As markets end the last day of the financial year in green, analysts expect the auto and financial sectors to be the top picks for the new fiscal starting next week.

"We are heading towards an all-time high trajectory. Also, looking at the broad-based bank action in the large-cap and mid-cap space, that clearly shows that these momentums can extend further," said Rajesh Palviya, senior vice president of technical and derivatives research at Axis Securities Ltd.

On the first day of April, there is going to be a new all-time high trajectory for Nifty and this rally could extend to the 22,700–22,800 level, he said.

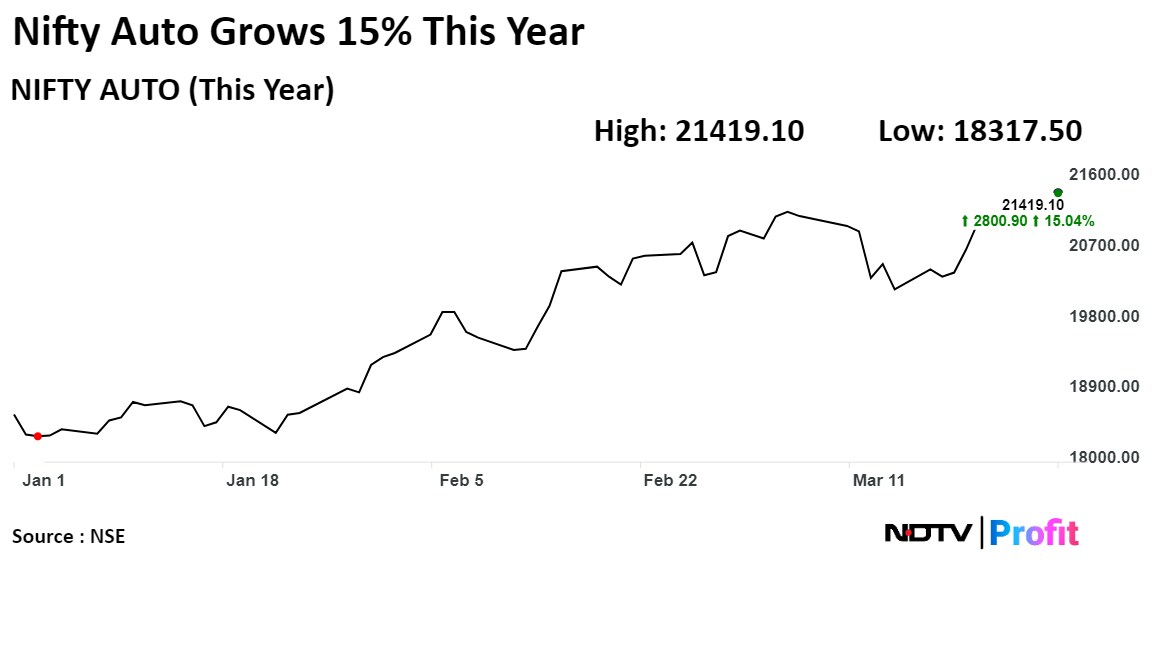

One of the top picks for the upcoming financial year is the auto sector, which has grown by over 15% this year.

Benchmark equity indices pared some gains in the last hour of Thursday's session but still managed to close the last week of the financial year over 1% higher. The NSE Nifty 50 ended 219.85 points, or 0.99%, higher at 22,343.50, while the S&P BSE Sensex closed 639.16 points up, or 0.88%, at 73,635.48.

"I would like to bet my money on the auto sector. We all know next week that auto numbers will be pouring in for the month of March and at the same time, the numbers are going to be good," said Sunny Agarwal, head of fundamental equity research at SBICap Securities Ltd. Mahindra and Mahindra Ltd. and Eicher Motors Ltd. are his top bets in the sector.

Foreign investors often lean towards large caps, according to Jonathan Schiessl, deputy chief investment officer of Westminster Asset Management. The financial sector is his pick.

"The reality is that foreign investors play in a fairly small pool and tend to stick to the larger stuff... I think the best way of playing in India remains financials," said Schiessl. However, he leans more towards the private banks, as they give access to a broad number of sectors and also play into the Indian growth story.

According to Schiessl, Indian equity markets have performed well. Markets don't fall due to high valuations, but due to some triggers, he said. He also expects the markets to move higher as foreign investors expect the Narendra Modi government to continue being in power. Another reason for the markets to grow is that Chinese markets are still looking difficult, according to him.

Chinese markets are not picking up and India is the natural beneficiary, said Mihir Vora, chief investment officer of Trust Mutual Fund. However, there is no major increase in contributions from foreign investors, he said.

Watch The Full Video Here:

Disclaimer: The views and opinions expressed by the investment advisers on NDTV Profit are of their own and not of NDTV Profit. NDTV Profit advises users to consult with their own financial or investment adviser before taking any investment decision.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.