- Asian shares fell as caution grew before Trump-Zelenskiy talks in Washington

- Brent crude dropped 0.3% after US-Russia summit ended without new sanctions

- Investors await Powell's speech at Jackson Hole for hints on US rate cuts

Stocks, bonds and the dollar saw a quiet start to a pivotal Federal Reserve week, with geopolitics coming into play as Ukrainian President Volodymyr Zelenskiy and his European allies get ready to meet with Donald Trump.

Following a recent series of all-time highs for the S&P 500, the benchmark wavered on Monday. Wall Street will get a close look at how American consumers are faring in the early days of President Trump's tariff regime when the biggest US retailers like Walmart Inc. and Target Corp. report earnings this week.

The yield on 10-year Treasuries was little changed at 4.31%. The Bloomberg Dollar Spot Index rose 0.2%.

The Kansas City Fed's annual Economic Policy Symposium kicks off Thursday evening in Jackson Hole, Wyoming. Chair Jerome Powell in remarks on Friday is expected to unveil the Fed's new policy framework — the strategy it'll use to achieve its inflation and employment goals.

Powell may also drop some hints about the Fed's thinking ahead of its September policy meeting. Officials have left interest rates on hold so far this year as they wait to see how the Trump administration's tariffs impact the economy.

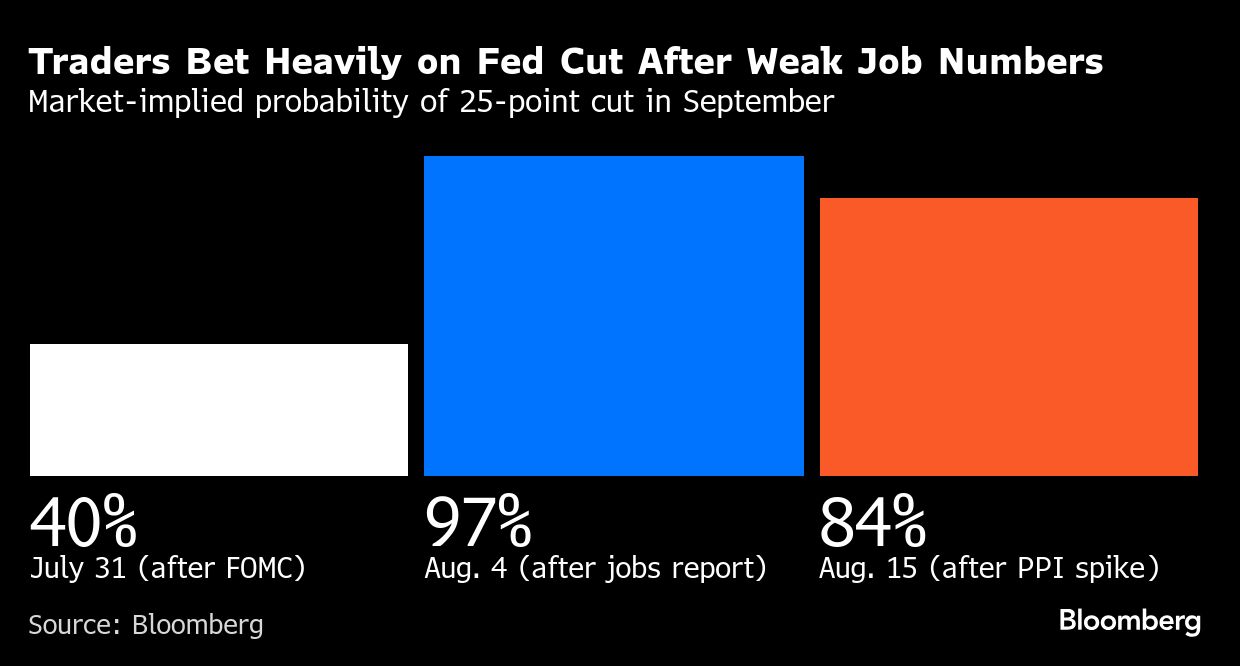

Two-year Treasury yields, the most sensitive to Fed policy, plunged this month as traders swung toward pricing in a quarter-point cut in September. Bond investors are waiting to see if Powell affirms this market pricing — or pushes back with a reminder that new data arriving before the next policy gathering could change the picture. They're also looking for clues about the longer-run trajectory of Fed cuts into next year.

“For now, the market appears to be betting that signs of labor-market weakness will outweigh inflation risk in the Fed's rate-cutting debate,” said Chris Larkin at E*Trade from Morgan Stanley. “And while retail earnings will have a high profile this week, the FOMC minutes and Jerome Powell's comments at the Jackson Hole confab will be parsed for any clues about which way the central bank is leaning.”

Meantime, S&P 500 companies trounced expectations this earnings season after they found ways to blunt the impact of tariffs and benefitted from a weaker dollar, according to strategists at Goldman Sachs Group Inc.

“The quarter has been marked by one of the greatest frequency of earnings beats on record,” David Kostin, chief US equity strategist at Goldman Sachs, wrote in a note.

Analysts are ratcheting up earnings estimates for the current quarter at the swiftest pace in nearly four years.

A Citigroup Inc. index that tracks the relative number of US earnings-per-share estimate upgrades versus downgrades is at its highest since December 2021. And the trend is just as strong among companies that recently issued their own outlooks. A gauge of forward guidance that compares corporate forecasts with the Wall Street consensus is hovering at its second-highest level in nearly four years, Bloomberg Intelligence data show.

Stocks

The S&P 500 was little changed as of 9:31 a.m. New York time

The Nasdaq 100 was little changed

The Dow Jones Industrial Average was little changed

The Stoxx Europe 600 was little changed

The MSCI World Index fell 0.1%

Currencies

The Bloomberg Dollar Spot Index rose 0.2%

The euro fell 0.2% to $1.1674

The British pound fell 0.1% to $1.3540

The Japanese yen fell 0.5% to 147.86 per dollar

Cryptocurrencies

Bitcoin fell 1.7% to $115,701.67

Ether fell 2.6% to $4,353.54

Bonds

The yield on 10-year Treasuries was little changed at 4.31%

Germany's 10-year yield declined two basis points to 2.77%

Britain's 10-year yield was little changed at 4.70%

The yield on 2-year Treasuries was little changed at 3.75%

The yield on 30-year Treasuries was little changed at 4.92%

Commodities

West Texas Intermediate crude fell 0.7% to $62.36 a barrel

Spot gold rose 0.2% to $3,341.54 an ounce

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.