.jpg?downsize=773:435)

Equities in Asia fell as the week got under way, with no sign of the recent jump in volatility subsiding for now. The British pound took a hit as pressure mounts on U.K. Prime Minister Theresa May after a raft of political scandals and scant progress on Brexit talks.

The Singapore-traded SGX Nifty, an early indicator of NSE Nifty 50 Index's performance in India, was little changed at 10,343.50 as of 7:00 a.m.

Short on time? Well, then listen to this podcast for a quick summary of the article!

DayBreak

Here's a quick look at all that could influence equities on Monday.

Global Cues

- Global equities hit historic highs last week as investors were encouraged by solid earnings and synchronized economic growth.

- But they sold off sharply on Thursday as the U.S. Senate revealed that its tax plan would delay cuts to the corporate rate until 2019.

#BQMarketsNow | U.S. stock markets posted first weekly loss in over two months amid fears of increasing taxes.https://t.co/xaZ27RNdOn pic.twitter.com/q7Ng0c9yFy

- The U.K. Labour Party accused May of lacking the support within her Conservative Party to deliver the Brexit transition period she's proposed.

- The news kick starts a week that also features a slew of Bank of England members speaking, along with updates on U.K. inflation, the labour market and retail sales.

Asian Cues

- Japan's Topix index fell 0.5 percent. The Nikkei 225 Stock Average slid 0.7 percent.

- South Korea's Kospi index fluctuated. Australia's S&P/ASX 200 Index fell 0.2 percent.

- Hang Seng Index futures dropped 0.1 percent.

- The MSCI Asia Pacific Index lost 0.4 percent.

Here are key events investors are watching this week:

- President Donald Trump continues on his final leg of his tour around Asia.

- Japan October PPI is due on Monday, while GDP is slated for mid-week.

- A raft of closely watched economic releases from China is due Tuesday, including industrial production, fixed-asset investment and retail sales.

- India October CPI is due on Monday.

- Australia updates on employment later this week.

- Outgoing Fed chair Janet Yellen takes part in a panel at a European Central Bank event on Tuesday in Frankfurt along with peers from Europe, Japan and the U.K., and Chicago Fed boss Charles Evans will also be at the conference.

- U.S. CPI is due Wednesday. If CPI misses, odds of a December hike from the Fed could head toward 50 percent, according to Morgan Stanley.

Commodity Cues

- West Texas Intermediate crude gained 0.2 percent to $56.86 a barrel.

- Gold was at $1,275.36 an ounce.

- Sugar ended higher for sixth consecutive session on Friday at 14.96 cents a pound; up 0.54 percent.

Shanghai Exchange

- Steel trades higher; up 0.11 percent.

- Aluminium snaps seven-day losing streak; up 0.13 percent.

- Zinc trades higher for second day; up 0.82 percent.

- Copper trades lower for fourth day; down 0.13 percent.

- Rubber trades was little changed.

Indian ADRs

Nifty Results Today

- Adani Ports & SEZ

- NTPC

Other Results Today

- Adani Enterprises

- Apollo Hospitals Enterprise

- Future Enterprises

- Gillette India

- GSPL

- Idea Cellular

- Max Financial Services

- NMDC

- Reliance Nippon Life Asset Management

- Repco Home Finance

- SpiceJet

- Sunteck Realty

- Tata Chemicals

- Vakrangee

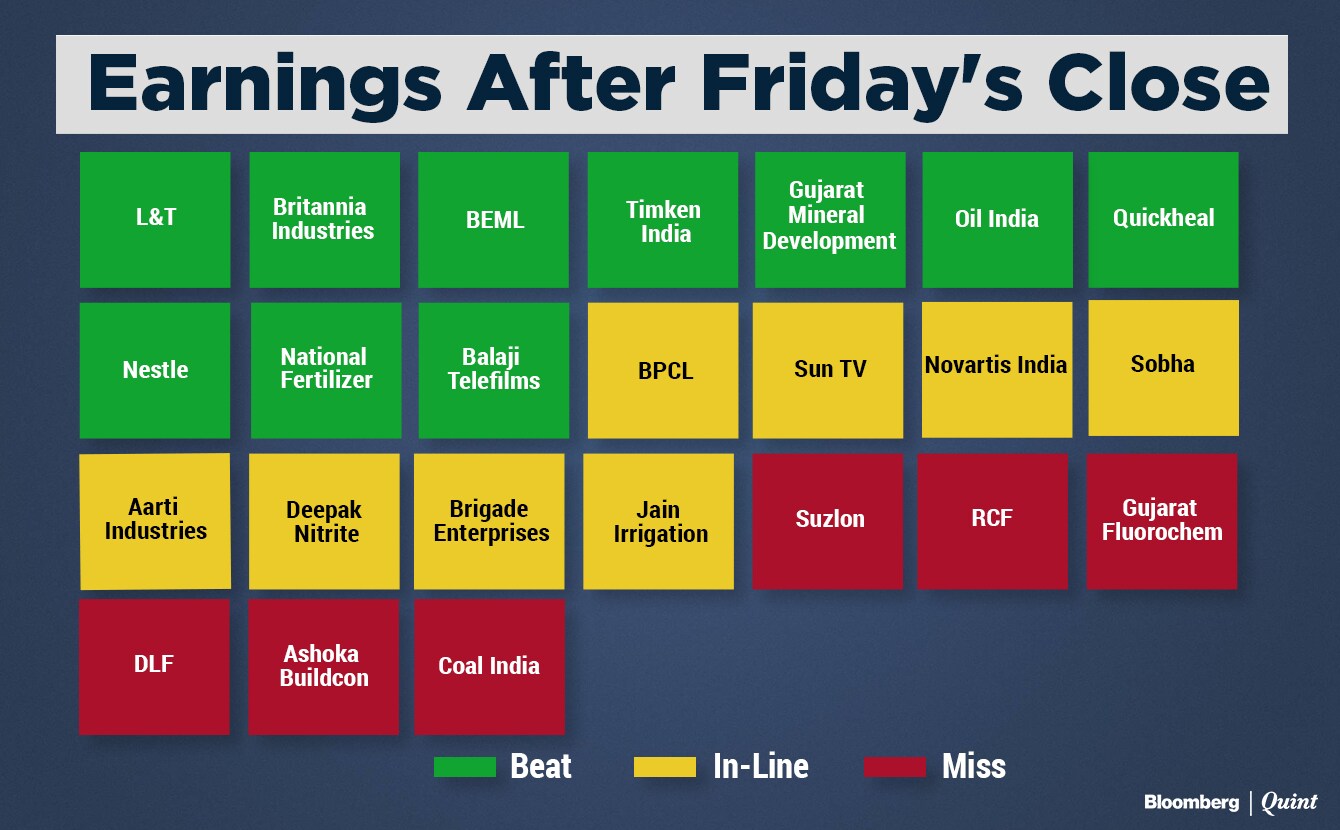

Results Announced

L&T Q2 (YoY)

- Revenue up 6.4 percent at Rs 26,446.8 crore.

- Net Profit up 27 percent at Rs 1,820 crore.

- Ebitda up 28 percent at Rs 2,960.5 crore.

- Margin at 11.2 percent versus 9.3 percent

Coal India Q2 (YoY)

- Revenue up 11.7 percent to Rs 18,148.3 crore.

- Net profit down 40 percent to Rs 369 crore.

- Ebitda up 56 percent to Rs 1,230.96 crore.

- Margin up to 6.7 percent versus 4.83 percent.

Britannia Q2 (YoY)

- Revenue up 6.6 percent at Rs 2,545.3 crore.

- Net Profit up 11.6 percent at Rs 261 crore.

- Ebitda up 11.4 percent at Rs 377.65 crore.

- Margin at 14.8 percent versus 14.2 percent

BEML Q2 (YoY)

- Revenue up 52 percent at Rs 690 crore.

- Net profit at Rs 10 crore versus net loss of Rs 16.6 crore.

- Ebitda at Rs 34 crore versus Ebitda loss of Rs 0.5 crore.

- Margins at 4.9 percent versus -0.1 percent.

Timken India Q2 (YoY)

- Revenue up 9.5 percent at Rs 310 crore versus Rs 283 crore.

- Net profit up 23 percent at Rs 37 crore versus Rs 30 crore.

- Ebitda up 12.5 percent at Rs 54 crore versus Rs 48 crore.

- Margin at 17.4 percent versus 17 percent.

Gujarat Mineral Development Q2 (YoY)

- Revenue up 39.5 percent at Rs 346 crore.

- Net profit up 55 percent at Rs 113 crore.

- Ebitda up 54 percent at Rs 101 crore.

- Margin at 29.2 percent versus 26.4 percent.

Oil India Q2 (QoQ)

- Revenue up 6 percent at Rs 2,474 crore.

- Net profit up 43.6 percent at Rs 646 crore.

- Ebitda up 16 percent at Rs 1,013 crore.

- Margins at 40.9 percent versus 37.5 percent.

Quickheal Q2 (QoQ)

- Revenue up 248 percent at Rs 104.5 crore.

- Net profit at Rs 39 crore versus net loss of Rs 11 crore.

- Ebitda at Rs 53.5 crore versus Ebitda loss of Rs 22 crore.

- Margin at 51 percent versus -73 percent.

Nestle India Q3 (YoY)

- Revenue up 7 percent at Rs 2,514 crore.

- Net profit up 23 percent at Rs 343 crore.

- Ebitda up 20.6 percent at Rs 589 crore.

- Margin at 23.4 percent versus 20.9 percent.

National Fertilizer Q2 (YoY)

- Revenue up 12.5 percent at Rs 2,133 crore.

- Net profit up 46 percent at Rs 67 crore.

- Ebitda up 20.4 percent at Rs 165 crore.

- Margin at 7.7 percent versus 7.2 percent.

Balaji Telefilms Q2 (YoY)

- Revenue up 4 percent at Rs 110 crore.

- Net loss of Rs 14 crore versus net loss of Rs 28 crore.

- Ebitda loss of Rs 10 crore versus Ebitda loss of Rs 26 crore.

- Margins at -9.1 percent versus -24.5 percent.

BPCL Q2 (QoQ)

- Revenue down 7 percent at Rs 53,325 crore.

- Net profit up 216 percent at Rs 2,357 crore.

- Ebitda up 186 percent at Rs 3528 crore.

- Margin at 6.6 percent versus 2.2 percent.

Sun TV Q2 (YoY)

- Revenue up 8.1 percent at Rs 676 crore.

- Net profit up 5.6 percent at Rs 285 crore.

- Ebitda up 6.8 percent at Rs 496.4 crore.

- Margin at 73.4 percent versus 74.3 percent.

Novartis India Q2 (YoY)

- Revenue down 4 percent at Rs 168 crore.

- Net profit up 18 percent at Rs 26 crore.

- Ebitda up 3 percent at Rs 15.85 crore.

- Margin at 9.5 percent versus 8.8 percent.

Sobha Q2 (YoY)

- Revenue up 20 percent at Rs 647 crore.

- Net profit up 32 percent at Rs 50 crore.

- Ebitda up 23 percent at Rs 125 crore.

- Margins at 19.3 percent versus 18.8 percent.

Aarti Industries Q2 (YoY)

- Revenue up 25 percent at Rs 888 crore.

- Net profit up 3 percent at Rs 78.5 crore.

- Ebitda up 6 percent at Rs 160 crore.

- Margin at 18 percent versus 21.3 percent.

Deepak Nitrite Q2 (YoY)

- Revenue up 5 percent at Rs 355 crore.

- Net profit up 15 percent at Rs 23 crore.

- Ebitda up 4 percent at Rs 52.5 crore.

- Margin at 14.8 percent versus 14.9 percent.

Brigade Enterprises Q2 (YoY)

- Revenue up 8 percent at Rs 485 crore.

- Net profit up 41 percent at Rs 41 crore.

- Ebitda up 5 percent at Rs 134.5 crore.

- Margin at 27.7 percent versus 28.4 percent.

Jain Irrigation Q2 (YoY)

- Revenue up 9.9 percent at Rs 1,598 crore.

- Net profit down 62 percent at Rs 10.6 crore.

- Ebitda up 4.5 percent at Rs 198.5 crore.

- Margin at 12.4 percent versus 13.1 percent.

Suzlon Q2 (YoY)

- Revenue down 56.5 percent at Rs 1,193 crore.

- Net profit down 72 percent at Rs 68 crore.

- Ebitda down 81 percent at Rs 107 crore.

- Margin at 9 percent versus 20.4 percent.

RCF Q2 (YoY)

- Revenue up 1.4 percent at Rs 1,802 crore.

- Net profit down 74 percent at Rs 11 crore.

- Ebitda down 37.9 percent at Rs 63 crore.

- Margin at 3.5 percent versus 5.7 percent.

Gujarat Fluorochem Q2 (YoY)

- Revenue down 42 percent at Rs 875 crore.

- Net profit down 20 percent at Rs 71.5 crore.

- Ebitda down 45 percent at Rs 148 crore.

- Margin at 16.9 percent versus 17.8 percent.

DLF Q2 (YoY)

- Revenue down 23 percent at Rs 1,588 crore.

- Net profit down 93 percent at Rs 14 crore.

- Ebitda down 23 percent at Rs 787 crore.

- Margin at 49.6 percent versus 49.3 percent.

Ashoka Buildcon Q2 (YoY)

- Revenue down 14 percent at Rs 379 crore.

- Net profit down 27 percent at Rs 33 crore.

- Ebitda down 28 percent at Rs 50.6 crore.

- Margin at 13.4 percent versus 15.8 percent.

Stocks To Watch

- Axis Bank to raise Rs 11,625.8 crore via issue of equity shares and convertible warrants to Bain Capital and other investors. To raise Rs 9,063 crore via equity and remaining Rs 2,563 crore through warrants.

- ONGC expects first oil from KG basin in 2020 and gas by 2019.

- Mcleod Russel to enter 50:50 stake joint venture with Greendale India (Subsidiary of Eveready Industries India) for development of packaged tea business.

- IPCA Labs wins order for supply of anti-malarial medicines by the Global Fund Pooled Procurement Mechanism.

- HSIL approves plan for demerger of retail and building products business.

- Bank of Maharashtra receives SEBI nod to raise Rs 800 crore by way of QIP.

- Welspun Enterprises signs agreement with NHAI for expansion of a section of NH-31 at a project cost of Rs 1,161 crore.

- Jain Irrigation to consider IPO for its food subsidiary Jain Farm Fresh Foods in next fiscal year.

- Technocraft Industries to buyback 28 lakh equity shares at a price of Rs 525 per share.

- Petronet LNG drops plans to buy 25 percent stake in GSPC's Mundra LNG Plant (Mint).

New Listing

- The New India Assurance Co. to start trading on BSE/NSE after selling shares at Rs 800 each in IPO that got 1.2 times demand.

Bulk Deals

Hatsun Agro

- DSP Blackrock MF bought 18.9 lakh shares or 1.2 percent equity stake at Rs 735 each.

- Promoter Chandramogan R G sold 31.5 lakh shares or 2.1 percent equity stake at Rs 735.01 each.

Just Dial

- HDFC MF bought 6.80 lakh shares or 1 percent equity stake at an average price of Rs 521.4 each.

- Samsung Asia Master Investment Trust bought 3.55 lakh shares or 0.5 percent equity stake at Rs 513.21 each.

Websol Energy System

- Garnet International bought 3 lakh shares or 1.2 percent equity stake at Rs 111.39 each.

- India Max Investment Fund sold 2.03 lakh shares or 0.8 percent equity stake at Rs 111.53 each.

Arshiya Ltd

- Ecap Equities bought 40 lakh shares or 2.5 percent equity stake at Rs 81.75 each.

- Promoter Archana Mittal sold 40 lakh shares or 2.5 percent equity stake at Rs 81.75 each.

Soril Holdings

- Kuber India Fund bought 2.76 lakh shares or 0.5 percent equity stake at Rs 140.8 each.

Ruchi Soya

- Albula Investment Fund sold 44.65 lakh shares or 1.3 percent equity stake at Rs 25 each.

Who's Meeting Whom?

- Dr Lal Pathlabs to meet several analysts and investors including CLSA, Fidelity, ICICI Securities from Nov. 13 to Dec. 7.

- PI Industries to meet series of investors like AIDA, Grandeur Peak from Nov. 13 - 16.

- Hindalco to meet investors like GS AMC and AIDA wellington from Nov. 15 - 16.

- DCM Shriram to meet Farlet Capital on Nov. 14.

- Shriram Transport to meet Capital World Investors on Nov. 13 and Kotak Securities on Nov. 20.

- Tata Steel to meet Reliance Capital Asset Management on Nov. 13 and Alliance on Nov. 20.

- Havells to meet CLSA on Nov. 13, IDFC on Nov. 16 and UBS on Nov. 17.

Rupee

- Rupee ended lower at 65.17 per dollar against Thursday's close of 64.94

Top Movers And Shakers Last Week

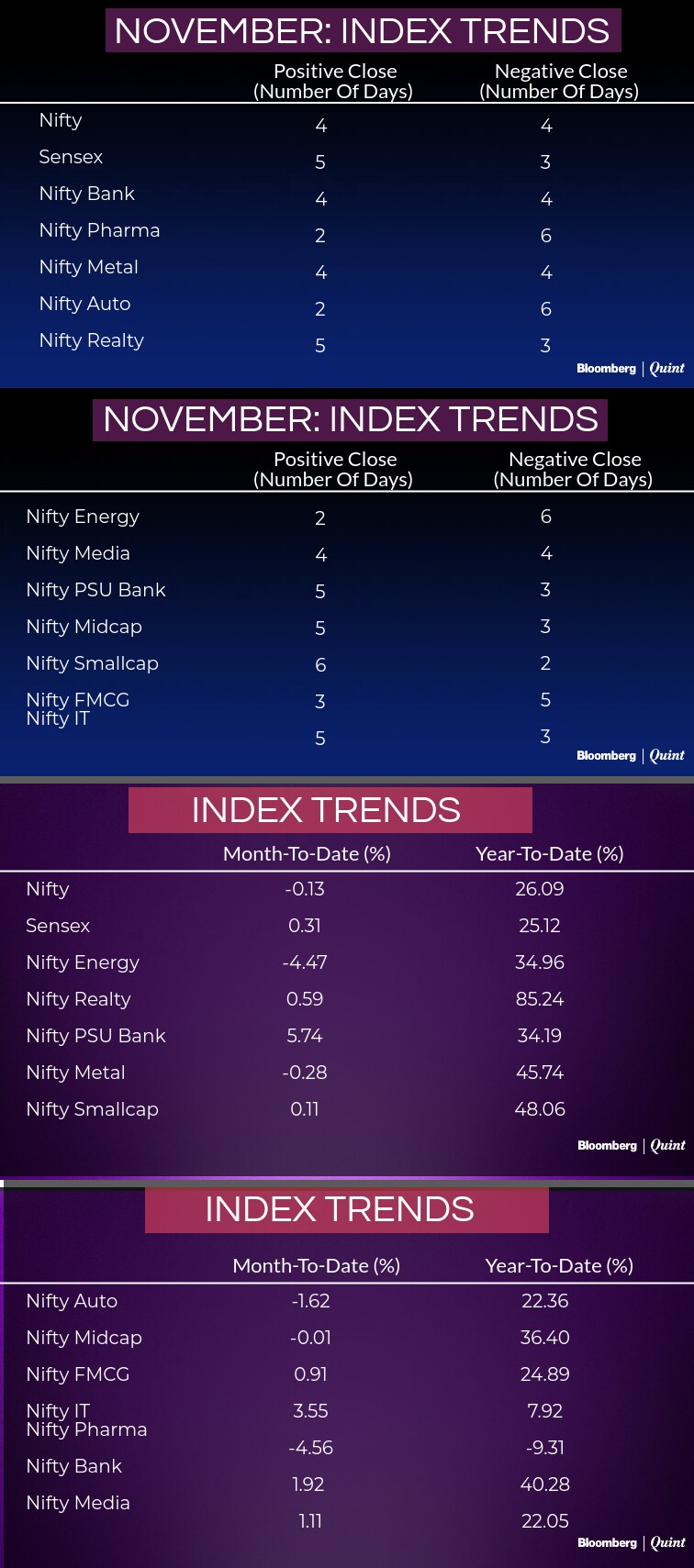

Index Trends

F&O Cues

- Nifty November futures closed at 10,334, premium of 12 points versus 52.8 points.

- November contracts: Open interest up 4 percent and Bank Nifty open interest up 4 percent.

- India VIX closed at 13.4, up 1.5 percent.

- Max open interest for November series at 10,500 call, open interest at 45.7 lakh shares, up 1 percent.

- Max open interest for November series at 10,200 put, open interest at 56.1 lakh shares, up 2 percent.

F&O Ban

- In Ban: DHFL, HDIL, Indiabulls Real Estate, India Cement, Infibeam, Jet Airways, Jain Irrigation, JSW Energy,Just Dial, Reliance Communications.

- New in Ban: Just Dial.

Alert: Only intraday positions can be taken in stocks which are in F&O ban, incase of rollover of these intraday positions there is a penalty

Put-Call Ratio

- Nifty PCR at 1.33 versus 1.35.

- Nifty Bank PCR at 1.25 versus 0.90

Fund Flows

Brokerage Radar

Kotak Securities on Quess Corp

- Initiated ‘Buy' rating with a price target of Rs 1,010; implying a potential upside of 23 percent form Friday's close.

- Management has a strong pedigree of successful acquisition with five years of payback period.

- Quess has created a strong platform in the large business service space.

- Premium to sustain given secular organic growth, strong promoter financial commitment and management track record.

- Expect revenue, Ebitda and net profit to grow at a compound annual growth rate of 31 percent, 46 percent and 75 percent by March 2019, supported by both organic and inorganic growth.

- Expect an operating margin of 6 percent and 6.7 percent in the current and the next financial year.

- Positives: High growth predictability, margin improvement, strong growth history, thrust on acquisitions, large size and huge growth opportunities.

- Quess is a compelling investment as numbers do not factor incremental upside from acquisitions which remain fundamental to business model.

CLSA on SBI

- Maintained ‘Buy'; hiked price target to Rs 400 from Rs 350.

- Lower slippages and higher provisions a positive.

- Weak topline a concern but merger synergies playing out.

- Cut earnings estimates by 6-13 percent to build higher credit costs and weaker topline.

- BUY given stronger deposit franchise and better asset quality across PSUs.

IDFC Securities on SBI

- Upgraded to ‘Outperformer' from ‘Neutral'; hiked price target to Rs 375 from Rs 275.

- Asset quality improved during the previous quarter, provisions dent profit.

- Credit cost to remain high as new chairman plans to move towards IFRS

- Cut earnings for the current financial year and raise earnings for the next financial year as bank could prepone some provisioning.

- For the next two financial years, we expect return on asset of 0.5 percent 0.7 percent respectively and return on equity of 7 percent and 11 percent respectively.

- Upgrade driven by strong retail franchise, lower than sector stress loans and better capitalization

Deutsche Bank on SBI

- Maintained ‘Buy'; hiked price target to Rs 380 from Rs 345.

- Better asset quality were reported during the previous quarter, slippages decline and coverage increases.

- Growth continues to remain weak; No further significant improvement in net interest margins.

- Expect net interest margins to marginally decline during the current financial year, led by lower yields and asset re-pricing.

- Expect slippage trends to moderate in the second half; Slippages of 4 percent and 2 percent respectively for the next two financial years.

Kotak Securities on SBI

- Maintained ‘Buy'; hiked price target to Rs 375 from Rs 350.

- Gains on stake sale were utilised to improve provision coverage by 470 basis points.

- Still pressure on revenue growth and path to profitability.

- Have scope for improvement largely driven by resolutions and lower slippages.

- Slippages might still be volatile but likely to show lower negative surprises.

Deutsche Bank on Axis Bank

- Maintained ‘Buy'; hiked price target to Rs 620 from Rs 575.

- Big capital raise boosts confidence; Fades near-term overhang.

- Earnings during the current quarter will be diluted by 4 percent; Book value per share to increase by 9 percent and 8 percent for the next two financial years respectively.

- Issuance to help focus on growth revival and improving retail franchise.

- CET-1 at 12.5 percent now looks comfortable beyond the next financial year as well.

CLSA on Axis Bank

- Maintained ‘Buy'; hiked price target to Rs 650 from Rs 612.

- Fund raising to absorb credit costs and aid growth.

- Issuance to cause equity dilution of 9 percent, lift net worth by 18 percent for the next financial year, Tier I CAR by around 180 basis points and adjusted book value per share by 15 percent.

- Normalisation of asset quality and lift to capital base should ease concerns.

- Expect credit costs to normalise from the next financial year onwards and resolution of non-performing loans can abate concerns.

CLSA on Sun TV

- Maintained ‘Buy'; hiked price target to Rs 1,025 from Rs 965.

- Ad revenue recovers in the previous quarter despite GST disruption.

- Recovery in ad revenue to accelerate with improving viewership

- Subscription revenue outlook is strong boosting subscriptions at a compound annual growth rate of 21 percent by March 2020.

- Expect net profit to grow at a compound annual growth rate of 18 percent by March 2020.

CLSA on Voltas

- Maintained ‘Sell'; hiked price target to Rs 390 from Rs 366.

- Early festive season drives AC revenue and margin during the previous quarter, but slow growth during the present quarter.

- New energy efficiency norms effective January 2018 could hike cost by 2 percent.

- Voltas stock not in sync with its growth.

- Not see much improvement in Voltas' fundamentals, but the stock is scaling new highs on price to earnings bands on domestic liquidity, while foreign institutional investors remain sellers.

Kotak Securities on Mahindra & Mahindra

- Maintained ‘Buy'; hiked price target to Rs 1,710 from Rs 1,615..

- Ebitda was above above estimates due to improvement in automotive margins

- Tractor demand likely to remain strong; Expect tractor industry volumes to grow at 12 percent in the current and the next financial year.

- Reduction in losses of two-wheeler business positive

- Positives: reasonable valuations, strong tractor demand and efforts to reduce losses in subsidiaries.

Deutsche Bank on Motherson Sumi

- Maintained ‘Hold'; hiked price target to Rs 315 from Rs 253.

- Strong earnings growth during the previous quarter, despite overall margin miss

- Raised Ebitda and earnings per share estimates by 8 percent and 11 percent respectively and 3 percent and 10 percent respectively for the current and next financial years, to factor in strong performance and consolidation.

- Company continues to outperform the underlying car industry growth.

- Wiring harness business could be a net beneficiary of electrification.

IDFC Securities on L&T

- Maintained ‘Neutral'; hiked price target to Rs 1,259 from Rs 1,194.

- Raised EPS estimates for the current and the next financial year by 11 percent and 7 percent respectively to factor in annualized increase in tariffs in Nabha Power.

- Asking rate for the second half appears to be steep at 15 percent due weak revenue growth in previous half

- Expect revenue and profit before tax to grow at a compound annual growth rate of 11 percent and 15 percent respectively by March 2020.

- Stock does not offer margin of safety against risk to earnings from weak order inflow/execution.

Edelweiss on L&T

- Maintained ‘Buy' with a price target of Rs 1,350.

- Revenue guidance maintained for the current financial year; Order intake guidance cut.

- With GST issues behind, better growth in the second half seems fairly possible.

- Positives: government's focus on large infra projects, strong balance sheet & execution capability.

- Expect earnings per share to grow at a compound annual growth rate of 15 percent by March 2019 given business consolidation and strong infra potential.

Kotak Securities on Oil India

- Maintained Sell; hiked price target to Rs 310 from Rs 270.

- Results during the previous quarter boosted by modestly higher sales volumes, lower costs and higher other income.

- Cautious given muted production guidance and declining reserves.

- Raise earnings per share estimates by 3-6 percent for the next two financial years, factoring in lower costs.

- Prefer ONGC as a play on higher oil and gas prices.

Kotak Securities on BPCL

- Maintained ‘Sell'; hiked price target to Rs 475 from Rs 440.

- Weaker refining margins offset by higher marketing volumes.

- Hiked earnings per share estimates to factoring in higher volumes and lower operating costs.

- Continued loss of market share in auto fuels, albeit at a slower pace

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.

.png)