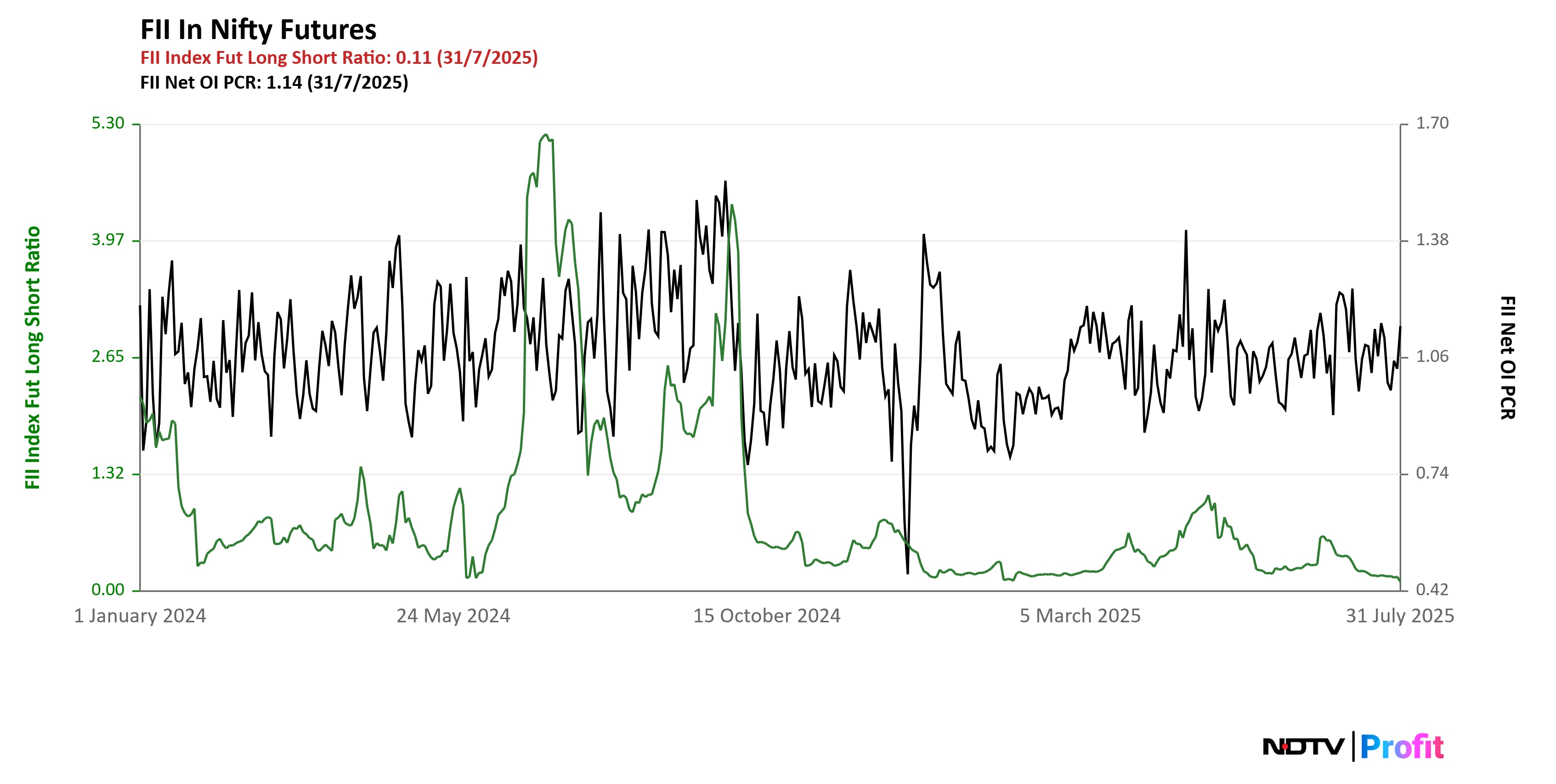

Foreign investors entered the August derivatives series with the lowest proportion of long positions in at least two years after a sharp reduction during the July expiry, according to data compiled by NDTV Profit.

Data from the National Stock Exchange showed foreign portfolio investors held only 9.59% of total open interest in long positions at the start of the August series, down from 14% ahead of Thursday's expiry. The rollover from July to August was led by short positions.

FPI Long Short Ratio after July 2025 series

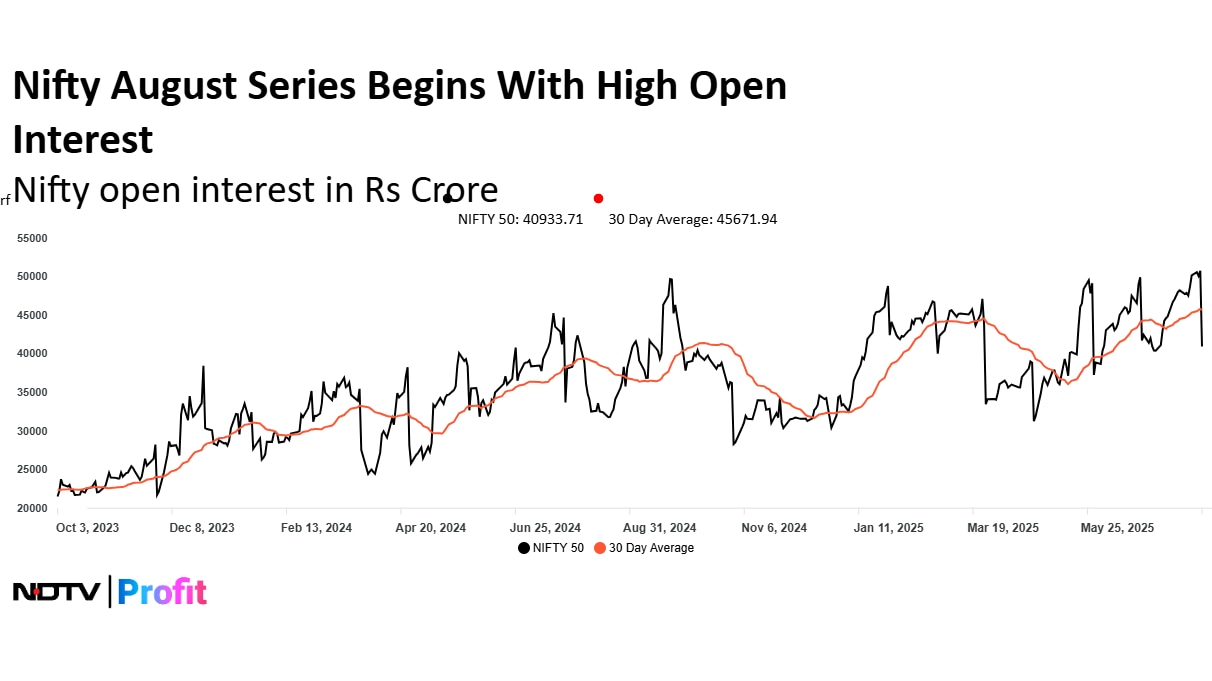

Nifty Futures open interest stood at Rs 40,934 crore following the July expiry. More than Rs 10,000 crore in open interest was not carried forward, even as the Nifty reversed early losses and closed just below the 24,800 mark.

FPIs added Rs 1,470.06 crore in short positions in Nifty Futures, raising their total open interest to Rs 22,803.70 crore. The overall reduction was mainly due to a cut in long positions. FPI open interest in Nifty Futures as a share of total open interest dropped to 55% from 64% earlier in the day.

In Nifty Bank Futures, total open interest at the start of the August series was Rs 10,992 crore, with FPIs accounting for Rs 5,457.39 crore.

In Nifty Options, the 25,000 call is acting as resistance, while support is seen at the 24,500 and 24,600 put levels.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.