Shares of Asian Paints Ltd. rose over 2% on Thursday after block deals.

Nearly 3.6% stake changed hands through open market transactions on Thursday. On NSE, 3.5 crore shares changed hands in one block deal at Rs 2,201 per share, taking the deal value to Rs 7,703.50 crore.

However, the identities of the buyers and sellers remain unknown.

As of March, Siddhant Commercials Pvt. holds a 4.9% stake in the company, while the Life Insurance Corporation of India holds an 8.29% stake in Asian Paints. Among promoters, Sattva Holding and Trading Pvt. owns a 5.71% stake, while Smiti Holding and Trading Company Pvt. holds 5.4% and Geetanjali Trading and Investments Pvt. owns 4.77%.

This comes after the paint maker received its lowest price target yet from Morgan Stanley on Tuesday, with the brokerage slashing its target price on the stock to Rs 1,909 from Rs 2,126 earlier—signalling a potential downside of nearly 15% from current levels.

CLSA and Elara Capital also hold similar views, with targets of Rs 1,966 and Rs 1,940, respectively—all projecting the stock to fall below Rs 2,000.

Morgan Stanley's downgrade is part of a broader sector call, as it warns of continued de-rating in India's paint industry. Indian paint companies are transitioning from an era of coordinated and disciplined double-digit value growth to one marked by hyper-competition and weakening correlation with macroeconomic cycles, according to the research firm.

The brokerage expects this ongoing structural transition to lead to further de-rating in sector valuations.

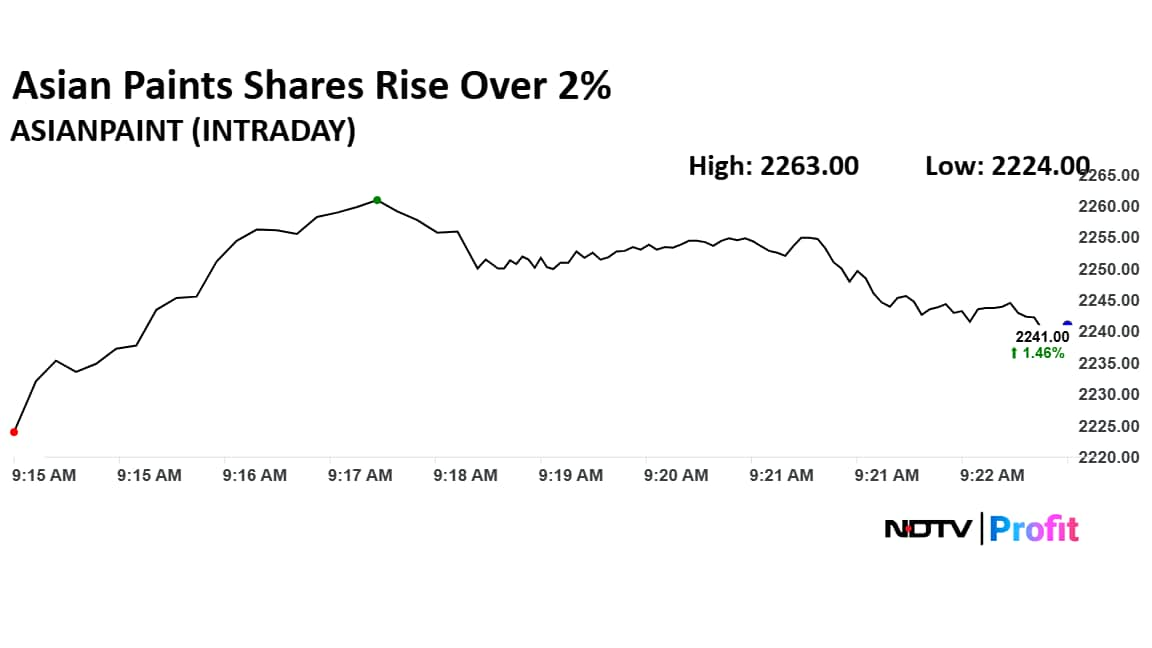

Asian Paints Share Price Rises

The shares of Asian Paints rose as much as 2.45% to Rs 2,263 apiece, the highest level since June 3. It pared gains to trade 2.11% higher at Rs 22,555.50 apiece, as of 9:18 a.m. This compares to a 0.10% advance in the NSE Nifty 50 Index.

It has fallen 22.55% in the last 12 months and 1.31% year-to-date. Total traded volume so far in the day stood at 1.25 times its 30-day average. The relative strength index was at 29.17.

Out of 38 analysts tracking the company, six maintain a 'buy' rating, 10 recommend a 'hold', and 22 suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 2.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.