Equities in Asia rose ahead of interest-rate decisions by major central banks across the globe due later this week, including the Federal Reserve.

A key stock benchmark for the region climbed, as did shares in Australia and Japan. South Korean equities fell, while futures for Hong Kong stocks pointed to a decline. The moves came after a positive session on Wall Street, where the Nasdaq 100 gained more than 1% to reach another record high.

All eyes will be on a multitude of central bank policy decisions slated for this week, including the US and Japan. Sentiment in the US is relatively positive, with a widely expected quarter-point rate cut from the Fed on Wednesday seen as adding fresh support and extending gains in stocks. That stands in contrast to losses in Asia on Monday after a soft data print in China. The 10-year Treasury yield was flat at 4.40%.

“Near-term momentum may depend on what Fed Chair Powell says after the announcement, and whether retail sales or the PCE Price Index catch the market off guard,” said Chris Larkin, manging director, trading and investing, at E*Trade from Morgan Stanley.

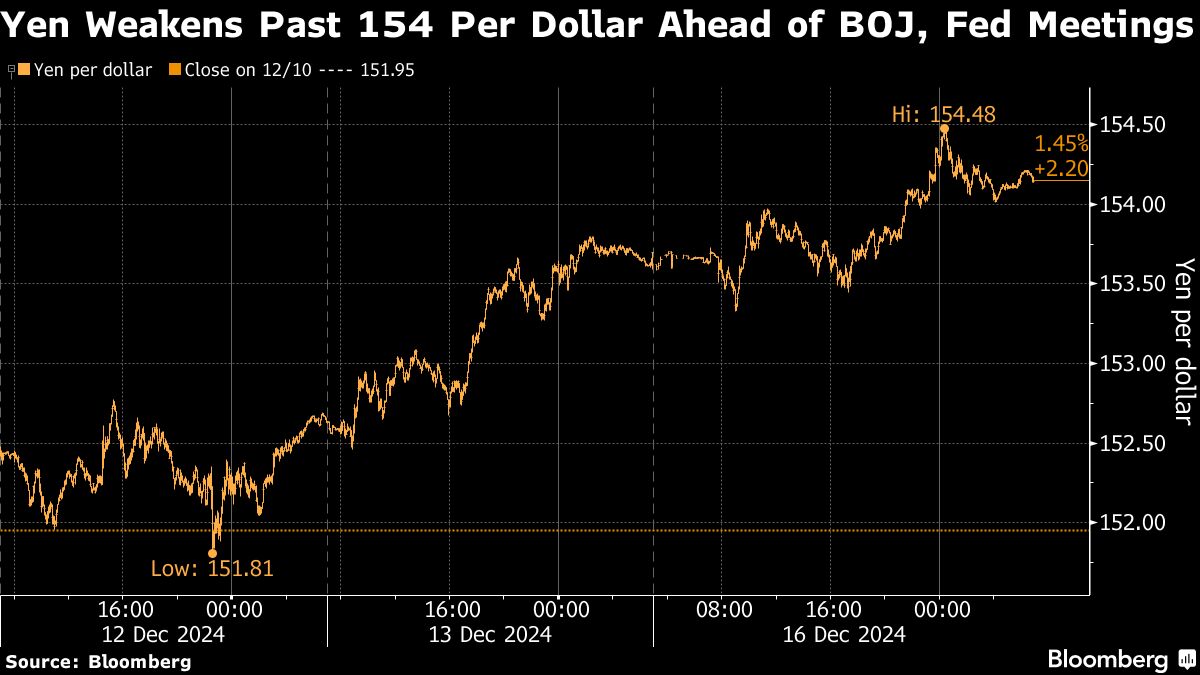

The yen steadied after six days of losses, as traders awaited this week's Bank of Japan policy decision. Traders are pricing in a less than 20% chance of a rate hike in December, according to swaps market pricing. The currency weakened beyond the 154 level versus the dollar overnight.

The Bloomberg's dollar index was largely unchanged Tuesday.

Australia's consumer confidence declined in December as persistent inflation and elevated interest rates at home coupled with upheaval abroad increased household uncertainty over the outlook for the economy.

In the US, traders will be parsing fresh economic data. On Monday, data showed that activity at US service providers is expanding at the fastest pace since October 2021. Meanwhile, a measure of New York state factory activity retreated by the most since last May.

The main focus remains Wednesday's Fed decision, which will be followed by policy announcements in Japan, the Nordics and the UK this week. Even if we get a “hawkish cut” from the Fed, it would be because the central bank sees underlying strength in the economy, and that means the rally in US stocks could continue to broaden out, Tony DeSpirito, BlackRock's global chief investment officer of fundamental equities, said on Bloomberg TV.

In the corporate world, President-elect Donald Trump announced that SoftBank Group Corp. planned to invest $100 billion in the US over the next four years during an event alongside Chief Executive Officer Masayoshi Son on Monday. Shares of SoftBank rose as much as 4%.

Elsewhere, French bonds lagged peers on Monday after Moody's Ratings cut the country's credit rating. The Bank of France trimmed its domestic growth outlook, with the central bank citing political upheaval as a drag on household and business confidence.

Oil steadied after a decline, after poor economic data from China reinforced concerns about weakening demand in the world's biggest crude importer. Meanwhile, gold was little changed, holding on to a slight gain in its previous session.

Key events this week:

UK jobless claims, unemployment, Tuesday

UK CPI, Wednesday

Eurozone CPI, Wednesday

US rate decision, Wednesday

Japan rate decision, Thursday

UK BOE rate decision

US revised GDP, Thursday

Japan CPI, Friday

China loan prime rates, Friday

Eurozone consumer confidence, Friday

US personal income, spending & PCE inflation, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures fell 0.1% as of 9:24 a.m. Tokyo time

Hang Seng futures fell 0.3%

Japan's Topix rose 0.5%

Australia's S&P/ASX 200 rose 0.5%

Euro Stoxx 50 futures were little changed

Nasdaq 100 futures were little changed

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0519

The Japanese yen was little changed at 154.21 per dollar

The offshore yuan was little changed at 7.2910 per dollar

The Australian dollar was little changed at $0.6372

Cryptocurrencies

Bitcoin was little changed at $106,118.98

Ether fell 1.8% to $3,975.38

Bonds

The yield on 10-year Treasuries was little changed at 4.39%

Australia's 10-year yield declined one basis point to 4.31%

Commodities

West Texas Intermediate crude fell 0.2% to $70.59 a barrel

Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.