Asian technology stocks climbed with U.S. equity-index futures after results from Apple Inc. buoyed sentiment in the sector. A drop in the Bloomberg Commodity Index weighed on raw-material producers in Asia after a stellar run.

Here's a quick look at all that could influence equities on Wednesday.

Global Cues

U.S.

- The Dow, along with the Nasdaq and the S&P, posted strong monthly gains in July as corporate quarterly results have mostly topped expectation

- Dow approaches 22,000 closes at a record high of 21,963.92; S&P 500 up by 0.24 percent at 2,476.35, while following the cues Nasdaq closed 0.23 percent higher at 6362.94

Europe

- European markets close higher on earnings; Rolls-Royce surges 10 percent

- FTSE ends up 0.7 percent at 7423.66, CAC up around 0.65 percent at 5127, while DAX gained over 1 percent to close at 12251.29

Asia

- Markets trading flat to positive

- Nikkei up 0.26 percent, Hang Seng up 0.79 percent

- The SGX Nifty trading positive, up 0.40 percent at 10,114.65.

Commodities

- Brent crude is trades lower 0.31 percent at $51.47/ barrel

- WTI crude trades weaker for second straight session ending at $48.85

- Ongoing high supplies from producer club OPEC, kept prices from rising further.

- Spot Gold marginally down 0.05 percent at $1268.20,

- ICE Sugar at 14.88, down 0.20 percent

Indian ADRs

- ICICI Bank: +0.86 percent

- Infosys: +0.70 percent

- HDFC Bank: +2.29 percent

- Tata Motors:+1.25 percent

- Wipro: +3.58 percent

- Vedanta: +0.85 percent

- Dr Reddy's Labs: +2.05 percent

Macroeconomic Events

- RBI bi-monthly monetary policy meet

Nifty Results Today

- Lupin

Other Results Today

- PNB

- Bata

- Capital First

- Edelweiss

- Emami

- Entertainment Network

- Godrej Properties

- KEC International

- Reliance Infrastructure

- Voltas

- Wockhardt

- Greenply Industries

- HEG

- Igarashi Motors

- Ingersoll Rand

- Kaya

- Magma Fincorp

- Mahindra Holidays

- Max Ventures

- Narayana Hrudayalaya

- Sical Logistics

- Solar Industries

- Transport Corporation of India

- Tribhovandas Bhimji Zaveri

- UCO Bank

- VST Industries

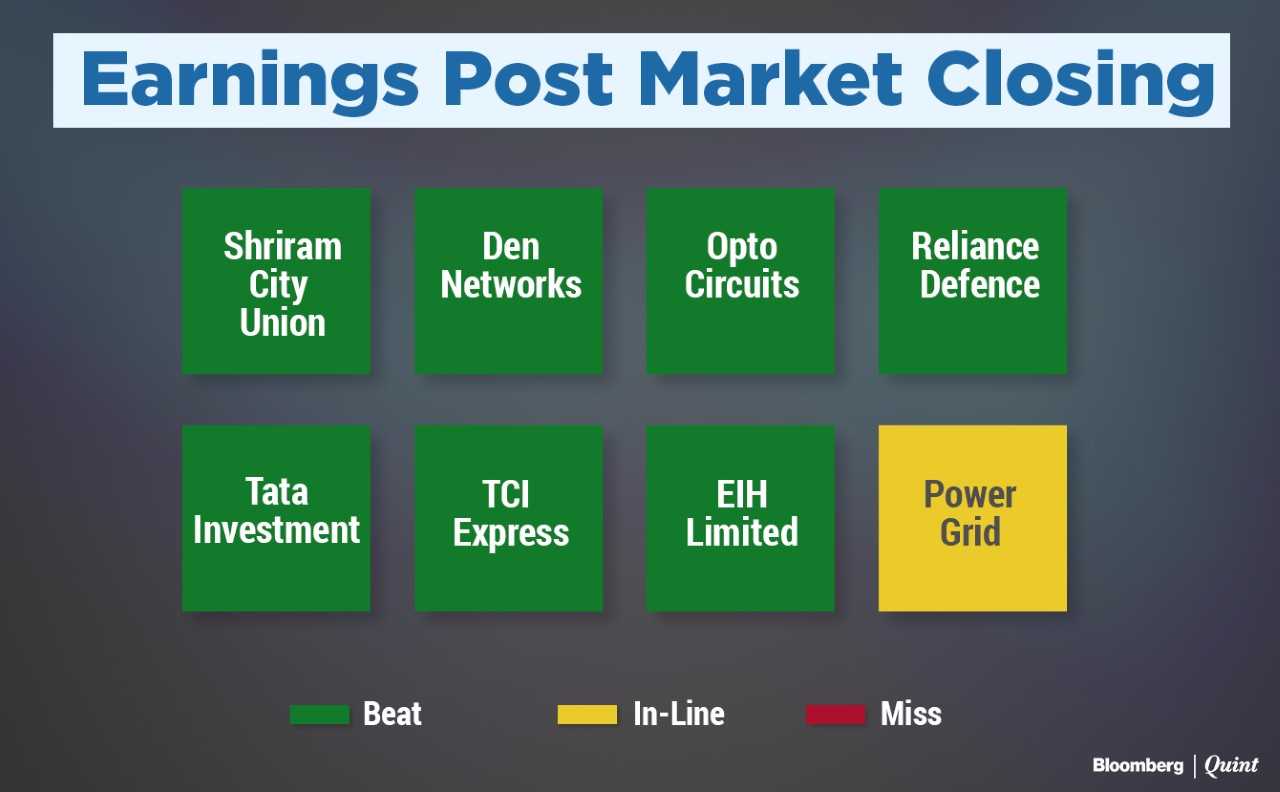

Earnings Watch

Power Grid Q1 (YoY)

- Revenue up 17.3 percent at Rs 7181 crore

- Net profit up 13.9 percent at Rs 2052 crore

- EBITDA up 14.4 percent at Rs 6,200 crore

- Margin at 86.3 percent versus 88.6 percent

Shriram City Union Q1 (YoY)

- NII up 19 percent at Rs 816 crore versus Rs 686 crore

- Profit up 7 percent at Rs 194 crore versus Rs 182 crore

- Provisions up 48 percent at Rs 200 crore versus Rs 135 crore

- Provisions down 51 percent at Rs 200 crore versus Rs 412 crore (QoQ)

- GNPA at 6.76 percent versus 6.73 percent (QoQ)

- Net NPA at 1.77 percent versus 1.79 percent (QoQ)

Reliance Defence Q1 (YoY)

- Revenue up 136 percent at Rs 165 crore versus Rs 70 crore

- Net loss at Rs 230 crore versus loss of Rs 135 crore

- Exceptional loss of Rs 163 crore dents profits

- EBITDA at Rs 13 crore versus Rs 1.3 crore, up 900 percent

- Margin at 7.9 percent versus 1.8 percent

Opto Circuits Q1 (YoY)

- Net profit at Rs 9 Crore Versus Rs 2 Crore loss

- Revenue down 5.9 percent at Rs 48 Crore

- EBITDA up 39.8 percent at Rs 7.5 Crore

- Margin at 15.6 percent Versus 10.5 percent

TCI Express Q1 (YoY)

- Revenue up 15.7 percent at Rs 203.2 crore

- PAT up 71.4 percent at Rs 12 crore

- EBITDA up 57 percent at Rs 18.5 crore

- EBITDA margin at 9.1 percent versus. 6.7 percent

EIH Q1 (YoY)

- Revenue up 3.8 percent at Rs 284.5 crore

- Net profit of Rs 11.5 crore versus. Net loss of Rs 12 crore

- EBITDA unchanged at Rs 28 crore

- EBITDA margin at 9.9 percent versus. 10.2 percent

Den Networks Q1 (YoY)

- Net loss of Rs 10 crore versus. Net Loss of Rs 45.5 crore

- Revenue up 27 percent at Rs 341 crore

- EBITDA up 102.5 percent at Rs 88.1 crore

- EBITDA Margin at 25.8 percent versus. 16.2 percent

Tata Investment Q1 (YoY)

- PAT up 181 percent at Rs 45 crore

- Revenue down 9.3 percent at Rs 22.5 crore

Stocks To Watch

- Coal India July sales at 4.43 crore tonnes versus 4.49 crore target

- Government to sell 3.7 crore shares in Hindustan Copper via offer for sale at Rs 64.75/share (8 percent discount)

- Dredging Corp lowest bidder for Mumbai Port Trust Project

- Lupin receives FDA approval for generic Lidex ointment

- Sharp India says its not in talks with any party for selling AC plant in Pune

- Tech Mahindra re-appoints CP Gurnani as MD and CEO for a 5-year term

- Tata Steel completes sale of Hartlepool SAW pipe mills

- JSW Steel says its looking to buy stressed assets, including Monnet Ispat

- Swan Energy unit signs pact worth Rs 459 crore for Jafrabad LNG Jetty

- Bharti Airtel is said to consider 3 percent stake sale in Infratel unit, Bloomberg reports

- GSFC restarts its Ammonia IV plant at 70 percent capacity

- Venus Remedies to consider qualified institutional placement on Aug 3

- Country Club shareholders approve sale/transfer of assets for the purpose of debt reduction

- Clix Capital may buy Religare's housing finance arm for Rs 600 crore (Economic Times)

Auto Sales Update

- Hero MotoCorp: July total sales at 6.23 lakh units versus BloombergQuint estimate of 6 lakh units

- TVS Motors: July total sales at 2.17 lakh unit versus BloombergQuint estimate of 2.75 lakh unit

- SML Isuzu: July sales down 42.4 percent at 788 versus 1,368 units

Bulk Deals

- Omkar Speciality Chemicals: Promoter Omkar Herlekar sold 1.5 lakh shares (0.7 percent) at Rs 89.93 each. He had sold 1.15 lakh shares (0.6 percent) on July 21 and 2.25 lakh shares (1.1 percent) on July 20.

- Ortel Communication: Kotak Mahindra Bank sold 2 lakh shares (0.66 percent) at Rs 43.3 each

New Offerings

- Cochin Shipyard Ltd.'s IPO subscribed 0.92 times at the end of first day of bidding

- SIS IPO subscribed 1.36 times at end of second day

Top Performers This Month On NSE 500

- Chennai Petroleum Corp: +7.05 percent

- Ramkrishna Forgings: +7.02 percent

- Voltas: +5.83 percent

- Navin Fluorine International: +5.66 percent

- Dilip Buildcon: +5.05 percent

Worst Performers This Month On NSE 500

- Godrej Consumer Products: 7.02 percent

- Century Plyboards India: -5.00 percent

- EIH: -4.97 percent

- Shilpi Cable Technologies: -4.97 percent

- Videocon Industries: -4.25 percent

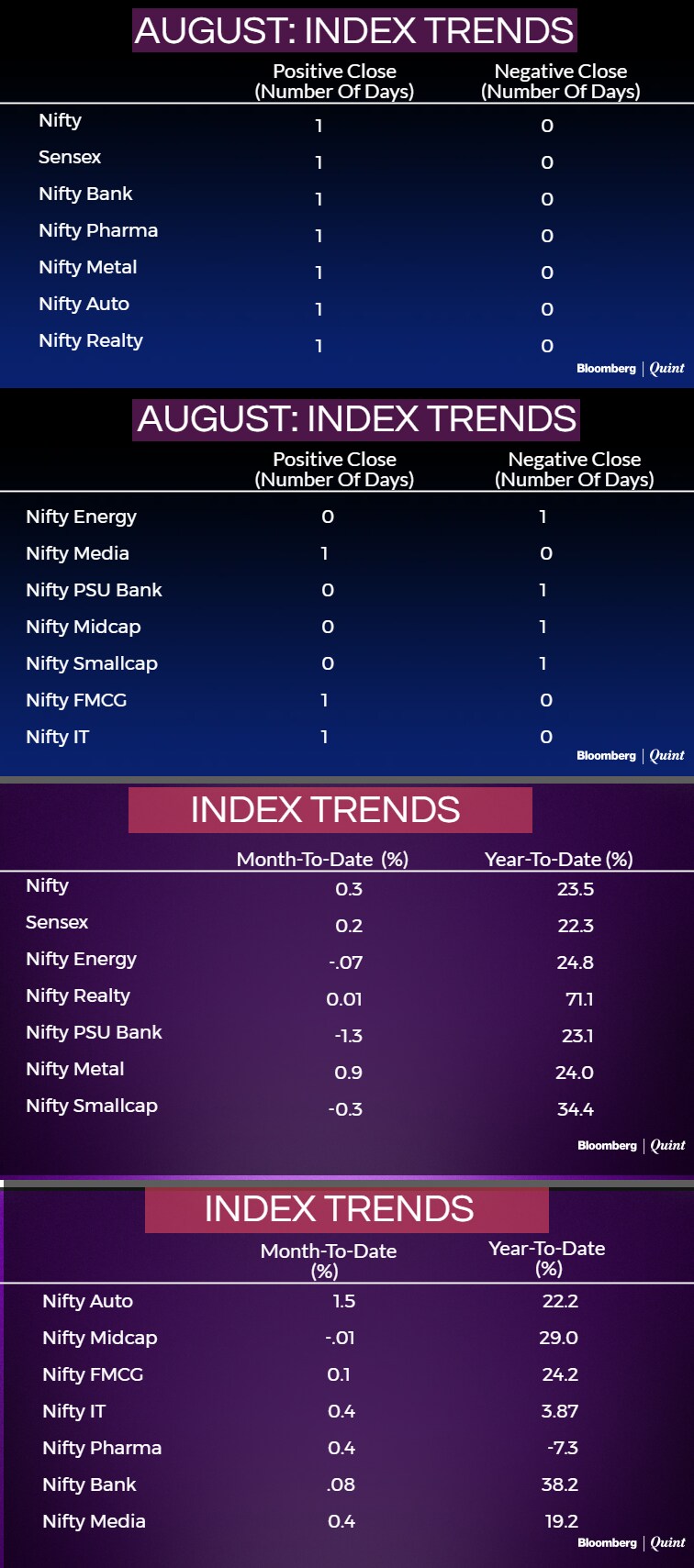

Index Trends

F&O Cues

- Nifty futures premium shrinks to 24 points from 26 points earlier

- Minor open interest addition seen on both Nifty and Bank Nifty

- Nifty range for August series in terms of open interest concentration between 10,000 to 10.500

- Maximum open interest on Put side at 10,000 strike; open interest at 49.6 lakh shares

- Maximum open interest on Call side at 10,500 strike; open interest at 34.5 lakh shares

- Put writing seen at 9,900 and 10,000 levels

- Call writing seen at 10,350 and 10,400 levels and unwinding at 10,300 and 10,200 levels

F&O Ban

- In Ban: Indiabulls Real Estate, JSW Energy, JP Associates

- Out of ban: Infibeam

- New in ban: JP Associates

- No fresh positions can be taken stocks under F&O ban

Put-Call Ratio

- Nifty PCR moves to 1.31 from 1.28

- Nifty Bank PCR moves to 0.97 from 1.10

- Alert: A higher PCR means a bullish trend

Stocks Seeing High Open Interest Change

- Marico sees open interest addition of 77 percent on short side

- Chennai Petro sees open interest addition of 50 percent on long side

- Tech Mahindra sees open interest addition of 29 percent on long side

- Voltas sees open interest addition of 23 percent on long side

- Eicher Motors sees open interest addition of 19 percent on long side

- Godrej Consumer sees open interest addition of 14 percent on the short side

Fund Flows

- FIIs In Cash Market: Sold Rs 946 crore (NSE Provisional)

- DIIs In Cash Market: Bought Rs 1,391 crore (NSE)

- FIIs In F&O Market: Sold Rs 689 crore (NSE)

- FII In Cash Market: Sold Rs 1,218 crore (On Monday; data from NSDL)

Brokerage Radar

- CLSA raises Power Grid Corp. target to Rs 265 from Rs 240; Maintains Buy

- Credit Suisse upgrades Container Corp; Raises target price to Rs 1,060 from Rs 880

- Credit Suisse raises JSW Steel target to Rs 265 from Rs 240; Maintains Outperform

- Nomura cuts Marico target to Rs 268 from Rs 275; Maintains Reduce

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.