Amazon.com Inc's share price dropped in late trading after projecting weaker-than-expected operating income and trailing the sales growth of its cloud rivals, leaving investors searching for signs that the company's huge investments in artificial intelligence are paying off.

Operating profit will be $15.5 billion to $20.5 billion in the period ending in September, compared with an average estimate of $19.4 billion. Sales will be $174 billion to $179.5 billion, the company said Thursday in a statement. Analysts, on average, expected $173.2 billion.

Chief Executive Officer Andy Jassy is engaged in an AI infrastructure arms race with Microsoft Corp. and Alphabet Inc. that requires heavy spending on data centers. Both of those rivals earlier reported strong earnings showing they are benefiting from the AI boom.

Amazon spent a record $31.4 billion on capital expenditures in the quarter, up about 90% from the same period a year earlier. Chief Financial Officer Brian Olsavsky said that spending would be “reasonably representative” of what the company plans for the second half of the year.

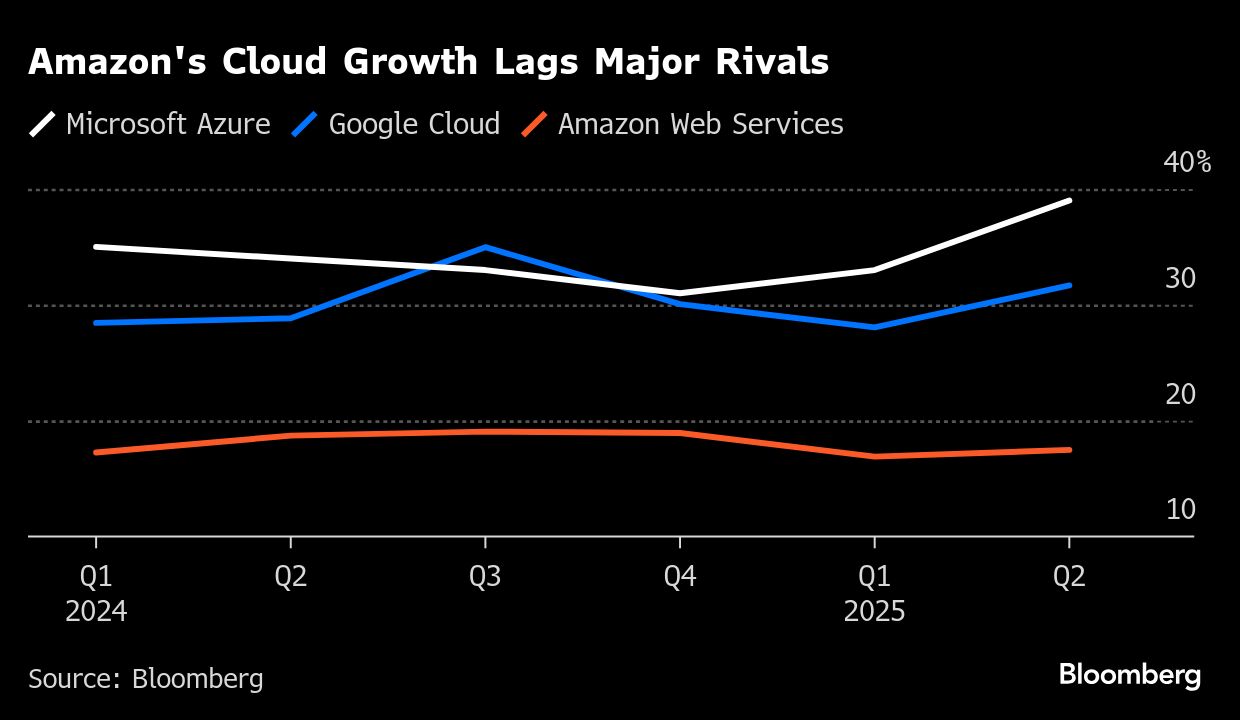

In the second quarter, revenue jumped 13% to $167.7 billion, handily beating estimates. But Amazon Web Services, the largest seller of rented computing power, gained a little more than 17% to $30.9 billion, just ahead of analysts' average estimate of $30.8 billion.

The AWS sales increase was “very disappointing” given the higher growth rates reported by Microsoft and Google, said Gil Luria, an analyst at DA Davidson. Microsoft's Azure posted a 39% rise in sales during the three months ended in June. Google Cloud revenue rose by 32%.

Jassy was pressed by analysts on a conference call after the results about why AWS wasn't growing as fast as rivals in the face of staggering demand to feed AI workloads.

“There is a Wall Street finance person narrative right now that AWS is falling behind,” Brian Nowak, an analyst with Morgan Stanley, said on the call.

Amazon's CEO said it was “very early days” in artificial intelligence, and that the company's efforts to lower the costs of running AI applications would draw more customers over time. He repeated his view that it will take time to build sufficient capacity to meet customers' needs. Finding enough electricity to power data centers is the biggest constraint to expanding cloud services, he added.

Jassy said AWS offered advantages in availability and security. “There are very different results in security in AWS than you'll see in other players,” he said, citing “what's happened in the last couple of months.” Microsoft has faced repeated cybersecurity incidents, drawing criticism from the US government.

“It's still a pretty significant market segment leadership position that we have,” Jassy said. “And regardless, these are all really just moments in time.”

Amazon share price, which declined in extended trading after the earnings report, slid further during Jassy's comments on the call. The stock fell about 7.3% after closing at $234.11 Thursday in New York. The shares had gained 6.7% this year through the close.

“There's a note of caution in the wide range in its operating income guidance for Q3, indicating that, as was the case in Q2, there's still potential for curve balls from ongoing trade negotiations and accelerating competition on the AI front,” Sky Canaves, an analyst at EMarketer, said in an email.

Second-quarter operating profit was $19.2 billion, compared with the average estimate of $17 billion.

Amazon reported total operating expenses increased 11% to $148.5 billion in the quarter. The number of full- and part-time employees rose 1% from a year earlier to more than 1.54 million. Jassy is trying to thin Amazon's corporate ranks, reduce the ratio of middle managers to workers and enforce a five-day office mandate he says is required to strengthen company culture.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.