Treasuries fell and the dollar rose as stronger-than-forecast employment growth soothed concern the US economy is poised to slow, stanching speculation the Federal Reserve will need to cut interest rates any time soon. Stocks hit fresh all-time highs.

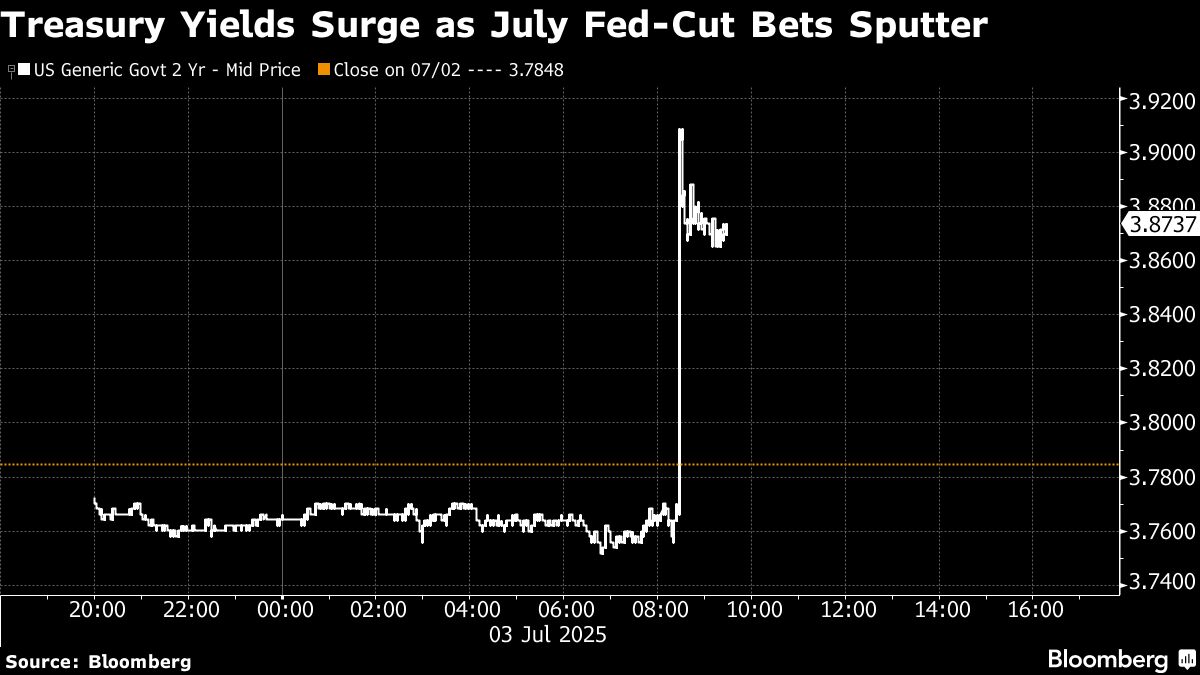

Short-dated bonds underperformed, with two-year yields up eight basis points to 3.87%. Money markets showed traders saw almost zero chance for a Fed reduction in July, compared with the roughly 25% probability seen before the report. The chance of a move in September was reduced to about 75%. The S&P 500 rose for the fifth time in six days.

Traders parse jobs data.

US job growth exceeded expectations in June for a fourth straight month and the unemployment rate fell, showcasing a labor market that is holding up. Payrolls increased 147,000 last month. The unemployment rate fell to 4.1%.

“The labor market remains on solid footing,” said Sameer Samana at Wells Fargo Investment Institute. “The data will reinforce the Fed's wait-and-see approach and we would not expect a cut in July.”

Fed Chair Jerome Powell has said there is no rush to reduce borrowing costs until there is more clarity about the impact of tariffs on inflation. Price pressures have been subdued so far this year.

Corporate Highlights:

President Donald Trump's administration has lifted recent export license requirements for chip design software sales in China, as Washington and Beijing implement a trade deal for both countries to ease some restrictions on critical technologies.

Alibaba Group Holding Ltd. is seeking to raise HK$12 billion ($1.5 billion) from the sale of bonds exchangeable into shares of Alibaba Health Information Technology Ltd.

BlackRock Inc. is considering a sale of its stake in the leasing rights to Saudi Aramco's natural-gas pipeline network back to the energy giant, according to people familiar with the matter.

Volkswagen AG's Audi won't increase prices in the US in July after its sales there nosedived in the second quarter.

Zurich Insurance Group AG agreed to buy BOXX Insurance Inc, a Canadian cyber risk management firm, marking the Swiss insurer's latest push into the insurance technology sector.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.