- Bajaj Consumer Care board will consider a second share buyback on 24 July 2024

- Promoter equity in Bajaj Consumer stood at 40.95% as of March 2024

- Domestic institutions hold 18.54% and foreign investors 10.6% equity in the company

Bajaj Consumer Care Ltd. board will consider its second share buyback in a year during a meeting on Thursday, July 24. The company had repurchased shares from the market in July 2024.

The Bajaj Group company's promoter equity stood at 40.95% as of March, according to BSE shareholding data.

Domestic institutions like mutual funds and insurance companies own 18.54% equity in Bajaj Consumer, followed by foreign investors who have 10.6% stake. Over 13 lakh retail investors hold a combined 19.1% equity.

A share buyback is a process in which a company repurchases its own stock from shareholders via tender or open market. When the board approves the buyback plan, it will disclose the offer details including the number of shares to be repurchased and the offer price.

Buybacks reduce the number of shares available on the open market.

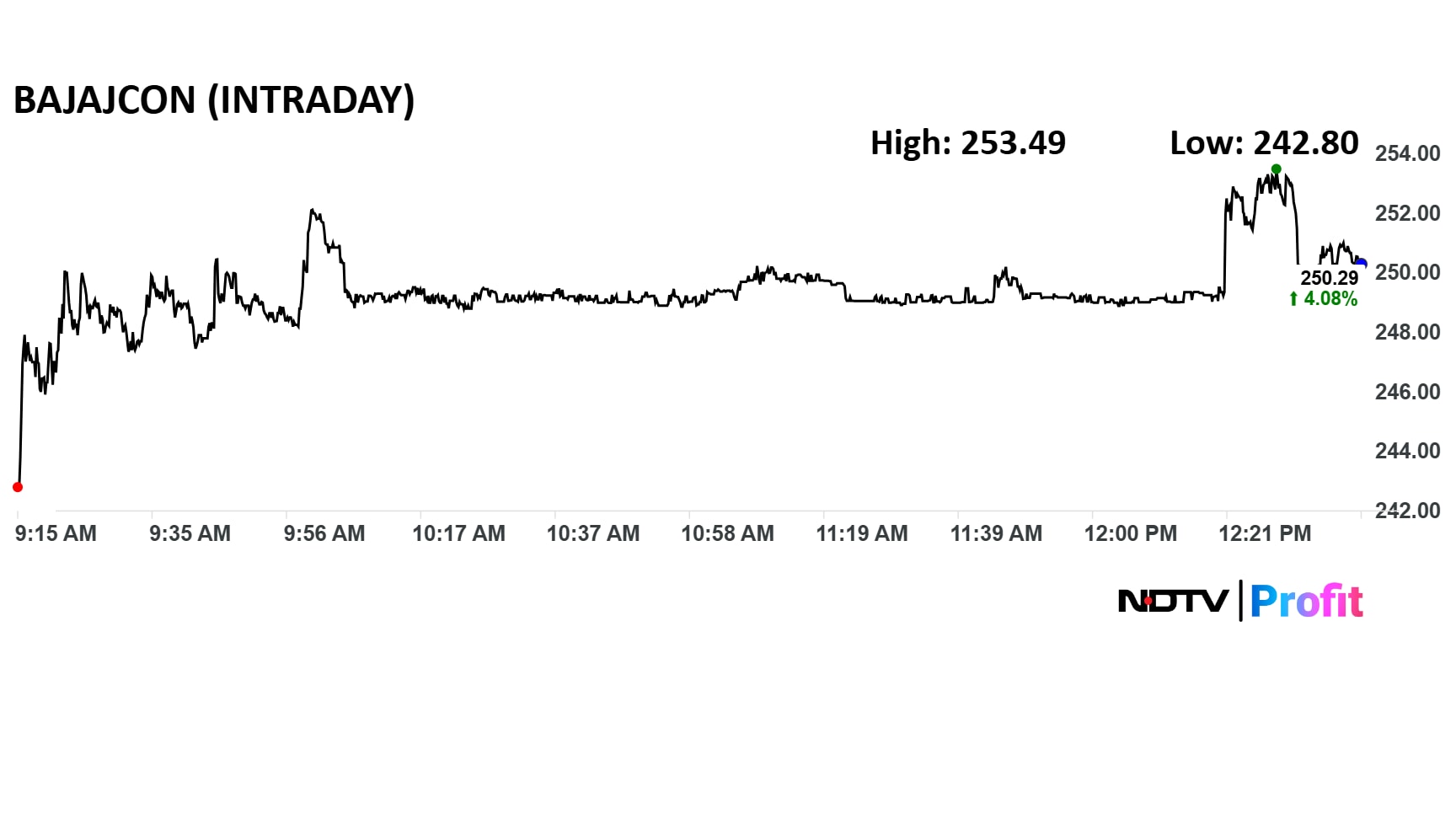

Bajaj Consumer share was trading 4% higher at Rs 250.29 as of 12:40 p.m. after the announcement.

Bajaj Consumer share was trading 4% higher at Rs 250.29 as of 12:40 p.m. after the announcement.

In July last year, the company bought back 0.57 crore shares at Rs 290 apiece, aggregating to Rs 166.5 crore.

Last month, companies like SIS Ltd., Orient Cement Ltd., Dhampur Sugar Mills Ltd., Infobeans Technologies Ltd. and Paramatrix Technologies Ltd. undertook share buybacks.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.