Ashok Leyland Ltd.'s share price declined in Thursday's session following the news of the promoter pledging additional shares. On Wednesday, the company created an additional pledge of 10.21%, taking the total pledge to 25.59%.

As of December 31, 2024, the promoter had pledged 15.38% of its stake.

This is largely seen as an aftermath to the sharp fall in the share price of IndusInd Bank. Both the companies have the Hinduja Family as the promoter.

Shenu Agarwal, MD & CEO, Ashok Leyland, said he is not privy to current promoter pledge increase or the use of the funds but reiterated the utmost focus on Ashok Leyland by the promoter family.

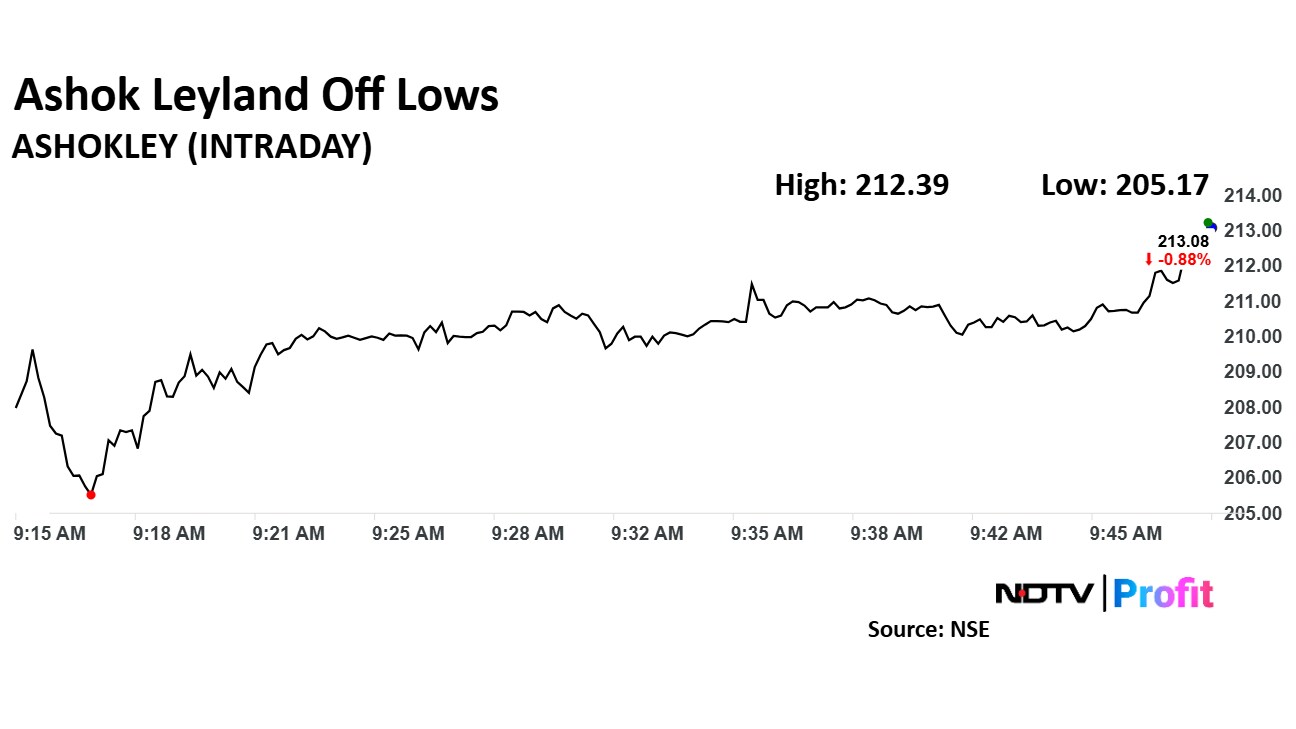

Shortly after open, Ashok Leyland's share price declined 4.56% to Rs 205.17 apiece, the lowest level since March 19. It pared losses to trade 0.98% lower at Rs 212.87 apiece as of 9:50 a.m., as compared to 0.17% advance in the NSE Nifty 50 index.

The stock rose 25.96% in 12 months, and declined 3.63% on year to date basis. Total traded volume so far in the day stood at 3.7 times its 30-day average. The relative strength index was at 54.29.

Out of 44 analysts tracking the company, 36 maintain a 'buy' rating, four recommend a 'hold,' and four suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 19.7%

The company was also in focus as it initiated the process to shut down Switch UK, an EV-focused stepdown subsidiary of the auto major.

The truck manufacturer said in the exchange filing on Wednesday that Switch UK has begun a consultation process for the cessation of manufacturing facility in Sherburn. Ashok Leyland said that economic uncertainty is the reason behind the decision of closure of the UK subsidiary.

Analysts and brokerages are taking the strategic move as positive development as it failed to meet expectation especially in the electric vehicle bus segment. They are bullish on Ashok Leyland's India EV business.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.