Axis Capital began coverage of Ajanta Pharma Ltd. with an upside projection of 12%. The brokerage sees a robust growth outlook for the pharmaceutical's India business and overall stable earnings in the near term. The rating for the counter is 'Add' and the target price is Rs 3,050 apiece.

Axis Capital values Ajanta Pharma at 30 times the financial year 2027's estimated earnings per share. Its Ebitda margin will likely touch 30% in the financial year 2028, which is significantly ahead of its large and mid-cap peers barring Torrent Pharma Ltd.

Ajanta Pharma's aggressive capital expenditure will be enough to sustain growth for the next three to four years. Free cash flow will likely be at Rs 2,800 crore over the financial years 2025 and 2027. Ajanta Pharma deserves to be at a premium because of these factors, along with limited earning risk, the brokerage said.

Axis Capital expects 12% CAGR for the pharmaceutical company's India business for the period over the financial years 2024 and 2028, driven by volumes and new launches. Ajanta Pharma's recent foray into nephrology and gynaecology will add to India's business growth.

Ajanta Pharma's India business has a strong foundation because of its specialised product portfolio, with cardiovascular, ophthalmology, and dermatology products accounting for approximately 90% of its revenue, according to Axis Capital.

In the Asia region, Ajanta Pharma may deliver a 14% CAGR. New launches in the Philippines and Iraq will contribute to this growth. The US region may deliver an 11% CAGR. The West African outlook remained stable while the Anglo-Africa is set to start contributing post-financial year 2026, Axis Capital said.

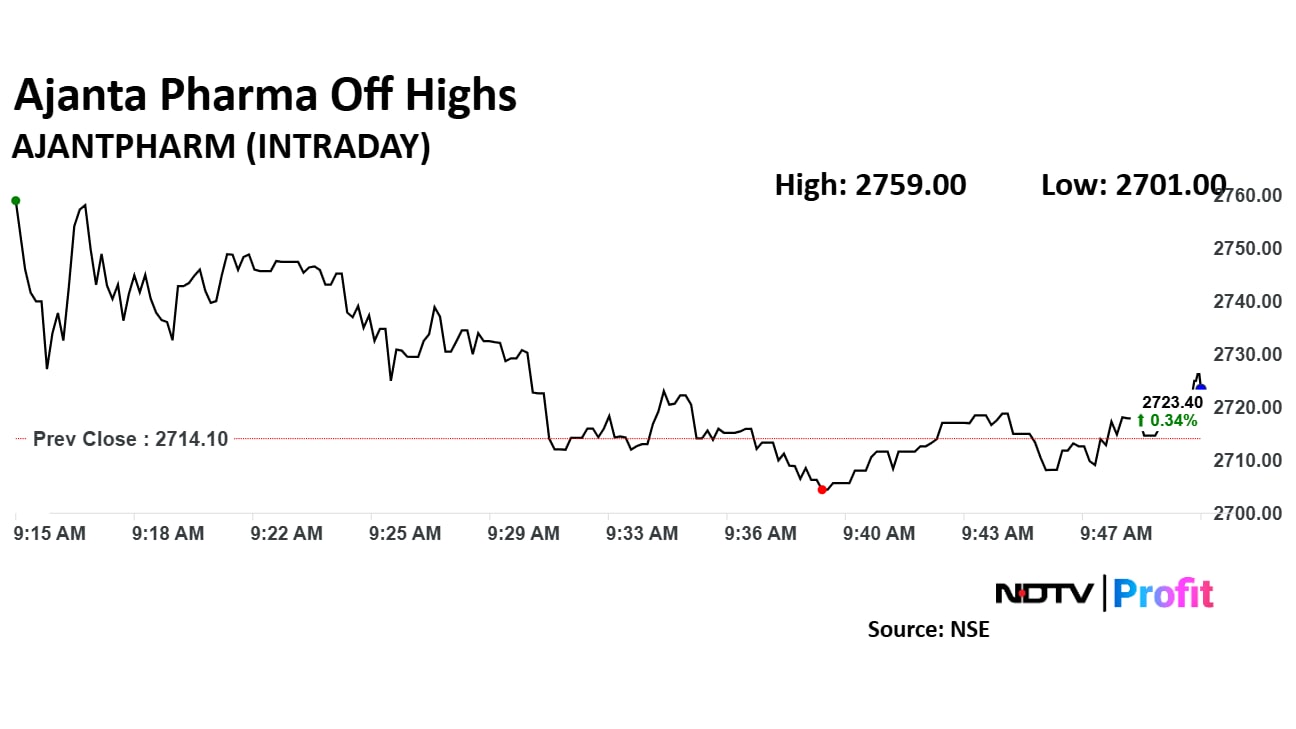

Ajanta Pharma share price rose 1.65% to Rs 2,759 apiece. It erased gains to trade 0.03% down at Rs 2,713.20 as of 9:48 a.m., as compared to 0.64% advance in the NSE Nifty 50 index.

The stock rose 22.05% in 12 months. The relative strength index was at 59.40.

Out of 15 analysts tracking the company, 12 maintain a 'buy' rating, and three suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 17.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.