JM Financial has maintained a 'buy' rating on One 97 Communications following report China's Ant Financial will sell its entire remaining stake of 5.84% in Paytm.

As per a media report, Ant Financial is selling its entire stake in Paytm through a block deal valued at Rs 38 billion. This transaction, dubbed a "clean-out trade," marks the conclusion of a phased divestment that began in 2023.

JM Financial's positive stance is based on the view that this event could lead to an uplift for the stock, removing a major overhang and potentially opening up opportunity for crucial regulatory approvals.

"This could clear the way for the company getting some licenses which have been due, that's a possibility," said Sachin Dixit, lead internet research analyst at JM Financial.

"I do not see any major headwinds per say but there could be regulatory tailwinds. There are a bunch or regulatory triggers that could come. Not sure how the regulator is thinking of it, but there needs to be some sustainability that needs to come to UPI transactions which could be a very big trigger for Paytm," he said.

End of Overhang and Potential for Buoyancy

The core of the analysis is based on the "clean-out trade" and its implications. The brokerage notes that the stock could experience a surge in "buoyancy" with the end of the Chinese ownership overhang. This is seen as a positive signal to the market, as it resolves a long-standing concern for investors.

The complete exit of Antfin, the last remaining Chinese shareholder, could potentially attract a wider range of investors who were previously cautious due to the Chinese ownership.

Precursor to Regulatory Approvals

Another key point highlighted by the brokerage is that this deal could be a "precursor to the company receiving certain regulatory approvals." The complete removal of Chinese ownership might address some of the regulatory hurdles that the company has faced in the past.

This development could unlock new opportunities and provide a clearer path for Paytm's growth and expansion. The end of this ownership structure could bring regulatory clarity, according to the analyst.

Valuations and Investor Sentiment

The brokerage has a price target of Rs 1,320 on the counter, according to Dixit. Noting that the stock has more room to grow and is currently trading at an attractive level, the brokerage views the development as a key positive.

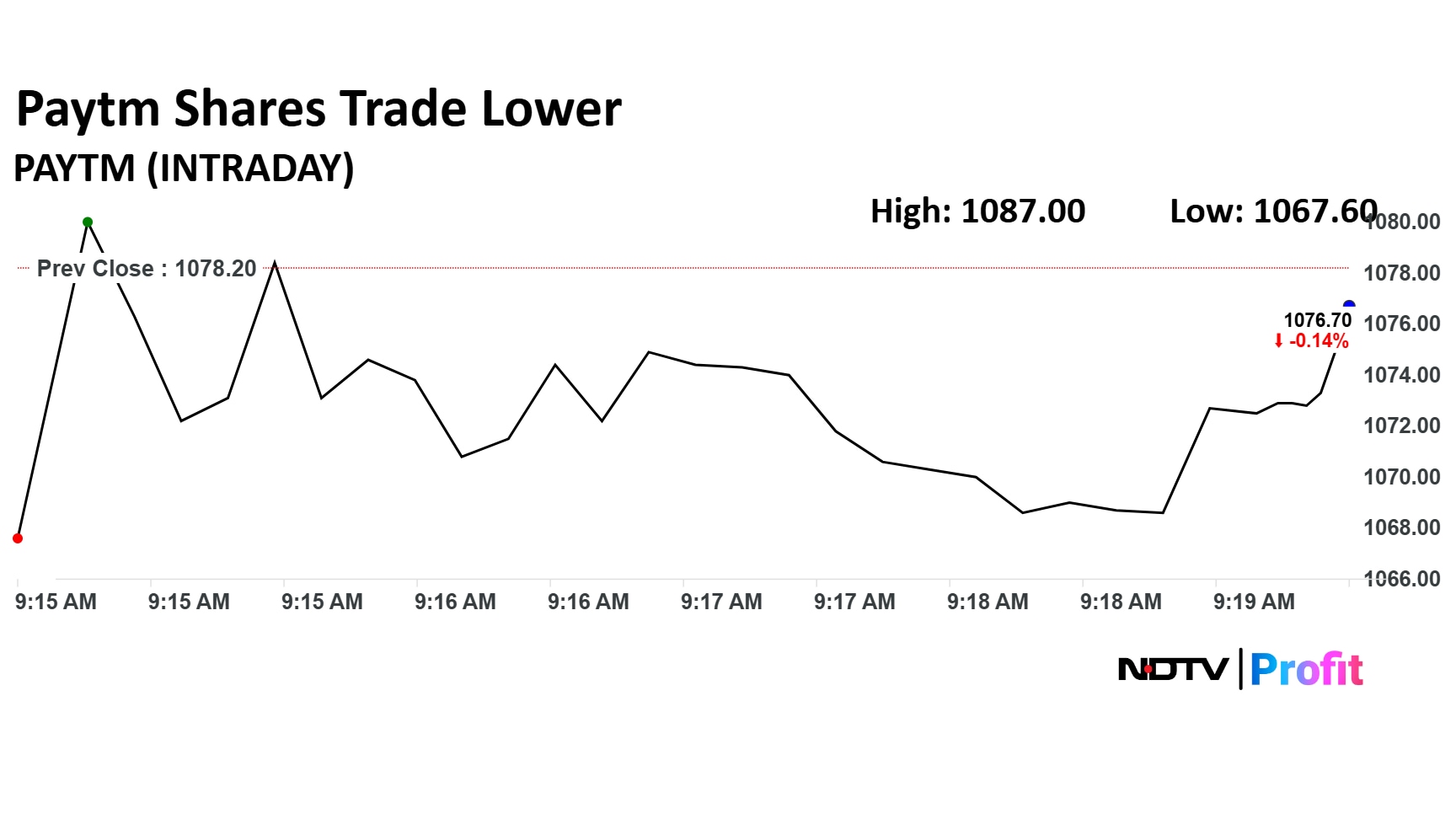

Paytm Share Price

Paytm stock fell as much as 0.98% during the day to Rs 1,067 apiece on the NSE. It was trading 0.63% lower at Rs 1,071 apiece, compared to an 0.18% decline in the benchmark Nifty 50 as of 9:62 a.m.

It has risen 115.84% in the last 12 months and 6.01% on a year-to-date basis.

Ten out of the 19 analysts tracking the company have a 'buy' rating on the stock, five recommend a 'hold' and four suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 1,101, implying an upside of 2.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.