US stocks flipped between small gains and losses on Monday as investors awaited the outcome of crucial trade talks between Washington and Beijing in London.

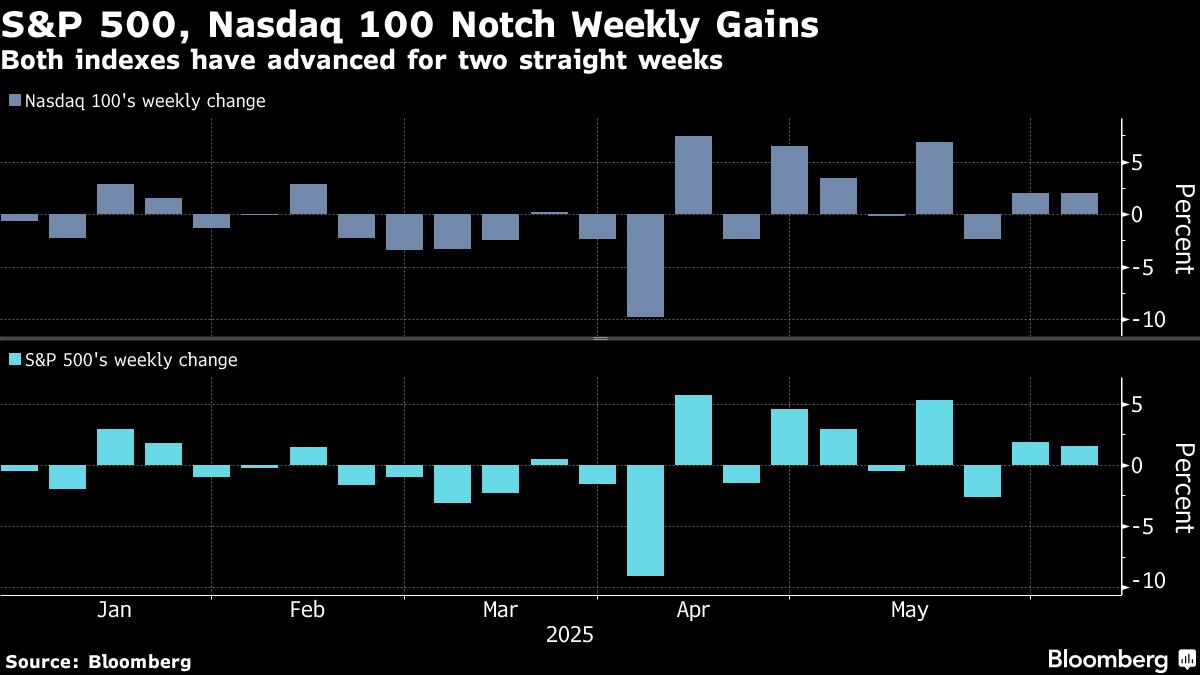

The S&P 500 Index rose less than 0.1% as of 9:51 a.m. in New York, after notching a second straight week of gains that pushed it above the psychologically important 6,000 level on Friday for the first time since Feb. 21. The Nasdaq 100 Index climbed less than 0.1%. A basket tracking so-called Magnificent Seven stocks including Tesla Inc., Nvidia Corp. and Meta Platforms Inc. rose just 0.3%.

Tesla fell 1.1% after receiving two downgrades from Baird and Argus Research due to its highly uncertain outlook, especially on the political front. Shares are down nearly 30% in 2025, making it the weakest performer of the Magnificent Seven stocks. The electric-vehicle is poised to begin its long-awaited robotaxi service in Austin later this week.

Shares of Apple Inc. ticked up 0.5% ahead of its annual Worldwide Developers Conference, with Chief Executive Tim Cook scheduled to give a keynote address at 1 p.m. Eastern. After starting the year as the world's most valuable company, Apple now ranks third behind Microsoft Corp. and Nvidia after its shares tumbled more than 18% in 2025. The event is expected to focus on design and productivity enhancements for its operating system franchises.

Talks between the US and China kicked off in London, with the US signaling willingness to remove restrictions on exports in exchange for assurances that China is easing limits on rare earth shipments. The meeting, which started Monday just after 1 p.m. local time, is expected to extend into the UK evening and might spill into Tuesday.

“Markets have moved higher on tariff postponement and the perception that they will be more moderate than initially announced,” wrote Richard Saperstein, chief investment officer at Treasury Partners, an investment firm based in New York City. “Trade deals take time to negotiate and unsettling tariff news is likely to cause noticeable volatility.”

With key inflation data on tap and the Federal Reserve in a blackout period before its June 18 interest rate decision, money managers are wrestling with what could propel the S&P 500 back to previous highs after the index soared 20% from its April lows. The equity benchmark is now less than 2.5% away from its record high.

The latest report on the consumer price index is due on Wednesday, followed by the producer price index Friday. Traders will be looking for clues as to how tariffs are flowing through the economy. A new consumer sentiment reading from the University of Michigan — which includes data around inflation expectations — is also set for release on Friday.

Wall Street strategists have been growing more optimistic about US stocks, with forecasters at Morgan Stanley and Goldman Sachs Group Inc. the latest to suggest that resilient economic growth would limit potential pullbacks over the summer. Meanwhile, Citigroup Inc. equity strategists led by Scott Chronert raised their year-end S&P 500 target to 6,300 from 5,800, though the new target implies just a 5% return from Friday's close.

Among other individual stock movers, Warner Bros Discovery Inc. climbed 9.4% after the company said it would into two publicly traded businesses. Meantime, Robinhood Markets Inc. declined 5.9% and Applovin Corp. dropped 4.2% after S&P Dow Jones Indices left the S&P 500 unchanged in its latest round of quarterly rebalancing on Friday.

EchoStar Corp. slid 9.1% after the Wall Street Journal reported the company is weighing a potential chapter 11 bankruptcy filing amid a Federal Communications Commission review of certain of its wireless and satellite spectrum rights, citing people familiar with the matter.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.