Asian stocks crept higher in early trade following a sluggish session on Wall Street as investors awaited clues on the Federal Reserve's policy path in its final interest-rate decision of the year.

Benchmark share indexes in Australia and Japan both nudged higher, while US equity futures were little changed after the S&P 500 closed almost flat on Tuesday. A gauge of US-listed Chinese stocks fell 1.4% following a lack of stimulus signals from a meeting of top Communist Party leaders.

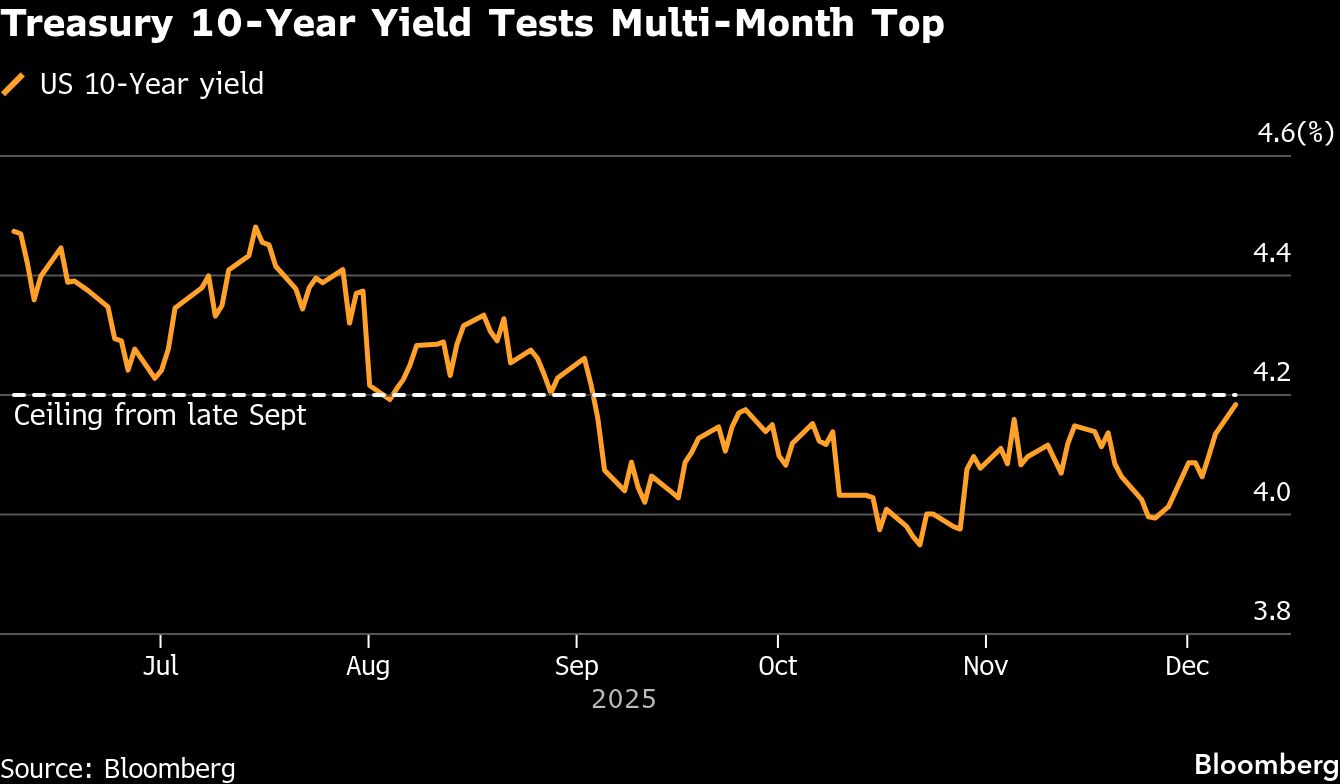

The Treasury 10-year yield hovered at around 4.18% following an auction of the securities on Tuesday, while the dollar was little changed and Bitcoin reversed early losses.

Traders are anticipating a Fed rate cut on Wednesday, while the focus will also be on the central bank's latest dot plot, economic projections and comments from Chair Jerome Powell. Volatility around the decision has been among the defining characteristics of equity trading in the past six weeks — superseding worries about an AI bubble and the impact from President Donald Trump's trade policies.

Money markets are pricing around two cuts in 2026 after a likely quarter-point reduction on Wednesday — a retreat from more optimistic forecasts in recent weeks.

“It's not too much of an exaggeration to say that the rate cut is actually the least important part of this meeting,” said Tom Essaye, the founder of The Sevens Report. The market “cares much more that the Fed signals it will continue to cut rates and does not signal a pause in the rate-cut cycle.”

Treasury yields climbed from earlier lows on Tuesday after data showed October US job openings increased to the highest level in five months. The Fed's two previous cuts this year were intended to address weakening employment conditions, including a rise in the unemployment rate to nearly 4.5%.

Kevin Hassett, the frontrunner in Trump's search to replace Powell, said at an event Tuesday that he sees plenty of room to substantially lower rates, even more than a quarter-point cut.

“If the Fed is too hawkish, we expect the White House to soon announce Powell's replacement,” said Fundstrat's Tom Lee. That would be a “market clearing event” in his view.

In Asia, market watchers will be focusing on the yen after Bank of Japan Governor Kazuo Ueda said the central bank is getting closer to attaining its inflation target, adding to signals that the BOJ may raise its interest rate at a policy meeting next week.

The yen strengthened a touch as Ueda's comments were streamed, briefly dipping below the 156 mark against the dollar.

Globally, government debt markets have been under pressure as central bankers signal that their easing cycles are coming to an end. On Tuesday, Australia's Michele Bullock declared her country's easing phase over, following comments from the European Central Bank's Isabel Schnabel that she's comfortable with the next move being higher.

“Given all the tension in global bond markets at the moment, the meeting of the Fed could potentially add fuel to the fire,” said Vincent Juvyns, chief investment strategist at ING in Brussels. “Investors will also be watching very closely the results of Oracle and Broadcom. There's a lot at stake this week.”

In commodities, silver topped $60 an ounce on Tuesday for the first time on continued supply tightness. Gold also climbed.

Corporate News:

SpaceX is moving ahead with plans for an initial public offering that would seek to raise significantly more than $30 billion, people familiar with the matter said, in a transaction that would make it the biggest listing of all time.

JPMorgan Chase & Co.'s Marianne Lake said the bank anticipates spending $105 billion next year, an outlook that surpasses analyst estimates and sent shares tumbling.

Major investors in First Brands Group have offloaded stakes in the bankrupt auto supplier's debt in recent days, causing the value of its most senior loan to collapse and prompting it to pull forward a lender call to calm nerves.

Microsoft Corp. pledged to invest $17.5 billion in artificial intelligence and cloud computing in India over four years, targeting the world's most populous nation to help fuel its growth.

Indian food delivery major Swiggy Ltd. on Tuesday launched a new share offering for institutional investors to raise up to 100 billion rupees ($1.1 billion), just a year after its market debut.

This week's major events:

Some of the main moves in markets:

Stocks

S&P 500 futures were little changed as of 9:15 a.m. Tokyo time

Hang Seng futures fell 0.2%

Japan's Topix rose 0.6%

Australia's S&P/ASX 200 rose 0.2%

Euro Stoxx 50 futures were little changed

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.1628

The Japanese yen was little changed at 156.81 per dollar

The offshore yuan was little changed at 7.0618 per dollar

Cryptocurrencies

Bitcoin was little changed at $92,629.79

Ether rose 0.6% to $3,321.25

Bonds

The yield on 10-year Treasuries was little changed at 4.18%

Japan's 10-year yield was unchanged at 1.955%

Australia's 10-year yield advanced three basis points to 4.78%

Commodities

West Texas Intermediate crude rose 0.2% to $58.38 a barrel

Spot gold was little changed

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.