(Bloomberg) -- Stocks kept climbing after hitting a record last week as strong economic data and corporate results fueled Wall Street's appetite for risk.

Equities are shaking off a rocky start to the year amid conviction that the Federal Reserve will soon cut interest rates and bets that the artificial-intelligence boom is set to continue. Meanwhile, earnings season kicks into high gear this week, with companies including Netflix Inc., Tesla Inc. and Intel Corp. due to report their numbers.

“The equity rally we are seeing is based on on the soft-landing scenario that's being priced,” said Charles Diebel at Mediolanum International Funds. “If the economy does well, then why would you sell equities? And the counterfactual for equity markets is that if things do weaken, they will get rate cuts.”

The S&P 500 extended its advance above 4,800, led by gains in big tech. Treasury 10-year yields declined three basis points to 4.09%. The dollar wavered.

Last week's record close for US stocks has pulled valuations back to the highs seen last July. But a closer look shows that the market isn't as expensive as it appears, according to Citigroup Inc.'s Scott Chronert.

Gains in Apple Inc., Microsoft Corp., Nvidia Corp., Alphabet Inc., Amazon.com Inc., Meta Platforms Inc. and Tesla Inc. have powered the resurgence on Wall Street, largely based on optimism around artificial intelligence and cost-cutting efforts at these companies. The equally weighted version of the S&P 500 strips out some of their outsized influence and results in a ratio of around 16 times forward earnings, a discount of 17% to the benchmark's standard valuation.

Options traders are betting on more gains in the S&P 500 after it hit a record high on Friday.

A slew of bullish wagers shifted the yardstick of what's seen as the upper bound of the US benchmark's trading range. The so-called call wall has moved to 5,000 points from 4,800 — signaling that traders see the market clearing the next hurdle toward further gains, according to SpotGamma data. That points to a further 3.3% of upside, based on Friday's close.

“We may just get the upside follow-through that we too to signal that last week's breakout to new all-time highs in the S&P 500 and the Nasdaq 100 has been confirmed,” said Matt Maley at Miller Tabak + Co. “We do need to point out that both indices are reaching overbought levels, so they could take a breather at any time. However, as long as any ‘breathers' do not become severe reversals, the bulls have a lot going for them right now.”

The Ned Davis Research Leading Indicator Model — based on 10 indicators that typically lead the S&P 500 — has already been flashing bullish for most of the past year. The majority of the components are price-based and include one on sentiment with two others on macroeconomics.

Although the model is just off its highs, with four of the seven bullish indicators starting to weaken including financials, volume demand and weekly new highs on the New York Stock Exchange, the key gauge still points to equity strength.

Even as the S&P 500 closed Friday at an all-time high, money managers and analysts are contending with data that signals US economic resilience and Fed officials who've pushed back against reducing interest rates too soon.

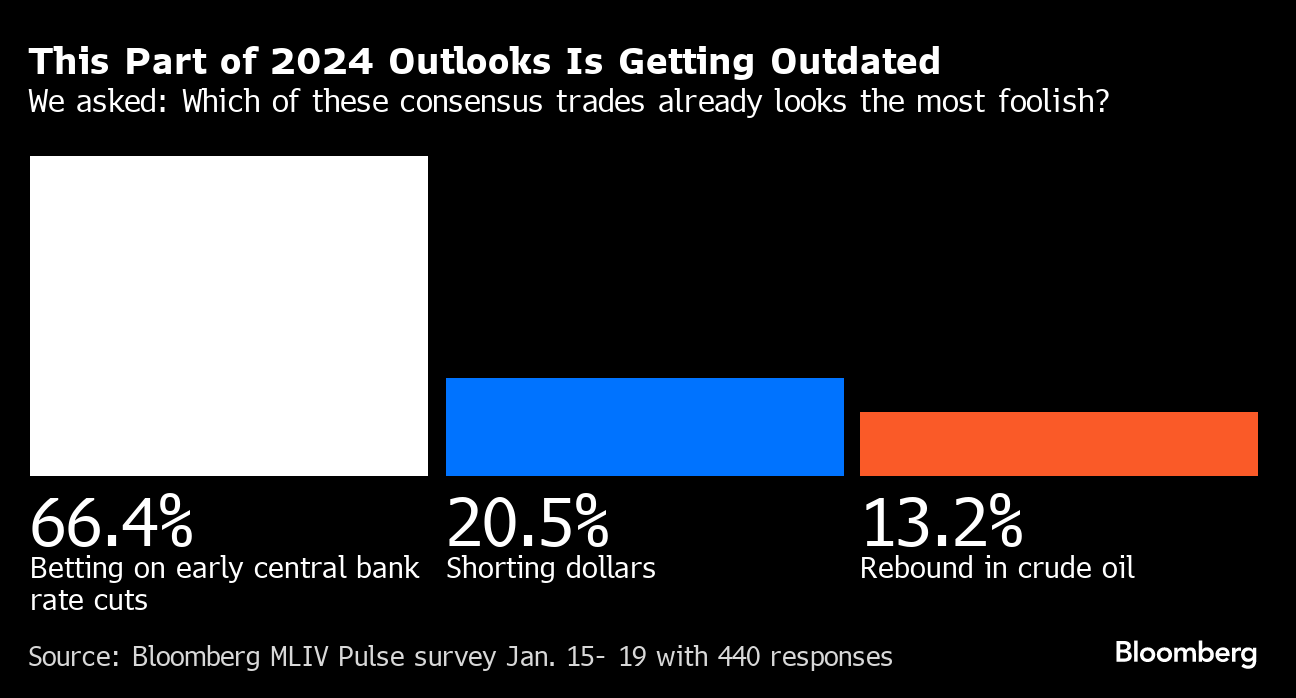

The latest warning for investors unleashing dovish monetary wagers across the board: Two thirds of Bloomberg Markets Live Pulse respondents said that betting on early monetary easing is the “most foolish” among popular trades heading into 2024.

“The push and pull between interest rates and the markets have been discussed , but looking back over the past two years, it has been the Fed's actions that have led the markets, said Paul Nolte at Murphy & Sylvest Wealth Management. “Will the economy catch a chill if the Fed keeps rate cuts on ice? It will depend largely on the earnings season that gets into full swing this week.”

Meantime, two major Wall Street firms are recommending investors start buying five-year US notes after they saw their worst rout since May last week.

Morgan Stanley sees scope for a rebound in Treasuries on expectations data in the coming weeks may surprise to the downside. JPMorgan Chase & Co. is suggesting investors buy five-year notes as yields have already climbed to levels last seen in December, though it warned that markets are still too aggressive in pricing for an early start to central bank interest-rate cuts.

Corporate Highlights:

- Archer-Daniels-Midland Co. plunged after the US agricultural trading giant suspended its chief financial officer and cut its earnings outlook pending an investigation into its accounting practices.

- Sunoco LP, a US gas station owner, agreed to acquire pipeline and fuel storage company NuStar Energy LP for about $7.3 billion in a move to buy up more of a key part of its supply chain.

- Digital World Acquisition Corp., the blank-check firm seeking to take Donald Trump's media company public, surged after Ron DeSantis dropped out of the 2024 US presidential race and endorsed Trump.

- Macy's Inc. said Sunday that it wasn't interested in a bid from Arkhouse Management Co. and Brigade Capital Management to take over the retailer, claiming the offer lacked “compelling value.”

- Gilead Sciences Inc.'s Trodelvy failed to significantly improve survival in a trial of patients with advanced lung cancer, a blow to the targeted treatment that's in one of the most promising classes in oncology.

- US authorities are investigating B. Riley Financial Inc.'s deals with a key client who was linked to a securities fraud, and the use of his assets to help the investment bank obtain a loan from Nomura Holdings Inc., according to people familiar with the matter.

- Scrutiny of Boeing Co.'s manufacturing quality expanded after federal regulators told airlines to check the door plugs on a second 737 model, where operators have also found issues with fasteners.

- Truist Financial Corp. and Fifth Third Bancorp are tapping the US investment-grade market on Monday, joining other Wall Street banks in selling bonds after reporting fourth-quarter earnings.

- Amer Sports Inc., the maker of Wilson tennis rackets and Salomon ski boots, is seeking to raise as much as $1.8 billion in what would be one of the year's first major initial public offerings.

Key events this week:

- Japan BOJ rate decision, Tuesday.

- Eurozone consumer confidence, Tuesday.

- New Hampshire holds first-in-the-nation presidential primary, Tuesday.

- European Central Bank issues bank lending survey, Tuesday.

- Canada rate decision, Wednesday.

- Eurozone S&P Global Services & Manufacturing PMI, Wednesday.

- US S&P Global Services & Manufacturing PMI, Wednesday.

- Eurozone ECB rate decision, Thursday.

- Germany IFO business climate, Thursday.

- US GDP, initial jobless claims, durable goods, wholesale inventories, new home sales, Thursday.

- Japan Tokyo CPI, Friday.

- US personal income & spending, Friday.

- Bank of Japan issues minutes of policy meeting, Friday.

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.5% as of 9:53 a.m. New York time

- The Nasdaq 100 rose 0.5%

- The Dow Jones Industrial Average rose 0.5%

- The Stoxx Europe 600 rose 0.7%

- The MSCI World index rose 0.5%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0891

- The British pound rose 0.1% to $1.2720

- The Japanese yen rose 0.2% to 147.84 per dollar

Cryptocurrencies

- Bitcoin fell 2.8% to $40,584.86

- Ether fell 4.4% to $2,362.87

Bonds

- The yield on 10-year Treasuries declined three basis points to 4.09%

- Germany's 10-year yield declined six basis points to 2.28%

- Britain's 10-year yield declined five basis points to 3.87%

Commodities

- West Texas Intermediate crude rose 1.5% to $74.50 a barrel

- Spot gold fell 0.3% to $2,022.46 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Denitsa Tsekova, Kasia Klimasinska, Michael Msika, Sujata Rao and John Viljoen.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.