Aether Industries Ltd. received a 'Reduce' rating from Kotak Institutional Equities as it initiated coverage on the speciality chemicals firm. The stock fell over 3% during the session.

The Gujarat-based company is aiming at "aggressive growth" in coming years riding on a series of growth projects, it said in a note on Dec. 13. The brokerage assigned a target of Rs 810 per share, implying a downside of 9.8% from the previous close.

The lower target is given on account of high valuation, Kotak Institutional Equities said. "Valuations are full, while key projects need to demonstrate growth."

However, the company's promoter pedigree, technical capabilities, customer relationships and research and development investments are impressive, it said. "The company stands apart from domestic peers."

Aether seems poised for "rapid growth" driven by the start of commercial supplies under its numerous long-term contracts, the brokerage said. "A sizeable and growing order book indicates potential for strong growth in coming years."

The speciality chemicals firm has already announced more than a half-dozen agreements with global customers from a range of industries, Kotak noted. A key growth driver among this is the 5-year strategic supply agreement with Baker Hughes, which should commence from fourth quarter of the current fiscal.

Kotak expects more than half of the revenue growth over fiscal 2024-27 to be driven by the contract manufacturing business, underpinned by the Baker Hughes and converge polyols projects.

Any slippages in demand projections and on the ESG front may put Kotak's estimates at risk, it said in the note.

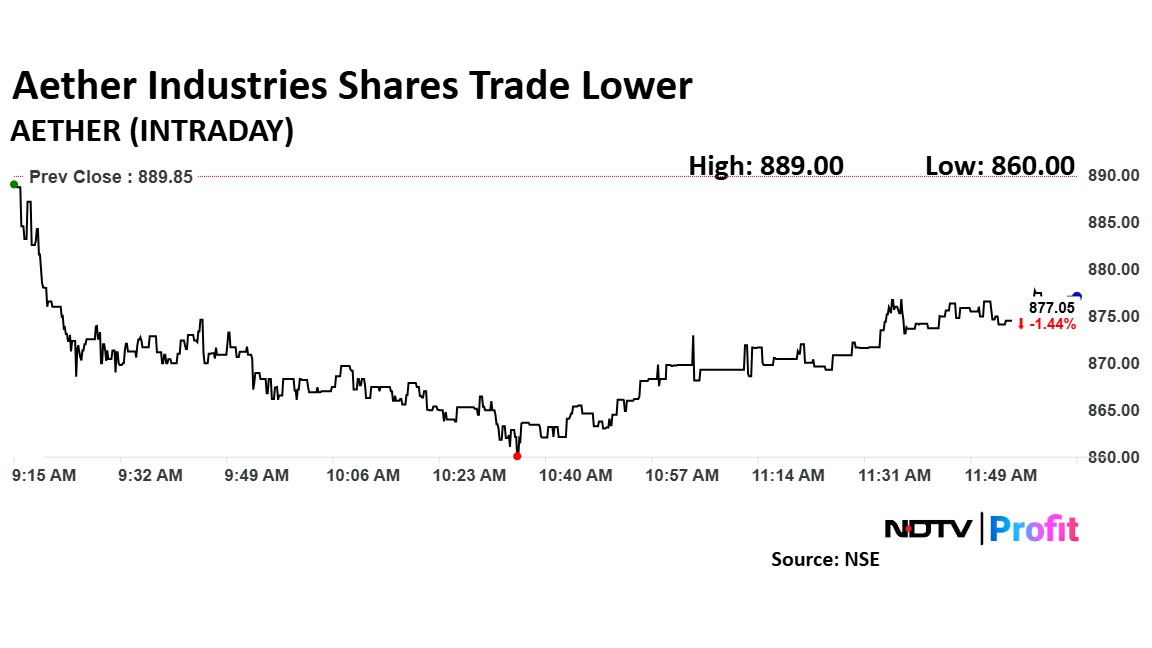

Aether Industries share price fell as much as 3.35% during the day to Rs 860 apiece on the NSE. It was trading 1.4% lower at Rs 876.5 apiece, compared to a 0.02% decline in the benchmark Nifty 50 as of 12:04 p.m.

It has risen 9% during the last 12 months and has declined by 1.2% on a year-to-date basis. The total traded volume so far in the day stood at 1.7 times its 30-day average. The relative strength index was at 54.

Four out of the five analysts tracking the company have a 'buy' rating on the stock, and one has a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 19%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.