Stocks in Asia traded in tight ranges amid relatively thin holiday trading after a rally in some of the world's largest technology companies boosted US benchmarks.

Shares swung between gains and losses in Japan and edged lower in Australia, with shortened sessions in Hong Kong and Sydney for Christmas Eve. US equity futures were little changed after Tesla Inc. and Nvidia Corp. drove a gauge of the “Magnificent Seven” megacaps up 1.4% Monday, helping the S&P 500 erase an earlier slide fueled by weaker-than-expected US consumer confidence data.

“This is the time of the year when there's a lot of noise and little to no signal in price action,” said Kyle Rodda, senior market analyst at Capital.Com. “There's a high chance of a pretty slow day for the region and an uneventful rest of the week as a high proportion of the markets log off for the holidays.”

Treasury 10-year yields opened little changed Tuesday at 4.58%, while Bloomberg's gauge of the dollar climbed 0.1%.

Nissan Motor Co. shares slid as much as 7.3% in Tokyo after the company confirmed it's in talks with Honda Motor Co. over a possible business integration. Honda shares climbed as much as 14%.

Data from South Korea on Tuesday showed consumer confidence dropped this month by the most since the outbreak of Covid-19, battered by the political turmoil triggered by President Yoon Suk Yeol's declaration of martial law and his impeachment. That will raise concerns about a further slowdown in private spending and boost speculation that the Bank of Korea may consider a rate cut in January.

The S&P 500 closed up 0.7% Monday and the Nasdaq 100 rose 1%, while a gauge of US-listed Chinese shares gained 0.9%.

“Primary uptrends remain intact for equities despite the recent profit-taking,” said Craig Johnson at Piper Sandler. “Given the short-term oversold conditions, we expect a ‘Santa Claus Rally' to be a strong possibility this year.”

Earlier Monday, US shares lost steam momentarily after data showed consumer confidence unexpectedly sank for the first time in three months on concerns about the outlook for the economy.

“The economic outlook is deteriorating,” said Neil Dutta at Renaissance Macro Research. “This was true before the Fed's December confab and remains true. The risk of the Fed flip-flopping is quite high.”

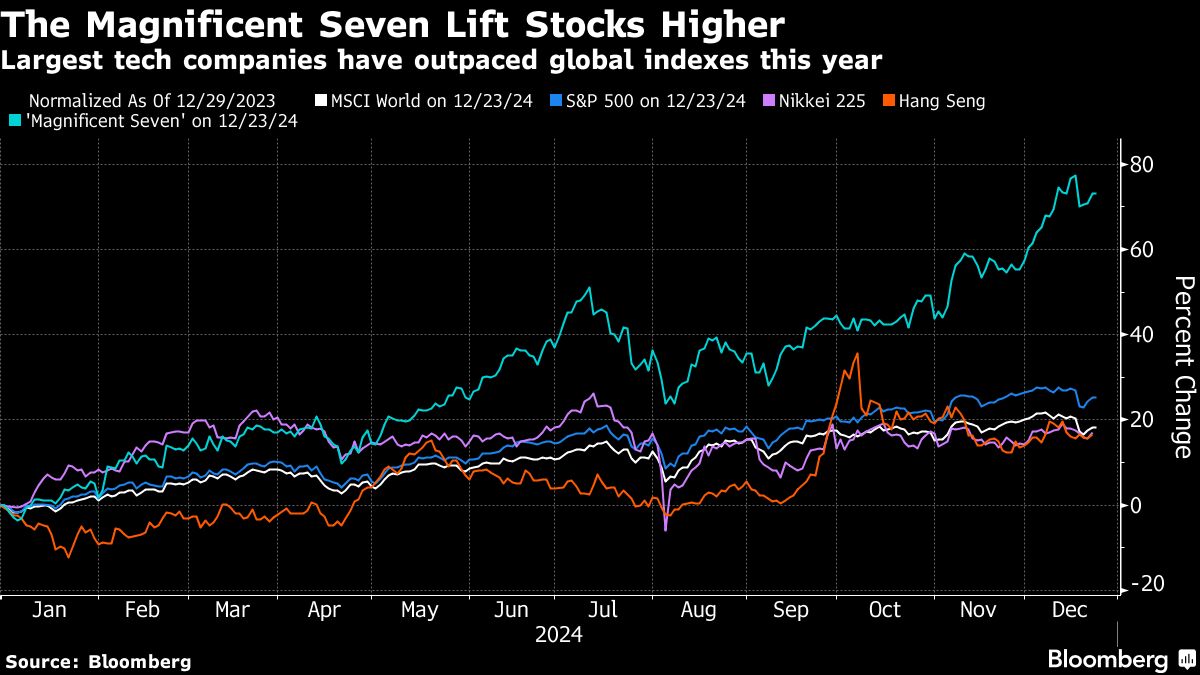

The S&P 500 is on its way to record a stellar annual return and back-to-back years of more than 20% gains. The index has risen about 25% since the end of 2023, with the top seven biggest technology stocks accounting for more than half of the advance.

Whether or not the gauge will be able to stage a “Santa Claus Rally” continues to be a barometer of investors' optimism into the new year. That seven-day period includes the last five trading days of the old year and the first two of the new one.

Key events this week:

Christmas Day, Wednesday

US initial jobless claims, Thursday

Boxing Day, Thursday

Japan Tokyo CPI, unemployment, industrial production, retail sales, Friday

US goods trade, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures were little changed as of 9:24 a.m. Tokyo time

Hang Seng futures rose 0.1%

Japan's Topix rose 0.2%

Australia's S&P/ASX 200 was little changed

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0402

The Japanese yen was little changed at 157.32 per dollar

The offshore yuan was little changed at 7.3081 per dollar

Cryptocurrencies

Bitcoin rose 0.4% to $94,255.7

Ether fell 0.7% to $3,395.11

Bonds

The yield on 10-year Treasuries was little changed at 4.58%

Japan's 10-year yield was unchanged at 1.055%

Australia's 10-year yield advanced two basis points to 4.43%

Commodities

West Texas Intermediate crude rose 0.4% to $69.51 a barrel

Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.