Asian Stocks Hold Near Record, Silver Falls From Peak: Markets Wrap

Gold and platinum also jumped to records on Friday before bullion headed lower on Monday.

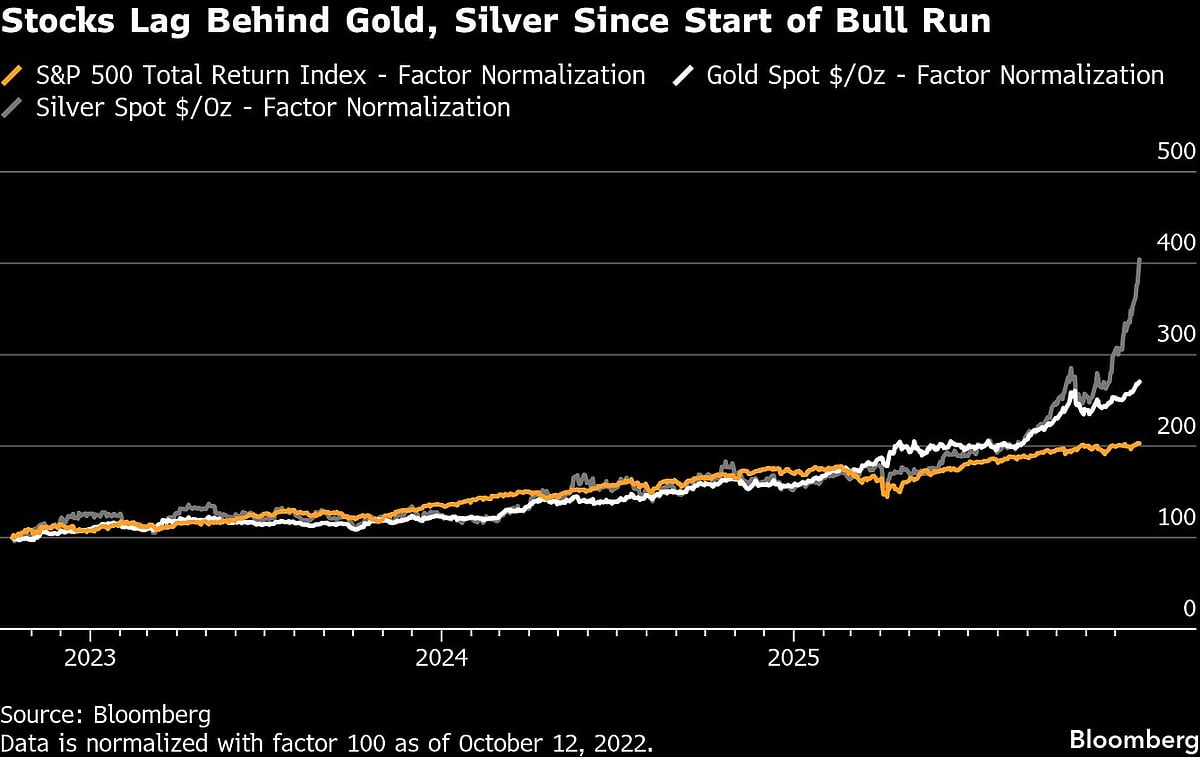

Global stocks held near a record high while silver climbed to a new peak before turning lower amid thinned holiday trading.

A gauge of Asian shares gained 0.2% in early trading, while US stock futures were steady after the S&P 500 finished near an all-time high on Friday. Silver rallied 6%, pushing beyond $80 an ounce for the first time, before reversing the gains and falling more than 2%.

“We are witnessing a generational bubble playing out in silver,” Tony Sycamore, market analyst at IG Australia, wrote in a note Sunday. “Relentless industrial demand from solar panels, EVs, AI data centres and electronics, pushing against depleting inventories, has driven physical premiums to extremes.”

Precious metals have emerged as a hot corner of financial markets in recent months, boosted by elevated central-bank purchases, inflows to exchange-traded funds and three successive rate cuts by the Federal Reserve. Lower borrowing costs are a tailwind for the commodities, which don’t pay interest, and traders are betting on more rate cuts in 2026.

Gold and platinum also jumped to records on Friday before bullion headed lower on Monday.

What Bloomberg Strategists say...

“Silver has particular drivers which mean it is understandable for it to be outperforming the general rally in metals, precious and otherwise, against the US dollar. Nevertheless it is very tough to justify the parabolic ramp-up in silver as it leaves peers behind.”

Garfield Reynolds, Markets Live Strategist. For full analysis, click here.

The MSCI All Country World Index — one of the broadest measures of the equity market — was little changed after climbing 1.4% last week to finish at a new all-time high as a much-expected year-end equities rally took hold. The gauge has risen nearly 22% in 2025, headed for a third straight annual gain and the biggest since 2019.

Trends in AI, the key driver of this year’s rally, as well as the path of the Federal Reserve’s interest rates are seen by investors as two of the most crucial factors that will determine how global stocks perform in 2026.

“The focus this week will be on the release of the FOMC minutes” from the Fed’s December meeting, according to Sycamore. “Markets will scour the minutes for deeper insights into the committee debates on the balance of risks and the timing of future easing.”

In Asia, Chinese markets will be in focus after the nation pledged to broaden its fiscal spending base in 2026, signaling sustained government support to drive growth in a challenging external environment.

Data over the weekend showed China’s industrial profits fell for a second month in November, adding to signs that weakening domestic demand and persistent deflation are weighing on corporate earnings.

Geopolitics is also in focus at the start of a new week. Donald Trump said he made “a lot of progress” in talks with Ukrainian President Volodymyr Zelenskiy as the US president pushes for a peace deal to end Russia’s invasion.

Elsewhere, oil ticked higher on prospects for improved Chinese demand while Bitcoin also advanced.

Action in bonds was muted on Friday, with Treasuries set for a monthly loss, yet on pace for their best year since 2020 after three Fed rate cuts. The dollar churned at the end of its worst week since June.

Stocks

S&P 500 futures were little changed as of 9:32 a.m. Tokyo time

Japan’s Topix rose 0.1%

Australia’s S&P/ASX 200 fell 0.1%

Euro Stoxx 50 futures rose 0.3%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.1780

The Japanese yen rose 0.3% to 156.14 per dollar

The offshore yuan was little changed at 7.0031 per dollar

Cryptocurrencies

Bitcoin rose 0.7% to $88,169.64

Ether rose 1.1% to $2,969.59

Bonds

The yield on 10-year Treasuries was little changed at 4.12%

Australia’s 10-year yield was little changed at 4.74%

Commodities

West Texas Intermediate crude rose 0.8% to $57.19 a barrel

Spot gold fell 1.1% to $4,484.95 an ounce