(Bloomberg) --

Asia's higher-yielding currencies are becoming more attractive to investors thanks to their improving carry compared with their Latin American peers.

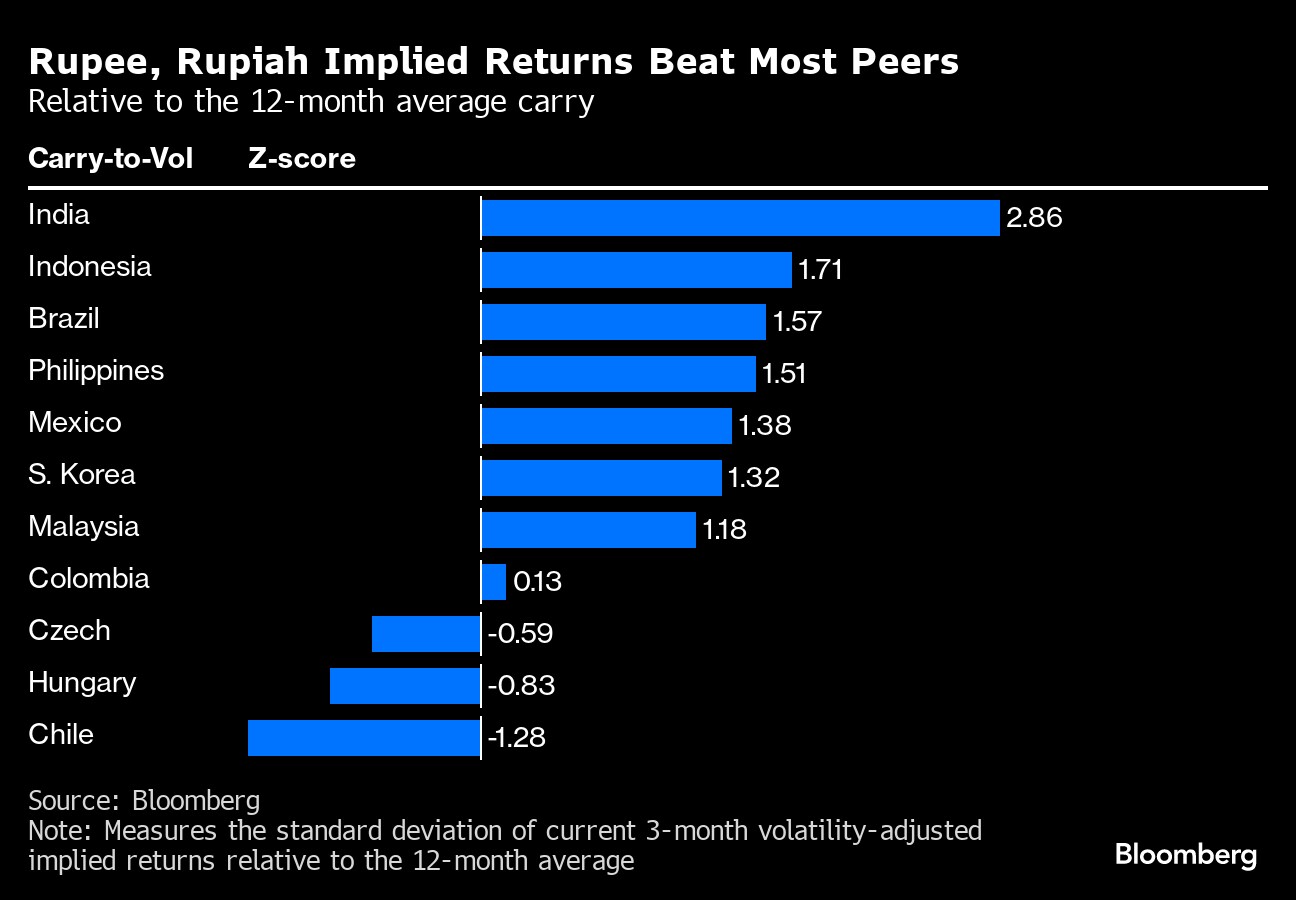

The Indian rupee's implied returns adjusted for volatility are about 2.9 standard deviations above their 12 months average, while those for the Indonesian rupiah are about 1.71 above the same mean, according to Bloomberg estimates. The two currencies have performed better than all their developing-nation peers relative to recent averages.

Underpinning the appeal of the rupee, rupiah and other Asian currencies is that central banks in the region have largely kept interest rates unchanged, while their Latin American counterparts have been easing policy. The policy divergence has lured overseas funds into most Asian countries this year.

Asian high-yield currencies look more attractive than their Latin American peers from a carry, volatility and growth perspective, according to JPMorgan Chase & Co. Both India and Indonesia are set to outperform South America and central and eastern Europe in carry returns, BNY Mellon Capital Markets says.

Indonesia and India will sustain their position as the dominant carry trades for the next three-to-six months, said Bob Savage head of markets strategy and insights at BNY Mellon in New York. “Really big carry trades like Mexico and Brazil are going to be difficult, they've seen a slowdown in investment.”

Fragile Five

India and Indonesia were famously lumped together as part of Morgan Stanley's “Fragile Five” in 2013 but have become investor favorites a decade later following successful programs of reform and fiscal restraint.

The results of recent elections in the two nations has also removed an area of potential risk, according to Bank of America Corp.

Read more: Fragile-Five Days Long Gone as Funds Pile Into India, Indonesia

Latin American assets may face more volatility as delays in Federal Reserve interest-rate cuts could convince emerging markets to slow the pace of any further easing, according to T. Rowe Price Group Inc.

The Fed repricing, coupled with elevated political concerns heading into the US elections, is putting into question one of the fund's top calls on the Mexican peso, said Leonard Kwan, a portfolio manager at T. Rowe Price in Hong Kong. “Despite the positive predisposition to Mexico, that's something we're going to be more watchful over.”

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.