Shares of Bajaj Finance Ltd. fell nearly 5% on Tuesday after its third-quarter net profit missed analysts' estimates.

The company's net profit rose 21% year-on-year to Rs 3,177 crore in the quarter ended December, according to an exchange filing. A Bloomberg poll of analysts estimated net profit at Rs 3,576.60 crore.

Pre-provisioning operating profit rose 27% to Rs 5,539 crore from a year ago. Loan losses and provisions, too, grew 54% year-on-year to Rs 1,248 crore in the quarter under review.

Bajaj Finance Q3 FY24 Highlights (Standalone)

Net profit up 21% at Rs 3,177 crore. (Bloomberg estimate: Rs 3,576.60 crore). (YoY)

Total income rises 31% to Rs 12,103 crore (YoY).

Gross NPA at 1.18% vs 1.14% (QoQ).

Net NPA at 0.46% vs 0.39% (QoQ)

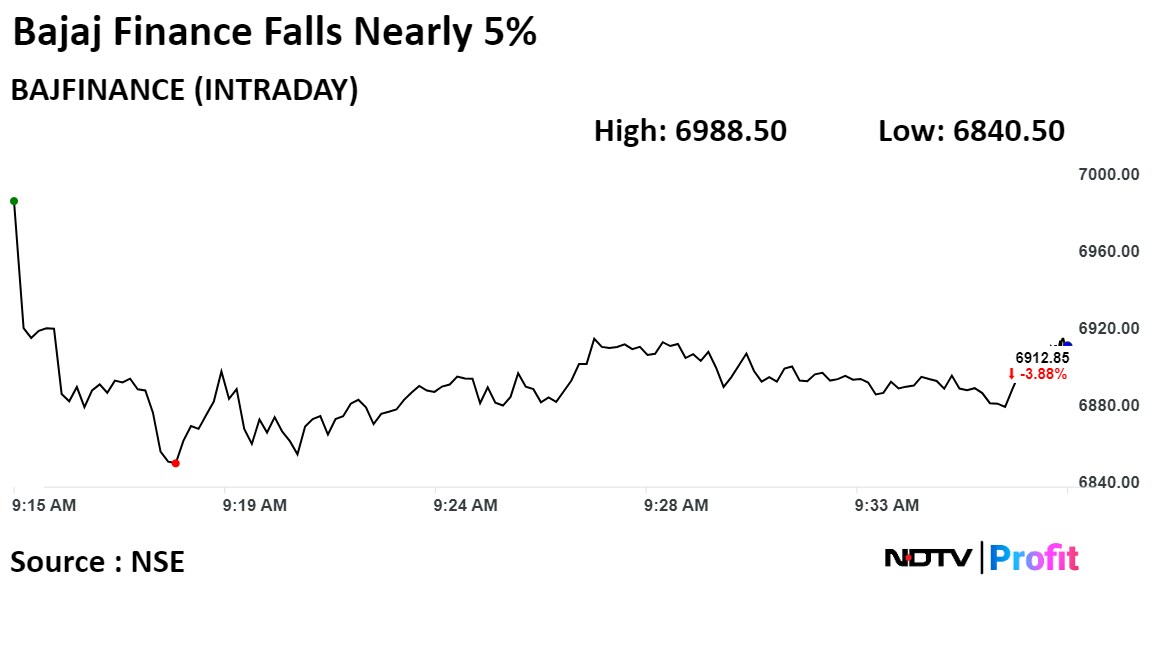

Shares of the company fell 4.88% to 6,840.50 apiece, the lowest level since Aug. 21, 2023. It pared losses to trade 4.10% lower at Rs 6,896.60 apiece as of 9:35 a.m. This compares to a 0.09% decline in the NSE Nifty 50 Index.

It has risen 14.53% in the last 12 months. Total traded volume so far in the day stood at 7.4 times its 30-day average. The relative strength index was at 31.

Out of 36 analysts tracking the company, 28 maintain a 'buy' rating, three recommend a 'hold', and five suggest a 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 14.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.