Alibaba Group Holding Ltd.'s stock leapt almost 15% after reporting a surge in revenue from AI, underscoring the steady progress it's making against rivals in a post-DeepSeek Chinese development frenzy.

China's e-commerce leader posted on Friday a triple-digit percentage gain in AI-related product revenue as well as a better-than-anticipated 26% jump in sales from the cloud division — the business most closely tied to the artificial intelligence boom.

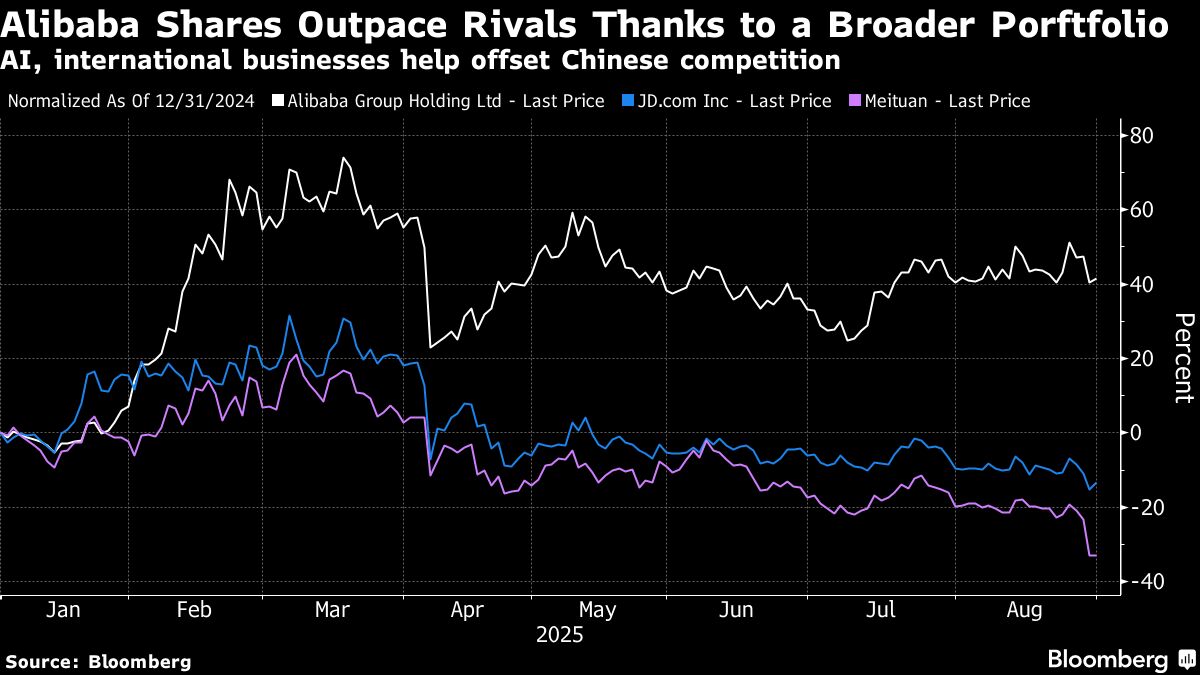

That helped assuage investors nervous about the fallout from a worsening battle with Meituan and JD.com Inc. in internet commerce. Its shares gained their most intraday since February in Hong Kong, after investors looked past a disappointing 2% rise in revenue and surprise decline in operating income.

Alibaba's progress in AI — where it is considered among the frontrunners in Chinese artificial intelligence development — helped gloss over concerns about an intense price war with JD and Meituan in the giant food delivery sector.

That three-way battle has dealt more damage than anticipated to some of the country's e-commerce leaders: JD's profit halved in the quarter while Meituan warned of major losses, triggering a $27 billion selloff of the three companies' shares last week.

The AI element helps explain why Alibaba's stock has easily outpaced its more commerce-reliant rivals this year. Alibaba has also leveraged the growth of an international arm that encompasses some of the world's most-recognized online shopping platforms from Lazada to AliExpress.

Alibaba has “China's best AI enabler thesis,” Morgan Stanley analysts including Gary Yu wrote in a research note. That's as losses from meal delivery and instant commerce peak this quarter, they argued.

Alibaba ADRs Rise With Cloud a Highlight of Results: Street Wrap

Investors are now focused on whether Alibaba will pursue that margin-eroding competition, at a time it's declared record amounts of spending toward developing AI services and computing. On Friday, commerce chief Jiang Fan argued that investments in quick commerce — food delivery and instant shopping — had already driven 20% growth in users on its main Taobao marketplace. The fledgling division has in four months grown to the point that it can begin to achieve economies of scale, he added.

Alibaba is making substantial investments in the AI sphere, developing large language models to avoid falling behind in a critical technological race.

The company views AI as essential to its future, whether in terms of providing cloud computing, powering its core business or coming up with services to challenge OpenAI and DeepSeek. CEO Eddie Wu went as far as saying in February that artificial general intelligence, or AGI, is now the company's primary objective.

Just last week, Alibaba updated its own open-source video generating model, part of a string of recent upgrades that span the gamut from agentic AI services to chatbots.

It remains to be seen if Alibaba can turn AI into a money-spinner in an increasingly competitive field. From Baidu Inc. to Tencent Holdings Ltd., Chinese firms are enhancing and releasing AI models at a frenetic pace, increasing the pressure on Alibaba to deliver breakthroughs.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.