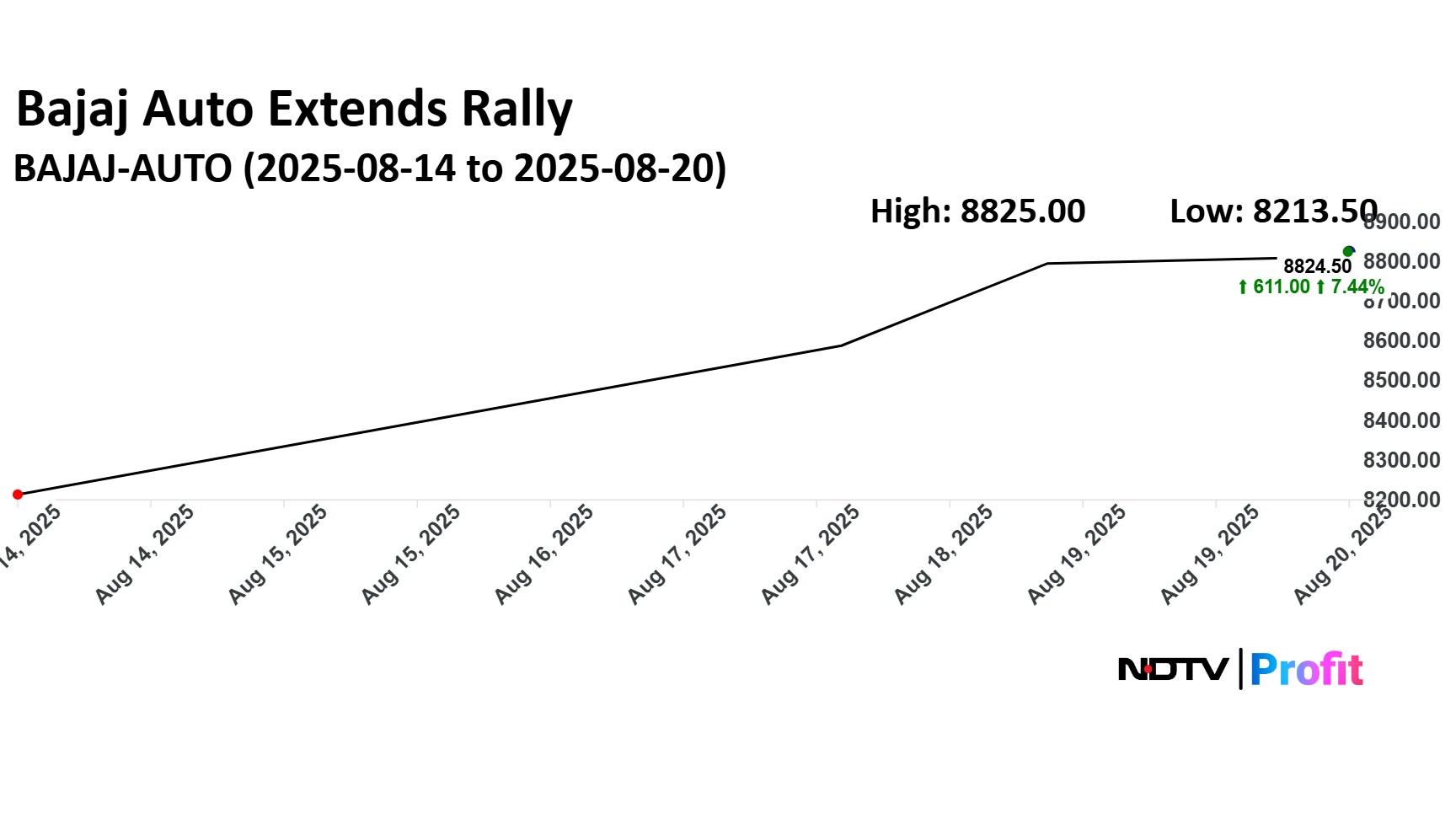

Bajaj Auto Ltd. share price extended gains to third session and clocked over 7% gain. The sentiment for the stock turned positive as the overall outlook for auto industry improved on announced GST reforms.

Last week, the company received a favourable order from Assistant Commissioner, Guwahati-I Division in case of discrepancies between e-way bill GSTR-3B for the period of 2020–21. The entire tax demand of Rs 2.32 crore along with 23 lakh interest was set aside.

Bajaj Auto's wholly owned subsidiary Bajaj Auto Credit Ltd. has issued allotted commercial paper aggregating to an amount of Rs 500 crore. The subsidiary issued the commercial papers on Monday and they became redeemable on Nov 17. The discount rate for the papers are 6.25%.

Bajaj Auto Credit's commercial papers have rating of Crisil A+. The issuance happened on National Stock Exchange, the company said in an exchange filing on Tuesday.

Bajaj Auto share price rose 0.62% to Rs 8,850 apiece. The stock gained 7.52% in the last three sessions. As of 11:14 a.m., the stock was trading 0.41% higher at Rs 8,832 compared to 0.20% advance in the NSE Nifty 50 index.

The stock declined 9.74% in 12 months, and rose 0.29% on year-to-date basis. The total traded volume so far in the day stood at 2.2 times its 30-day average. The relative strength index was at 70.79.

Out of 56 analysts tracking the company, 23 maintain a 'buy' rating, 25 recommend a 'hold' and eight suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 2.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.