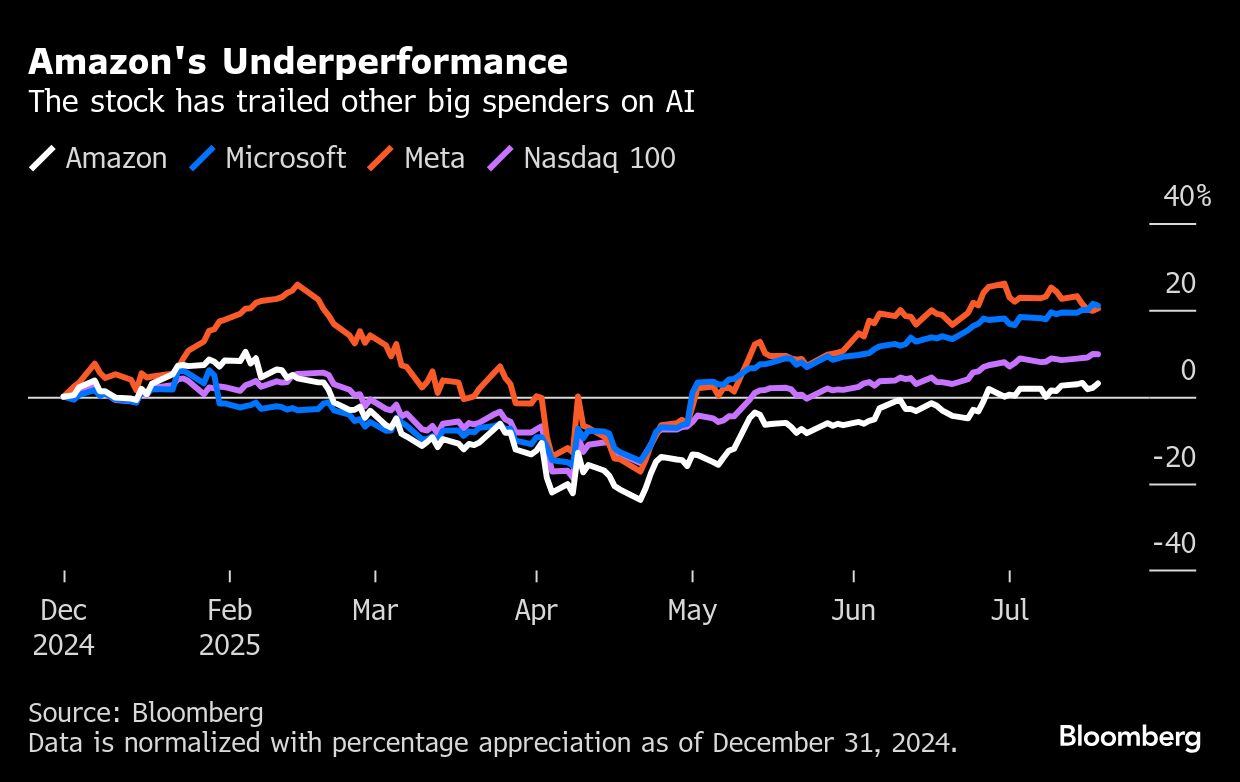

Aggressive spending on artificial intelligence is mostly being rewarded in the stock market these days. But when it comes to Amazon.com Inc., not so much.

Amazon's shares have gained about 3% this year despite the company's heavy outlays on AI, which it is touting as a path to greater efficiency and higher sales growth. That's left the stock lagging the S&P 500's 7% gain, while a peer like Meta Platforms Inc., which is sparing no expense in its quest for AI dominance, is up more than 20%.

“The stock isn't getting much credit for AI,” said Brian Recht, portfolio manager at Janus Henderson. “Investors want to see whether Amazon can actually deliver on using it for improved profitability, but we think evidence of AI benefits will become more clear by the quarter.”

AI has re-emerged as a key factor separating technology winners from losers in the stock market, after fears about the proliferation of advanced AI models developed on the cheap in China sparked a selloff earlier in the year. Meta, Microsoft Corp. and Nvidia Corp. are the S&P 500's three leading point gainers for 2025, while firms like Apple Inc. that are struggling with AI have seen their shares drop.

Although Amazon boasts a diverse set of businesses including cloud computing and advertising, the company is facing pressure from tariffs in its e-commerce operations, which account for the bulk of sales.

Most of the focus on AI contributions have been centered around Amazon Web Services, which is expected to benefit from increased customer demand as AI adoption speeds up. But the impact on Amazon's retail division could turn out to be equally sizable, according to Recht.

AI has been touted as a better way to target consumers with ads and products and to improve efficiency in Amazon's logistics network and warehouses. The company has also been promoting its Rufus chatbot to help shoppers sort through products, reviews and prices.

“Retail margins are narrow, so Amazon needs all the productivity boosts it can get, and there are huge use cases for AI and robotics within warehouses,” said Irene Tunkel, chief US equities strategist at BCA Research. “This is something that will play out over five or 10 years, but Amazon is at the forefront of it, and that definitely gives them an edge.”

Growth Challenges

When Amazon reports second-quarter results on July 31, the company is expected to deliver earnings per share of $1.32 on revenue of $162 billion, according to the average of analyst estimates compiled by Bloomberg. That would be an increase of 4% and 9%, respectively, from the same period a year ago. The average earnings growth for the Magnificent Seven is expected to be 15%, with revenue expanding 12%, according to Bloomberg Intelligence.

Amazon is projected to pour $104 billion into capital expenditures this year, the most in the S&P 500 by far, according to data compiled by Bloomberg. Beyond computing infrastructure, that sum includes warehouse construction and other expenses related to the company's logistics network. In June, it reported commitments to invest at least $30 billion in data center projects in Pennsylvania and North Carolina.

Last week, Amazon announced job cuts in its cloud-computing division, citing the need to invest and “optimize resources.” Chief Executive Officer Andy Jassy has said he expects the company's workforce to decline over the next few years as it hands off more tasks to AI.

Robotics is another area where Amazon investors are excited about the potential for improving efficiencies in logistics and warehouse operations. The company is designing an indoor obstacle course to train humanoid robots as part of a plan to automate package delivery, the Information reported last month.

Using robotics in delivery could unlock more than $7 billion in annual savings for Amazon by 2032, according to Bank of America estimates. Those kinds of efficiencies suggest Amazon's retail business could be the “most under-appreciated GenAI beneficiary in the tech space,” Morgan Stanley analysts wrote in a note last month.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.