(Bloomberg) -- Stocks in Asia sank after Wall Street posted its worst day since the Aug. 5 rout, as weak US data and falling oil prices raised concerns about the health of the global economy.

Japan led the slump, with the Nikkei 225 down over 3%. Shares also fell in Australia and South Korea, while futures pointed to losses in Hong Kong. US contracts edged lower in early Asian trading after the S&P 500 fell more than 2%, with Nvidia Corp. driving a plunge in tech stocks.

The risk-off mood came as the yen jumped and a closely watched US manufacturing gauge again missed forecasts. A selloff in tech stocks also rekindled worries about undue invesetor frenzy about artificial intelligence.

Wall Street's “fear gauge” - the VIX - soared. Treasury yields tumbled, with traders keeping their bets on an unusually large half-point Federal Reserve rate cut this year. A dollar gauge rose for a fifth session, its longest winning streak since April, before falling slightly in early trading on Wednesday.

The S&P 500 and the Nasdaq 100 saw their worst starts to a September since 2015 and 2002, respectively. With inflation expectations anchored, attention has shifted to the health of the economy as signs of weakness could speed up policy easing. While rate cuts tend to bode well for equities, that's not usually the case when the Fed is rushing to prevent a recession.

Traders are anticipating the Fed will reduce rates by more than two full percentage points over the next 12 months — the steepest drop outside of a downturn since the 1980s. The trepidation after the latest rise in unemployment will leave traders “on edge” until Friday's payrolls data, said Ian Lyngen and Vail Hartman at BMO Capital Markets.

“This week's jobs report, while not the sole determinant, will likely be a key factor in the Fed's decision between a 25 or 50 basis-point cut,” said Jason Pride and Michael Reynolds at Glenmede. “Even modest signals in this week's jobs report could be a key decision point as to whether the Fed takes a more cautious or aggressive approach.”

The S&P 500 dropped to around 5,530 while the Nasdaq 100 lost over 3% as Nvidia tumbled 9.5% — erasing $279 billion in a record one-day wipeout for a US stock. The US Justice Department sent subpoenas to Nvidia and other companies as it seeks evidence that the chipmaker violated antitrust laws.

US 10-year yields steadied after falling seven basis points to 3.83%, and the equivalent Australian note lost seven points early Wednesday. The yen climbed Tuesday as Bank of Japan's Kazuo Ueda reiterated the central bank will continue to raise rates if the economy and prices perform as expected.

Marking the start of a busy week for economic data, a report showed US manufacturing activity shrank in August for a fifth month.

The Morgan Stanley strategist who foresaw last month's market correction says firms that have lagged the rally in US stocks could get a boost if Friday's jobs data provide evidence of a resilient economy. A stronger-than-expected payrolls number would likely give investors “greater confidence that growth risks have subsided,” Michael Wilson wrote.

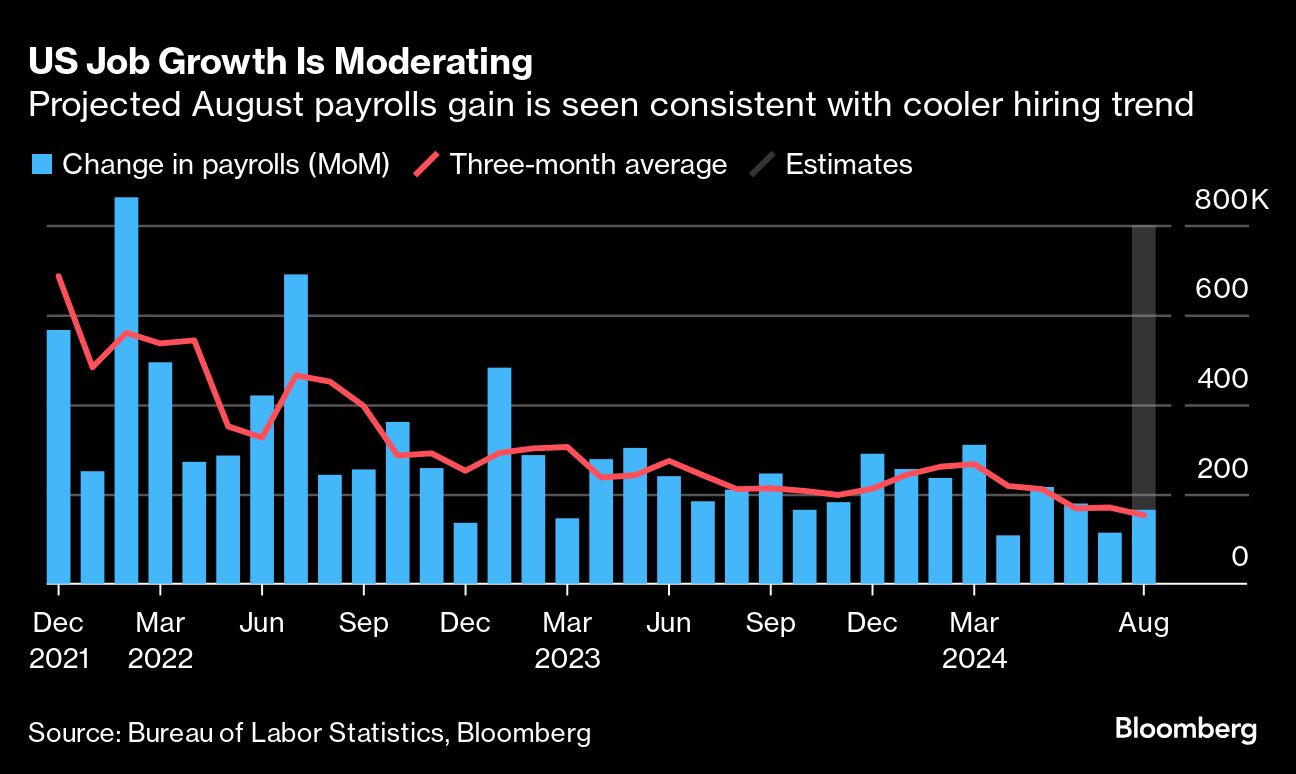

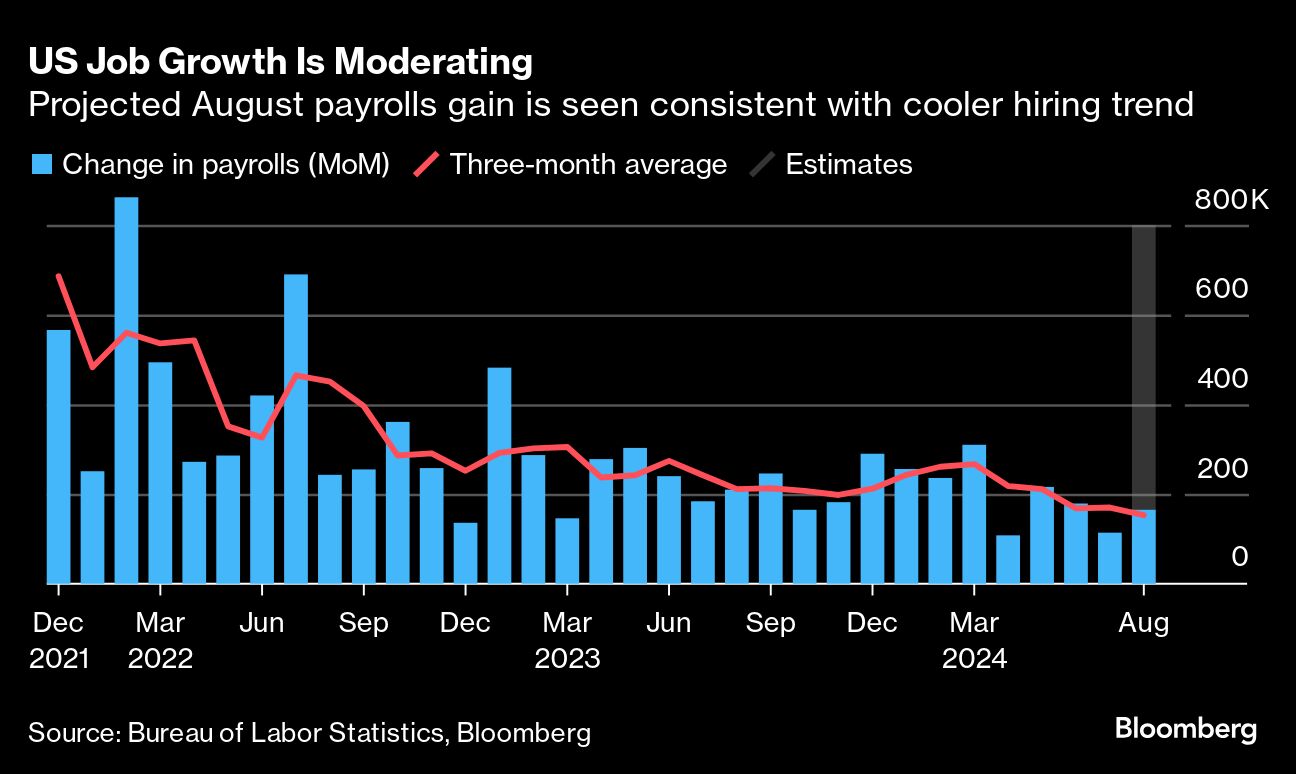

The August jobs report is expected to show payrolls in the world's largest economy increased by about 165,000, based on the median estimate in a Bloomberg survey of economists.

While above the modest 114,000 gain in July, average payrolls growth over the most recent three months would ease to a little more than 150,000 — the smallest since the start of 2021. The jobless rate probably edged down in August, to 4.2% from 4.3%.

While the Fed is finally coming around to cutting rates, it does not feel like stringing out a bunch of 25 basis-point rate cuts will do the job, said Neil Dutta at Renaissance Macro Research. Under that scenario, it will take a long time to return the funds rate to neutral and in the process, you'll keep policy restrictive, keeping open downside risks to growth.

“That muddling through scenario will probably risk further increases in the unemployment rate,” he said. “So, if they aren't going 50 in September, they are going to need to go 50 at some point later this year.”

Key events this week:

China Caixin services PMI, Wednesday

Eurozone HCOB services PMI, PPI, Wednesday

Canada rate decision, Wednesday

US job openings, factory orders, Beige Book, Wednesday

Eurozone retail sales, Thursday

US initial jobless claims, ADP employment, ISM services index, Thursday

Eurozone GDP, Friday

US nonfarm payrolls, Friday

Fed's John Williams speaks, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures were little changed as of 9:07 a.m. Tokyo time

Hang Seng futures fell 0.6%

Japan's Topix fell 2.8%

Australia's S&P/ASX 200 fell 0.9%

Euro Stoxx 50 futures fell 1.2%

Nasdaq 100 futures fell 0.2%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.1049

The Japanese yen was little changed at 145.43 per dollar

The offshore yuan was little changed at 7.1192 per dollar

The Australian dollar was little changed at $0.6712

Cryptocurrencies

Bitcoin fell 0.8% to $57,720

Ether fell 1.1% to $2,435.31

Bonds

The yield on 10-year Treasuries was little changed at 3.84%

Japan's 10-year yield declined 2.5 basis points to 0.895%

Australia's 10-year yield declined six basis points to 3.94%

Commodities

West Texas Intermediate crude fell 0.2% to $70.23 a barrel

Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.