Stocks in Asia were poised for modest advances after a rally in crude oil buoyed U.S. equities. Japan is closed for a holiday.

The Singapore-traded SGX Nifty, an early indicator of NSE Nifty 50 Index's performance in India, traded flat at 10,153 as of 6:55 a.m.

Here's a quick look at all that could influence equities on Wednesday.

Global Cues

- U.S. stocks edged higher, led by energy-related companies, as equity markets shrugged off weakness in technology and threats of global trade barriers.

- The yield on 10-year Treasuries rose three basis points to 2.88 percent.

#BQMarketsNow | U.S. stocks shake tech woes to close up; yields climb.https://t.co/o7UurxMKSX pic.twitter.com/UABPOr0Yg2

Amazon briefly overtakes Alphabet in market value.https://t.co/gvN14y1SJ8 pic.twitter.com/f9QEAxkixO

Europe Check

- European stocks gained for the first time this week as energy companies rallied with oil, offsetting weakness in telecom firms.

- Germany's 10-year yield rose one basis point to 0.58 percent.

- Britain's 10-year yield climbed four basis points to 1.48 percent.

- The euro fell 0.7 percent to $1.2250, in the biggest drop in more than a week.

- The British pound fell 0.2 percent to $1.4001.

What your fund management job will look like in a decade.

(via @gadfly)https://t.co/bnxU4Kclsj pic.twitter.com/lD911JRjSTAsian Cues

- Australia's S&P/ASX 200 Index rose 0.3 percent.

- Futures on Hong Kong's Hang Seng Index gained 0.2 percent.

- S&P 500 Index futures fell less than 0.1 percent.

Here are some key events on the schedule this week:

- The Fed decision and Jerome Powell's news conference come on Wednesday.

- The Bank of England is expected to keep interest rates and its asset-purchase program unchanged on Thursday. Attention will be on language and the odds for a May hike.

- New Zealand has a monetary policy decision Thursday.

- Company earnings scheduled for this week include Tencent, Hermes, PetroChina and Nike.

Commodity Cues

- West Texas Intermediate crude built on a 2.2 percent advance to gain 0.6 percent to $63.76 a barrel.

- Brent trades higher at $67.6 per barrel; up 0.3 percent.

- Gold was at $1,310.25 an ounce.

- Sugar ends lower at 12.6 cents per pound; down 2.6 percent.

Shanghai Exchange

- Steel snapped three-day losing streak; up 1 percent.

- Aluminium traded lower for the second day; down 0.4 percent.

- Zinc traded near three-month low; down 2 percent.

- Copper traded near six-month low; down 1.2 percent.

- Rubber traded lower for fourth day; down 0.6 percent.

Indian ADRs

Stocks To Watch

- Jindal Steel opens QIP at a floor price of Rs 227.15 apiece.

- Amtek says Liberty's resolution plan not yet approved by lenders.

- TCS partners with Saudi Real Estate Refinance company.

- Greenply Industries mulls demerger of MDF business. The board also approved expansion of Veneer Line at Gabon factory.

- Fortis to seek shareholders' approval for RHT acquisition.

- Newgen Software released Mobile Medicare Enrolment solution for U.S. health plans.

- Ashoka Buildcon declared lowest bidder for two projects worth Rs 447.51 crore.

- Transport Corporation of India acquired one ship with capacity of 26,262 DWT for Rs 48.80 crore.

- Dalmia Bharat unit provides performance bank guarantee of 10 percent for upfront payment to lenders in Binani Cement.

- Mercator to sell vessel for $4.25 million to Best Oasis Ltd; will use proceeds to repay debt.

- Manappuram Finance approved business plan for FY19.

- Transport Corp acquired a new ship to increase capacity in west coast.

Also Read: UltraTech Will Fight Off A Web Of Litigation To Buy Binani Cement: Exclusive

Dalmia Bharat provides performance bank guarantee for Binani Cement.https://t.co/r2jPMzeIRO pic.twitter.com/ToFboYRUyI

Media Reports

- Arcelor Mittal likely to offer Rs 3,000 crore to Uttam Galva to settle dues (Financial Express).

- IndiGo, Qatar Airways to amake a joint bid for Air India (Financial Express).

Bulk Deals

- Jindal Cotex: LTS Investment Fund sold 3.86 lakh shares or 0.9 percent equity at Rs 7.1 each.

- Intrasoft Technologies: Vora Financial services bought 86,329 shares or 0.6 percent equity at Rs 703 each.

IDFC Bank

- Copthall Mauritius Investment sold 96.74 lakh shares or 0.6 percent equity at Rs 50 each.

- Baobab Global Fund bought 96.74 lakh shares or 0.6 percent equity at Rs 50 each.

Sarveshwar Foods

- India Max Investment Fund sold 4.09 lakh shares at Rs 70.5 each.

- Krishen Bal bought 4.06 lakh shares at Rs 70.5 each.

Corporate Action

- India Nippon Electricals stock split from Rs 10 to Rs 5 per share.

- La Opala RG last trading day before going ex bonus.

- DCM Financial Services last trading day before shifting to T group.

Who's Meeting Whom

- Navin Fluorine to meet investors, analysts on March 21.

- Shriram Transport Finance to meet Balyasny Asset Management on March 26.

- Narayana Hrudayalaya to meet Janchor Partners on March 21 in Hong Kong.

- Balkrishna Industries to meet analysts, investors on March 21.

- Jain Irrigation to meet KBI Global Investors on March 21.

#JustIn | Fortis Healthcare to seek shareholders' approval for RHT acquisition.

(Source: Exchange Filing) pic.twitter.com/frdl9bDepgInsider Trades

- Chambal Fertilizers promoter SIL Investments Ltd acquired 58,787 shares on March 19.

- Chaman Lal Setia promoter Sukarn Setia sold 5,100 shares from March 15–16.

- Bhageria Industries promoters acquire 50,000 shares on March 19.

- Career Point promoter Pramod Maheshwari acquired 10,926 shares on March 19.

IPO Watch

- Mishra Dhatu Nigam IPO opens at an issue price of Rs 87-90 per share.

- Hindustan Aeronautics IPO subscribed 0.99 times on final day.

- Karda Construction IPO subscribed 1.42 times on final day.

- Sandhar Technologies IPO continues on day 3. The issue is subscribed 0.4 times.

Here's all you need to know about Mishra Dhatu Nigam's IPO.https://t.co/ojUlsOmMvh pic.twitter.com/d89GlfAne8

Rupee

- Rupee closed at 65.20/$ on Tuesday from 65.18/$ on Monday.

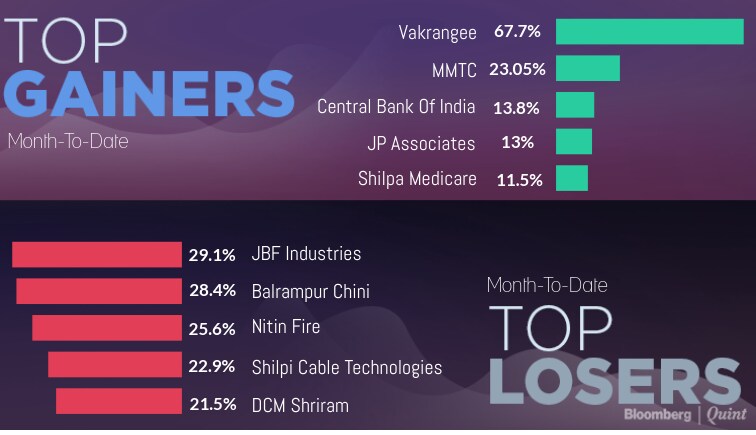

Top Gainers And Losers

Index Trends

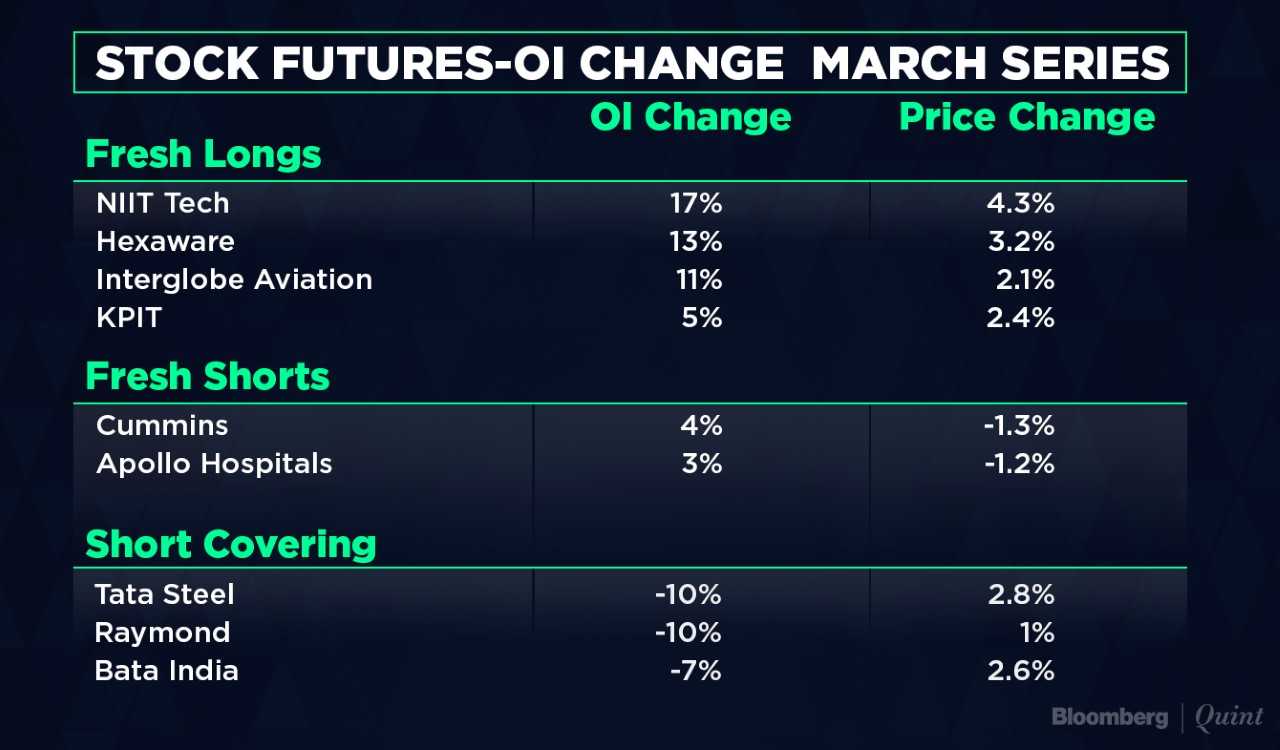

F&O Cues

- Nifty March futures closed trading at 10,143.2, premium of 18.9 points from 28.8 points.

- March series: Nifty open interest unchanged, Bank Nifty open interest down 5 percent.

- India VIX ended at 15.6, down 1.3 percent.

- Max open interest for March series at 10,500 call strike (open interest at 63.8 lakh, down 3 percent).

- Max open interest for March series at 10,000 Put (open interest at 66 lakh, up 5 percent).

Finance ministry to meet with primary dealers before near-record bond sales.https://t.co/6ES18XNUkV pic.twitter.com/NeBYqckP8W

F&O Ban

- In ban: Dewan Housing, HDIL, IDBI Bank, IFCI, Jindal Steel, JP Associates, Reliance Communications, SAIL.

- New in ban: IFCI, Jindal Steel.

- Out of ban: BEML.

Only intraday positions can be taken in stocks which are in F&O ban. There is a penalty in case of rollover of these intraday positions.

Put-Call Ratio

- Nifty PCR at 1.05 from 1.04.

- Nifty Bank PCR at 0.92 from 0.99.

Stocks Seeing High Open Interest Change

Fund Flows

Brokerage Radar

Credit Suisse on Emami

- Maintained ‘Outperform' with price target of Rs 1,260.

- Distribution challenges being overcome.

- Wholesale channel stabilised; E-way bill to be closely watched.

- Margins not a major concern for now.

- Focus on double-digit volume growth through a combination of existing and new products.

Credit Suisse on HDFC

- Maintained ‘Outperform' with price target of Rs 2,250.

- Strong growth in individual segment.

- Competition picking up in corporate segment.

- RERA would lead to some consolidation of the smaller players.

- Open to inorganic opportunities in housing segment.

- Looking at opportunities in health insurance space within HDFC ERGO.

Macquarie on Indian Steel

- Demand in China is just delayed, and not curtailed.

- Domestic prices and demand remains robust.

- Raw material weakness to partially offset steel price weakness.

- Domestic fundamentals remain robust.

- Steel producers to deliver $20-30/t QoQ margin expansion in current quarter.

- Positive on both Tata Steel and JSW Steel post recent correction.

- Tata Steel offers better risk-reward.

JPMorgan on Kotak Mahindra Bank

- Maintained ‘Overweight'; raised price target to Rs 1,200 from Rs 1,100.

- Bank in a strong position to leverage reduced competitive intensity in core banking.

- Elevated valuations supported by strong growth momentum and resilient asset quality.

- Bank's subsidiaries in a sweet spot.

- Kotak Mahindra Bank one of top picks.

ICICI Securities on Dr. Reddy's

- Upgraded to ‘Add' from ‘Hold'; cut price target to Rs 2,378 from Rs 2,487.

- Several triggers to revive growth and margins over the next two fiscals.

- US revenue run rate likely to bottom out in current fiscal.

- Price erosion likely to remain in double digit in the next fiscal.

- Several drivers in place to offset base business price erosion and drive U.S. sales.

- Current valuations factor in all negatives.

- Successful outcome of triggers may lead to valuation re-rating.

HDFC Securities on CDSL

- Initiated ‘Buy' with price target of Rs 425; implying a potential upside of 50 percent from the last regular trade.

- Gem of a business that investor constructive on India in the long term must own.

- Depository business is a proxy for capital market growth.

- Limited scope for any other depository to be set up.

- Diversified revenue stream with high component of annuity revenue.

- Operates at healthy operating margin with embedded non-linearity.

- CDSL gaining market share

- Robust balance sheet and cash generation.

- Pays healthy dividend; Payout could be higher.

- Expect revenue, operating income and ent profit to compound at 22 percent, 28 percent and 20 percent respectively over the fiscal 2017-2020.

- Operating margin to expand to 64 percent by March 2020, compared to 54.4 percent, clocked in the previous fiscal, led by fixed cost business model.

ICICI Direct on NGL Fine-Chem

- Initiated ‘Buy' with price target of Rs 465 – Rs 505.

- After stagnation, capacity expansion to support future growth.

- Likely adoption of dual source strategy to benefit Indian players.

- Expect revenue, operating income and net profit to compound at 15 percent, 14 percent and 19 percent respectively over the fiscal 2017-2020.

- Stock offers a compelling value proposition based on micro and macro parameters.

UltraTech-Binani side deal will test the insolvency process. And that may be a good thing.https://t.co/UiFrblNzG3 pic.twitter.com/Hnzc4Z567x

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.