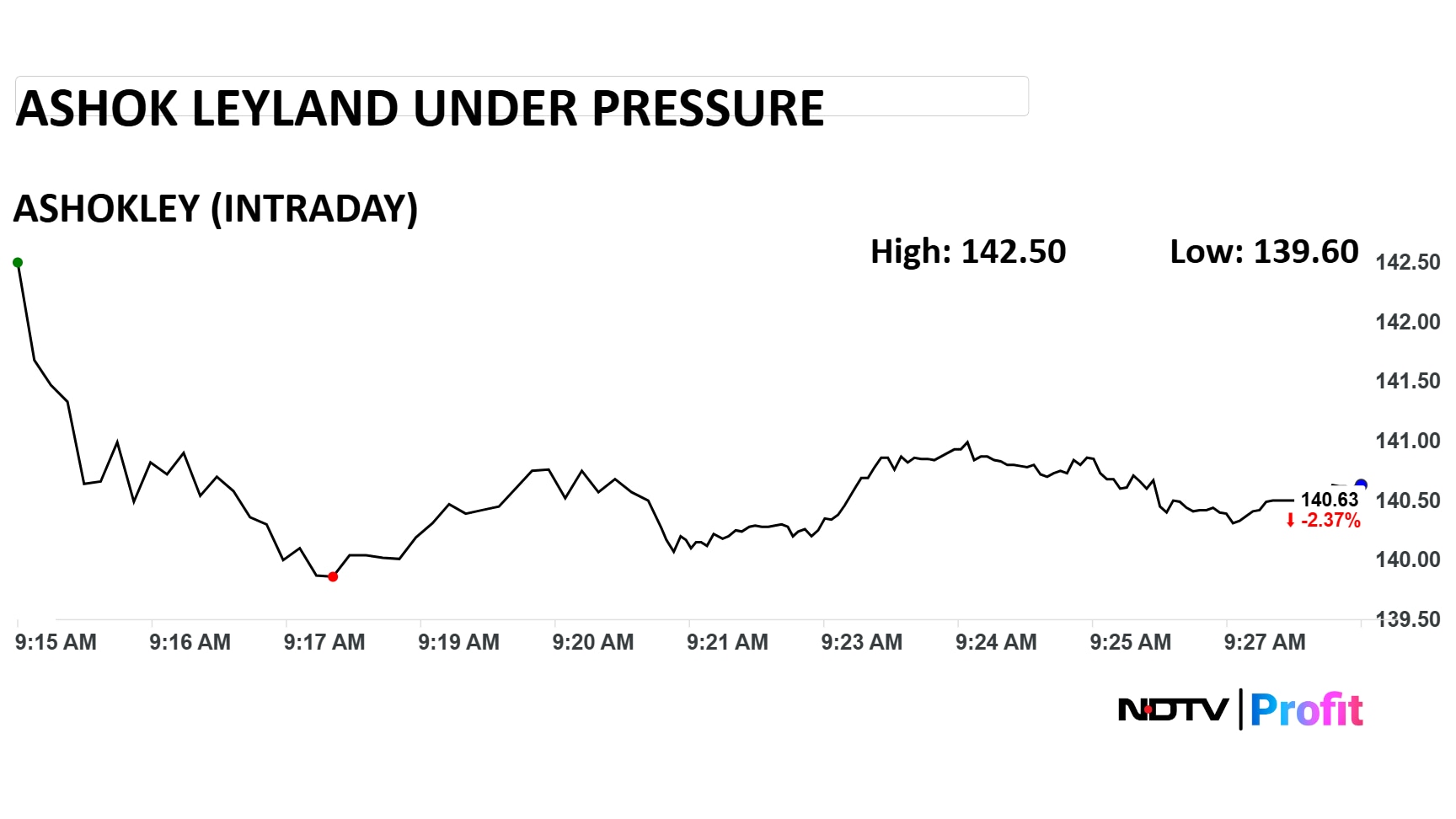

Ashok Leyland Ltd. share price fell are trading with cuts of almost 2.5% in Wednesday morning trade following a Goldman Sachs note, which downgraded the stock to 'neutral', although the target price of Rs 140 has remained unchanged.

Goldman Sachs note cited a likely shift in the broader economy away from capital expenditure towards consumption, a trend that may favour passenger cars over commercial vehicles.

“We expect car volume growth to exceed CV volume growth over the next 12 months,” the note said.

The investment bank also cut FY26 to FY28 earnings per share (EPS) estimates by 4% to 7%.

(Photo: NDTV Profit)

While Ashok Leyland has been a beneficiary of the infrastructure-driven demand for trucks and commercial vehicles as a whole, Goldman Sachs cautioned that demand could taper off in the medium term.

Another risk the note mentioned was the North West Dedicated Freight Corridor, which opens early next year in 2026.

The note cautioned that the Dedicated Freight Corridor may divert some freight traffic away from road transport to rail, potentially reducing demand for long-haul trucks, which is a key segment offering from Ashok Leyland.

Shares of Ashok Leyland have surged 27% on a year-to-date basis. In the pats six months, it has gained more than 30% as well.

Ashok Leyland currently trades at a relative strength index of 67, which suggests upward momentum, but the stock is close to entering the overbought territory.

Out of the 44 analysts tracking Ashok Leyland, 33 have a 'buy' rating on the stock, seven recommend a 'hold', and four suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price target implies the stock has already met its upside potential.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.