Ashok Leyland Ltd. saw its share price rise over 2% before declining on Thursday, following the announcement of strong third-quarter earnings and an optimistic outlook from brokerages.

The commercial vehicle manufacturer reported a consolidated net profit of Rs 761.74 crore, marking a 31% year-on-year increase from Rs 580.03 crore in the same period last year.

The company's revenue grew by 2.2%, reaching Rs 9,436.17 crore, compared to Rs 9,231.06 crore in the previous year. Earnings before interest, taxes, depreciation, and amortisation also saw a notable rise of 9%, amounting to Rs 1,168.93 crore, up from Rs 1,071.98 crore. The Ebitda margin improved to 12.4% from 11.6%.

Brokerages have responded positively to Ashok Leyland's performance, with several raising their target prices. Macquarie has maintained its ‘neutral' stance on the stock, but increased the target price to Rs 226, citing a margin-led Ebitda beat and a steady growth outlook for the fourth quarter. The brokerage expects demand to improve further, supported by favourable macroeconomic conditions and lower rates available to the company.

Bank of America has maintained its ‘buy' rating on Ashok Leyland, raising the target price by Rs 10 to Rs 260. The brokerage highlighted significant cost improvements in the third quarter and noted that this marks the eighth consecutive quarter of margin beats. Bank of America also pointed to green shoots in the diesel consumption segment and opportunities arising from increased government capital expenditure. Additionally, the company has been expanding beyond its core business of trucks into other segments.

Overall, Ashok Leyland's strong financial performance and positive outlook from brokerages have contributed to the upward movement in its share price.

Ashok Leyland Share Price Today

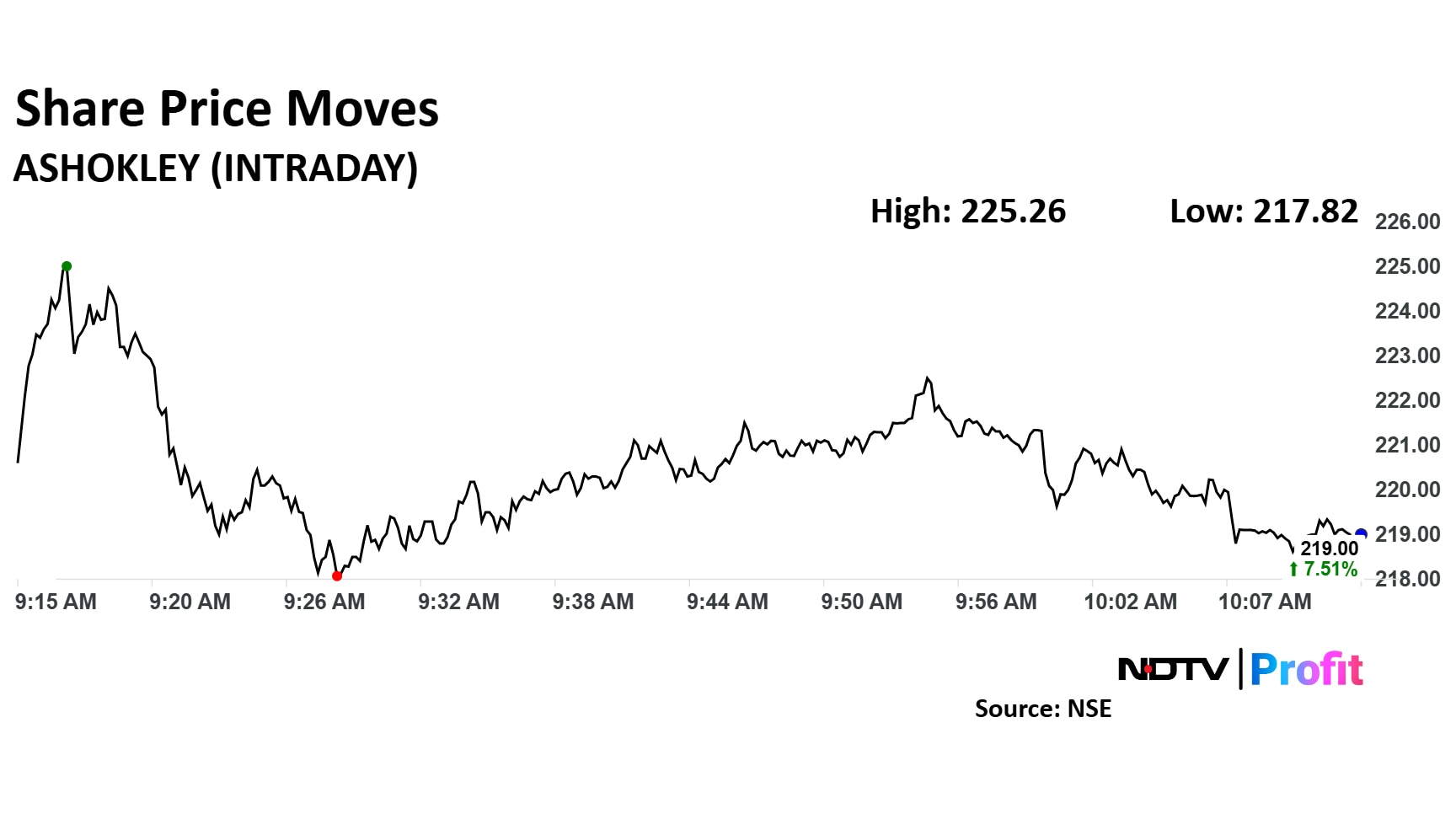

Shares of Ashok Leyland rose as much as 2.69% to Rs 225.26 apiece. They later gave up gains to trade 0.09% down at Rs 219.15 apiece, as of 10:11 a.m. This compares to a 0.60% advance in the NSE Nifty 50.

The stock has risen 26.58% in the last 12 months. Total traded volume so far in the day stood at 11 times its 30-day average. The relative strength index was at 56.

Out of 42 analysts tracking the company, 33 maintain a 'buy' rating, five recommend a 'hold' and four suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 13.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.