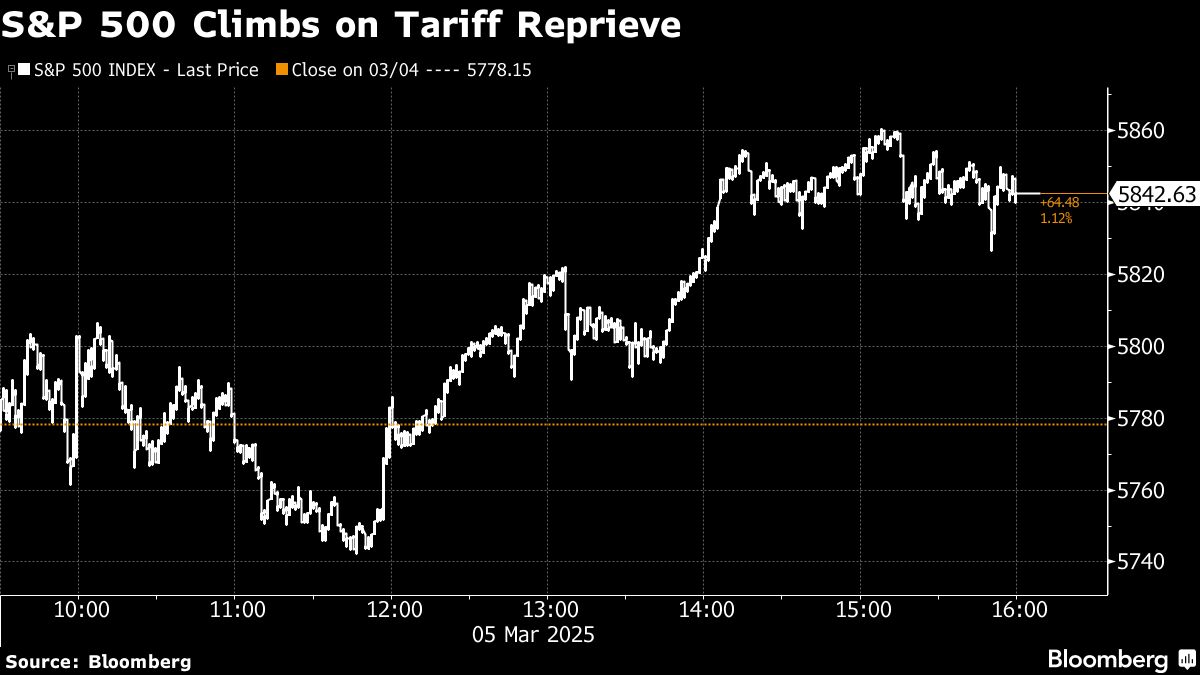

A late-session runup in US stocks capped another volatile day for global markets, a session that also featured extreme moves in European bonds and equities. Geopolitical news dominated sentiment once again, including a delay in the imposition of auto tariffs in Canada and Mexico by the White House.

Wall Street remained focused on the latest developments around trade negotiations and how that could impact the economy and Federal Reserve decisions. The S&P 500 rose over 1%, rebounding from a two-day slide. Treasuries saw small losses in a stark contrast to the plunge in their European counterparts. German bunds tumbled the most since 1990. The dollar fell 1%. Oil sank to the lowest in about six months.

The market has been on a wild ride, and traders expect more of that as they assess the latest tariff developments and brace for Friday's US payrolls report. Options trading projects the S&P 500 to move 1.3% in either direction, in what would be the most for any jobs day since the regional bank turmoil in March 2023.

The S&P 500 rose 1.1%. The Nasdaq 100 added 1.4%. The Dow Jones Industrial Average gained 1.1%.

The yield on 10-year Treasuries rose four basis points to 4.28%. The dollar dropped against most major currencies.

Corporate Highlights

Marvell Technology Inc. issued a revenue forecast that fell short of the highest estimates, disappointing investors who were looking for a bigger payoff from the AI boom.

Apple Inc. rolled out updated MacBook Air laptops and Mac Studio desktops, seeking to maintain a sales resurgence for the company's computer line.

Novo Nordisk A/S is following in rival Eli Lilly & Co.'s footsteps by selling its hit weight-loss drug Wegovy directly to US patients at a discount.

Microsoft Corp.'s $13 billion investment into OpenAI Inc. was cleared by the UK's antitrust watchdog, ending months of uncertainty over the tie-up.

Abercrombie & Fitch Co. is struggling to meet investors' lofty expectations. The retailer said revenue this year would grow 3% to 5%. Wall Street projected an average of $5.2 billion in annual sales, which would be a gain of about 5.5%.

Foot Locker Inc., the struggling sneaker chain, faces limited direct exposure to new US-imposed tariffs, with executives calling their impact small to moderate.

Oil refiner Phillips 66 is fighting back against activist investor Elliott Investment Management in a letter to shareholders Wednesday.

Key events this week:

Eurozone retail sales, ECB rate decision, Thursday

US trade, initial jobless claims, wholesale inventories, Thursday

US Treasury Secretary Scott Bessent speaks, Thursday

Fed's Christopher Waller and Raphael Bostic speak, Thursday

Eurozone GDP, Friday

US jobs report, Friday

Fed Chair Jerome Powell gives keynote speech at an event in New York hosted by University of Chicago Booth School of Business, Friday

Fed's John Williams, Michelle Bowman and Adriana Kugler speak, Friday

Some of the main moves in markets:

Stocks

The S&P 500 rose 1.1% as of 4 p.m. New York time

The Nasdaq 100 rose 1.4%

The Dow Jones Industrial Average rose 1.1%

The MSCI World Index rose 1.5%

Currencies

The Bloomberg Dollar Spot Index fell 1%

The euro rose 1.6% to $1.0792

The British pound rose 0.8% to $1.2899

The Japanese yen rose 0.6% to 148.88 per dollar

Cryptocurrencies

Bitcoin rose 3.3% to $90,367.57

Ether rose 2.3% to $2,228.73

Bonds

The yield on 10-year Treasuries advanced four basis points to 4.28%

Germany's 10-year yield advanced 30 basis points to 2.79%

Britain's 10-year yield advanced 15 basis points to 4.68%

Commodities

West Texas Intermediate crude fell 2.7% to $66.45 a barrel

Spot gold rose 0.1% to $2,921.24 an ounce

This story was produced with the assistance of Bloomberg Automation.

© 2025 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.