Shares in Asia climbed after global stocks hit a record with Jerome Powell's bullish comments that supported risk assets. Currency traders remained on alert as the French government fell after a no-confidence vote.

Shares in Japan and Australia rose, while equity futures in Hong Kong were slightly lower. US equity futures were little changed after Wednesday advances for the S&P 500 and tech-heavy Nasdaq 100 nudged a gauge of global stocks to a new high.

The moves were driven by US tech with the so-called Magnificent Seven rising for a fourth consecutive session, helped along by an advance for Nvidia Corp and Meta Platforms Inc.

Treasuries were steady after a rally in the prior session across the curve. The 10-year yield fell four basis points Wednesday, while the policy-sensitive two-year yield dropped by five basis points. An index of the dollar was steady.

Powell said the US economy is “in remarkably good shape,” and that downside risks from the labor market had receded, in comments at the New York Times DealBook Summit in New York. He also said Federal Reserve officials could afford to be cautious as they lower rates toward a neutral level — one that neither stimulates nor holds back the economy.

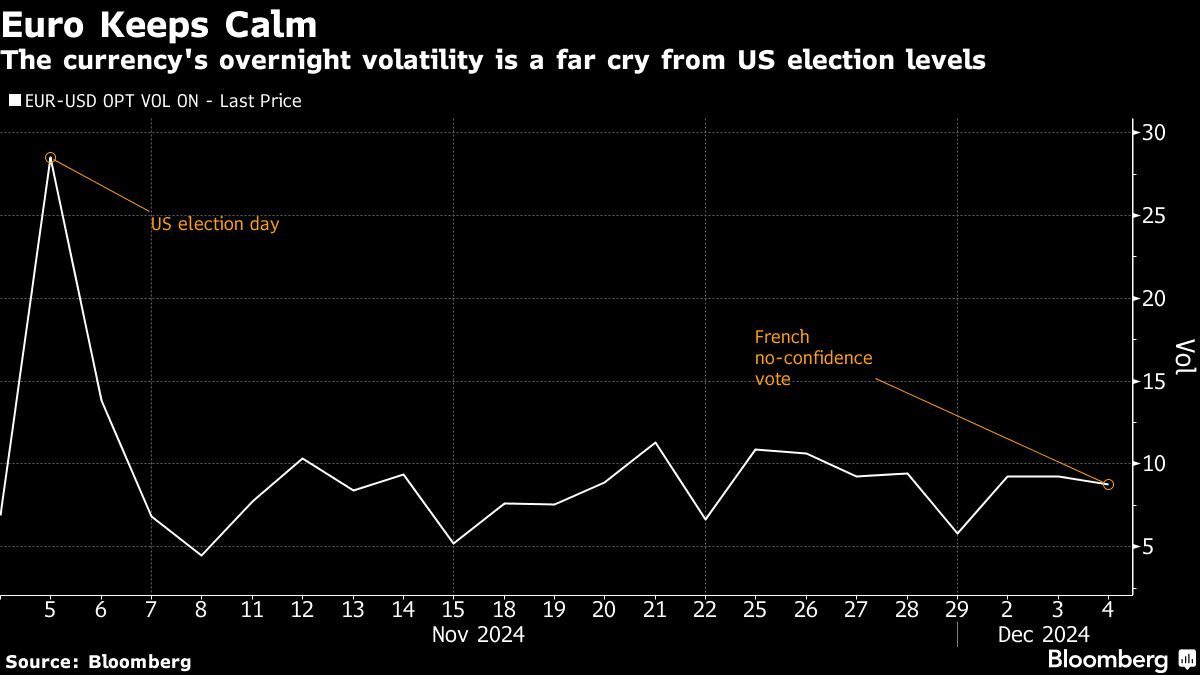

In Europe, the euro faced further headwinds following a dispute over next year's budget in Paris. France's far-right leader Marine Le Pen and a left-wing coalition voted against Prime Minister Michel Barnier's administration, muddying the outlook for investors. Markets had largely priced in the outcome ahead of time which came after regular trading had closed.

The won was steady after the tumult earlier in the week in South Korea. President Yoon Suk Yeol is expected to address the nation later Thursday. The yen was steady around 150 per dollar in early Thursday trading. Yields for Australian and New Zealand government debt fell early Thursday, reflecting the move in Treasuries the day before.

US Economy

Powell's comments did little to alter expectations implied by market pricing that the Fed will cut rates again when it meets later this month.

“We view this as slightly hawkish — but stopping well short of challenging the market's growing confidence that a December cut is the base case, which has been our view all along,” said Krishna Guha at Evercore.

One of Powell's favorite barometers of the economy — the Beige Book — showed economic activity increased slightly in November, and businesses grew more upbeat about demand prospects.

“The current market environment is clearly ‘risk-on',” said Steve Sosnick at Interactive Brokers. “Yet the evidence shows that someone has been buying insurance against a 10% correction in the S&P 500, even though — or perhaps because — we haven't seen one in months.”

The “cost to hedge” against a 10% correction is around the highest levels that we've seen in three years, he noted.

In commodities, West Texas Intermediate rose to pare a decline of 2% on Wednesday as tepid US economic data undercut OPEC+'s progress on a deal to keep output constrained. Gold was little changed early Thursday after two daily advances.

Key events this week:

Eurozone retail sales, Thursday

US initial jobless claims, Thursday

Eurozone GDP, Friday

US jobs report, consumer sentiment, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures were little changed as of 9:05 a.m. Tokyo time

Hang Seng futures fell 0.8%

Japan's Topix rose 0.5%

Australia's S&P/ASX 200 rose 0.2%

Euro Stoxx 50 futures rose 0.7%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0509

The Japanese yen was little changed at 150.48 per dollar

The offshore yuan was little changed at 7.2777 per dollar

Cryptocurrencies

Bitcoin rose 0.9% to $98,774.93

Ether fell 0.1% to $3,839.65

Bonds

The yield on 10-year Treasuries advanced one basis point to 4.19%

Japan's 10-year yield was unchanged at 1.055%

Australia's 10-year yield declined four basis points to 4.22%

Commodities

West Texas Intermediate crude rose 0.3% to $68.74 a barrel

Spot gold was little changed

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.