(Bloomberg) -- European stocks gained and the dollar fell after Federal Reserve meeting minutes showed support for more moderate interest-rate increases.

The Stoxx Europe 600 Index extended its recent rally as the real estate sector outperformed, boosted by the prospects of slower rate hikes and analyst upgrades. Dr. Martens Plc shares plunged the most on record after the bootmaker's sales and earnings missed expectations. An index of global stocks advanced for a third day.

Trading volumes are lower due to the Thanksgiving holiday, with no cash US equity market trading. Wall Street futures rose after the S&P 500 closed at a two-month high Wednesday. Asia's equities benchmark climbed.

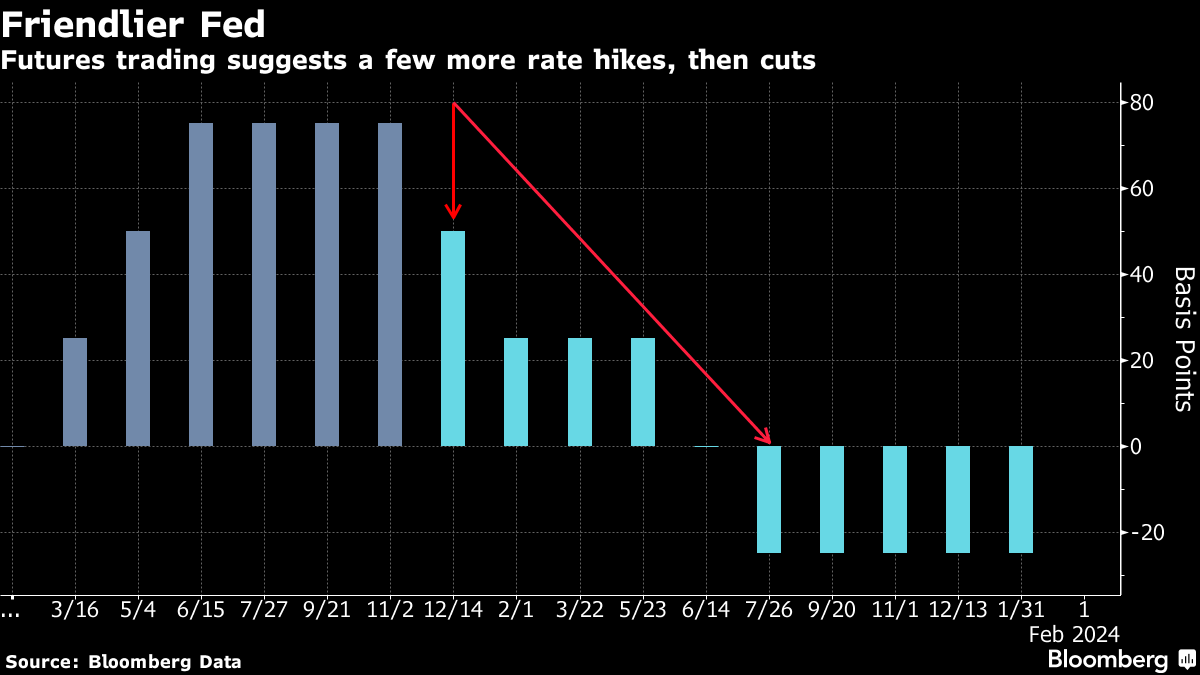

Minutes from the Fed gathering earlier this month indicated several officials backed the need to moderate the pace of rate hikes, even as some underscored the case for a higher terminal rate. This adds weight to expectations the central bank will raise rates by 50 basis points next month, ending a run of jumbo 75 basis point increases.

“It was the start of a more different and dovish narrative from the Fed,” said Sunaina Sinha Haldea, global head of private capital advisory at Raymond James. “Is it a pivot? No, but are we seeing a slowdown in rate hikes and that path downwards towards rate cuts coming through? Yes. I think we will look back and say this was the peak of it.”

Data Wednesday also showed US business activity contracted and unemployment applications rose as the economy cools.

A gauge of dollar strength fell further Thursday, taking declines into a third day. European bonds rallied as traders trimmed wagers on rate increases by the European Central Bank, with risk-sensitive Italian debt leading the gains. There is no trading in Treasuries due to the US holiday.

“A few” ECB officials favored a smaller increase in interest rates in October to tackle record inflation, an account of their last meeting showed. Those who preferred a less aggressive step cited the fact that the hike was accompanied by other monetary-tightening measures, according to the account, published Thursday.

Oil edged lower as the European Union considered a higher-than-expected price cap on Russian crude and signs of a global slowdown increased.

Meanwhile, Bank of America Corp. said its private clients are flocking to bonds and out of stocks amid fears of a looming recession. Bond funds attracted inflows for a 39th straight week, strategists led by Michael Hartnett wrote in a note. The strategists favor holding bonds in the first half of 2023, with stocks becoming more attractive in the last six months of next year.

“We stay bearish risk assets in the first half, set to turn bullish in the second half as narrative shifts from inflation and rate ‘shocks' of 2022 to recession and credit ‘shocks' in the first half 2023,” the strategists wrote.

Gold rose for a third day on the Fed minutes. The precious metal has been hurt by the US central bank's aggressive monetary-tightening policy to curb inflation, which has pushed up bond yields and the dollar and in turn sent bullion tumbling about 16% from its March peak.

In Asian trading, mainland Chinese stocks underperformed as investors weighed the impact of record Covid-19 cases against signs of loosening monetary conditions. Official comments broadcast Wednesday indicated the People's Bank of China would allow banks to reduce capital reserves to stimulate growth.

Key events this week:

- ECB publishes account of its October policy meeting, Thursday

- US stock and bond markets are closed for the Thanksgiving holiday, Thursday

- US stock and bond markets close early, Friday

Some of the main moves in markets:

Stocks

- Futures on the S&P 500 rose 0.3%, climbing for the third straight day, the longest winning streak since Nov. 8 as of 2:33 p.m. New York time

- Futures on the Dow Jones Industrial Average rose 0.2%, climbing for the third straight day, the longest winning streak since Nov. 8

- The MSCI World index rose 0.4%, climbing for the third straight day, the longest winning streak since Nov. 8

Currencies

- The Bloomberg Dollar Spot Index fell 0.2%, falling for the third straight day, the longest losing streak since Nov. 8

- The euro was little changed at $1.0405

- The British pound rose 0.5% to the highest since Aug. 12

- The Japanese yen rose 0.8% to the highest since Aug. 26

Cryptocurrencies

- Bitcoin rose 0.6% to $16,566.67

- Ether rose 2.9% to $1,203.05

Bonds

- Germany's 10-year yield declined eight basis points to 1.85%

- Britain's 10-year yield advanced three basis points to 3.04%

Commodities

- West Texas Intermediate crude was little changed

- Gold futures rose 0.5%, more than any closing gain since Nov. 11

This story was produced with the assistance of Bloomberg Automation.

--With assistance from .

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.