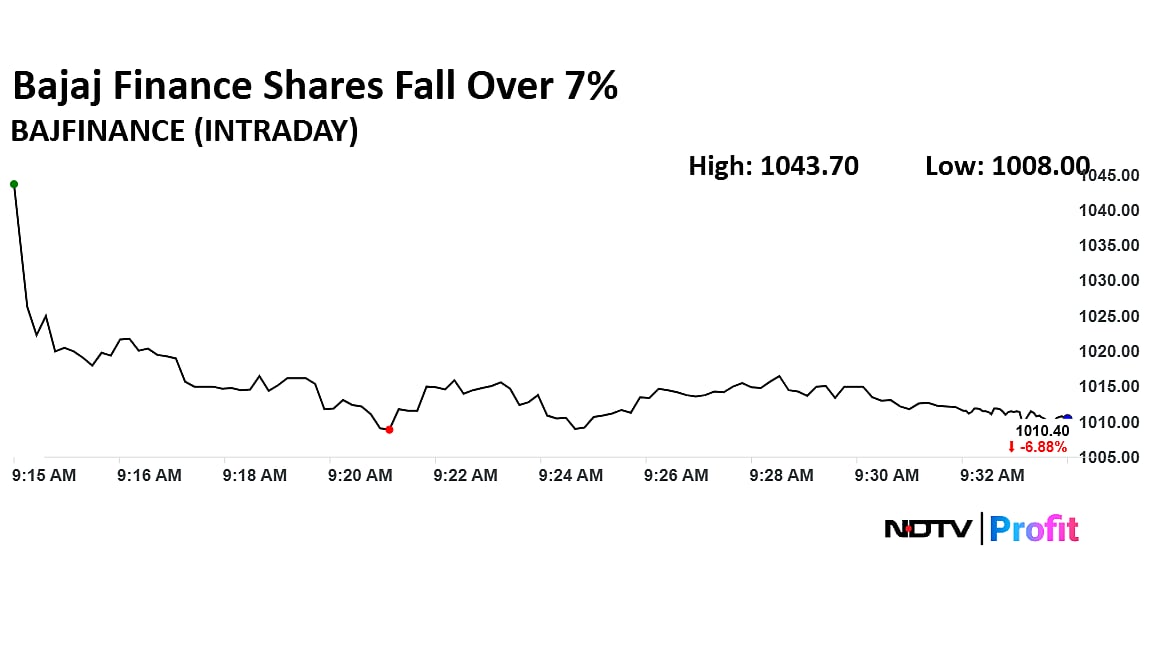

Bajaj Finance Shares Fall Over 7% After AUM Guidance Cut

Bajaj Finance also expects the cost of funds to remain stable in the range of 7.5% to 7.55% for FY26.

The shares of Bajaj Finance Ltd. fell over 7% on Tuesday after it revised its assets under management growth guidance to 22-23% from the earlier 24-25% for this fiscal.

The Net Interest Margin remained flat compared to the previous quarter. Managing Director Rajeev Jain highlighted that credit costs were elevated in second quarter and are expected to stay at the higher end of the guidance range of 1.85%–1.95% for the full year. However, the company anticipates a significant improvement in credit costs in FY27.

Bajaj Finance also expects the cost of funds to remain stable in the range of 7.5% to 7.55% for FY26. Meanwhile, the size of the MSME business has been reduced by 25% and continues to be closely monitored. The MSME segment is projected to grow modestly by 10–12% during FY26.

It also witnessed some asset quality pressures during the quarter.

Asset quality worsened, with the share of gross non-performing loans rising to 1.24% from 1.03% in the previous quarter. Net NPA came in at 0.60% versus 0.50% in the June quarter. Loan losses and provisions increased by 19%.

"Consumer leverage remains an area of concern. The company continues to take ongoing actions to reduce the contribution of customers with multiple loans. The vintage credit performance, as a result, are significantly better except for MSME," Bajaj Finance said in a statement.

Consolidated profit rose 22% year-on-year to Rs 4,875 crore in the July-September quarter, as per results announced on Monday, compared to an estimate of Rs 4,969 crore.

Net interest income also jumped 22% to Rs 10,785 crore, against a forecast of Rs 10,955 crore. Pre-provisioning operating profit increased by 21%.

Bajaj Finance Share Price Today

The scrip fell as much as 7.10% to Rs 1,008 apiece on Tuesday. It pared gains to trade 6.72% lower at Rs 1,012 apiece, as of 9:31 a.m. This compares to a 0.18% advance in the NSE Nifty 50 Index.

It has risen 49.22% in the last 12 months and 48.25% year-to-date. Total traded volume so far in the day stood at 7.07 times its 30-day average. The relative strength index was at 55.04.

Out of 37 analysts tracking the company, 19 maintain a 'buy' rating, 12 recommend a 'hold,' and six suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target of Rs 1,311.32 implies an upside of 29.8%.