- Shares of Ashok Leyland Ltd. rose 6.39% following positive market signals

- B&K Securities reported strong commercial vehicle demand through March 2026

- November wholesale volumes forecasted between 12,000 and 13,000 units

Shares of Ashok Leyland Ltd. surged 6.39% on Thursday after B&K Securities' channel checks signalled a strong commercial vehicle upcycle gaining momentum. Wholesale volumes for November are expected at 12,000–13,000 units, with vendors and dealers indicating robust schedules through March 2026.

Analysts believe the current cycle could surpass the FY19 peak by FY27 and extend into FY28, supported by sustained demand in the medium and heavy CV segment

Channel Check Indicates

Discussions with vendors and dealers indicate robust December schedules

Strength likely continuing through March 20

Once an MHCV up-cycle begins, it typically lasts at least 2 years.

Believe the current cycle should surpass the FY19 peak in FY27, followed by another record year in FY28.

Consensus estimates peg Ashok Leyland's target price at Rs 157, broadly in line with its current market price. Analyst recommendations remain largely positive, with 75% advising a Buy, 15% suggesting Hold, and 10% recommending Sell.

On valuations, the stock trades at a 12-month forward P/E of 31 times, significantly above its five-year average of 24 times, reflecting optimism around the ongoing commercial vehicle upcycle.

(Image Source: Bloomberg)

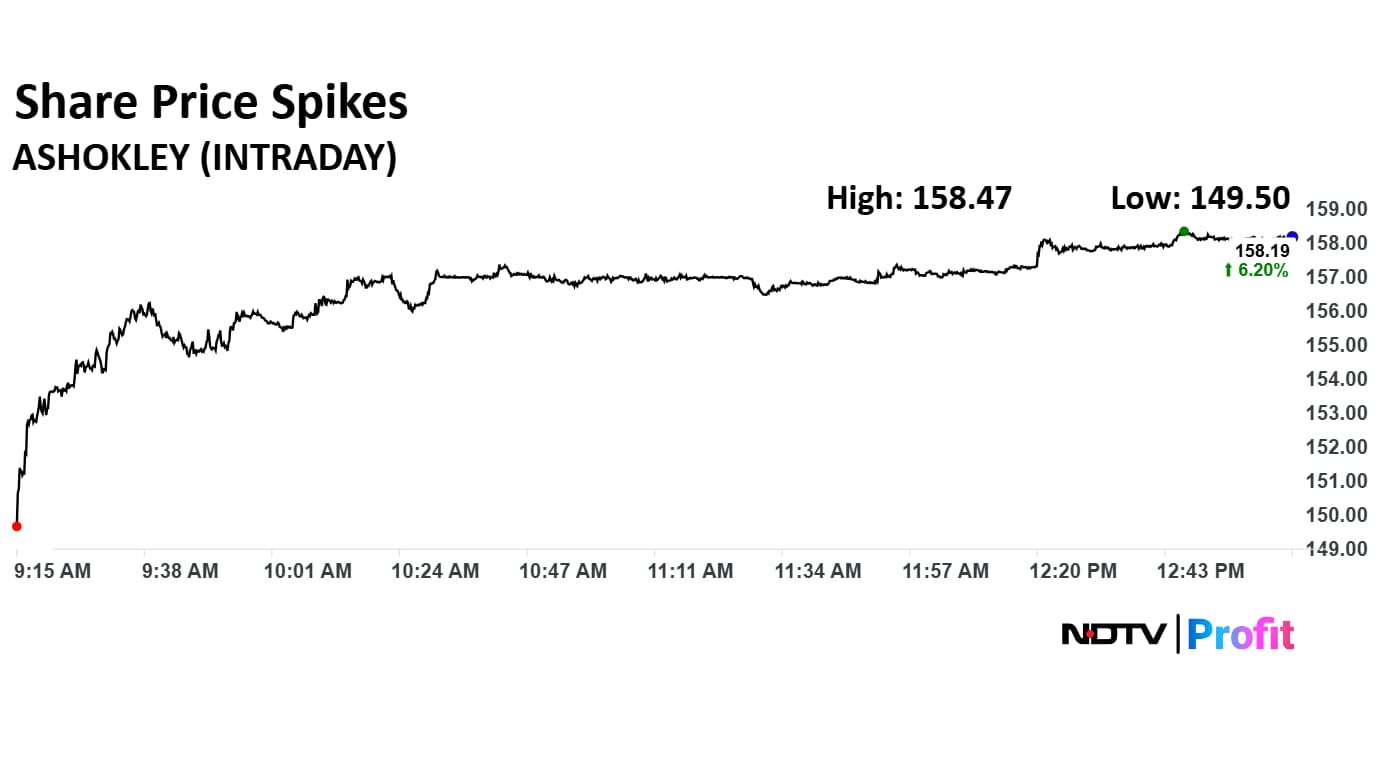

The scrip gained as much as 6.39% to 158.47 apiece. It pared gains to trade 6.21% higher at Rs 158.20 apiece, as of 01:36 p.m. This compares to a 0.18% advance in the NSE Nifty 50 Index.

It has risen 34.50% in the last 12 months. Total traded volume so far in the day stood at 3.9 times its 30-day average. The relative strength index was at 56.75.

Out of 45 analysts tracking the company, 34 maintain a 'buy' rating, four recommend a 'hold,' and seven suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 0.5%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.