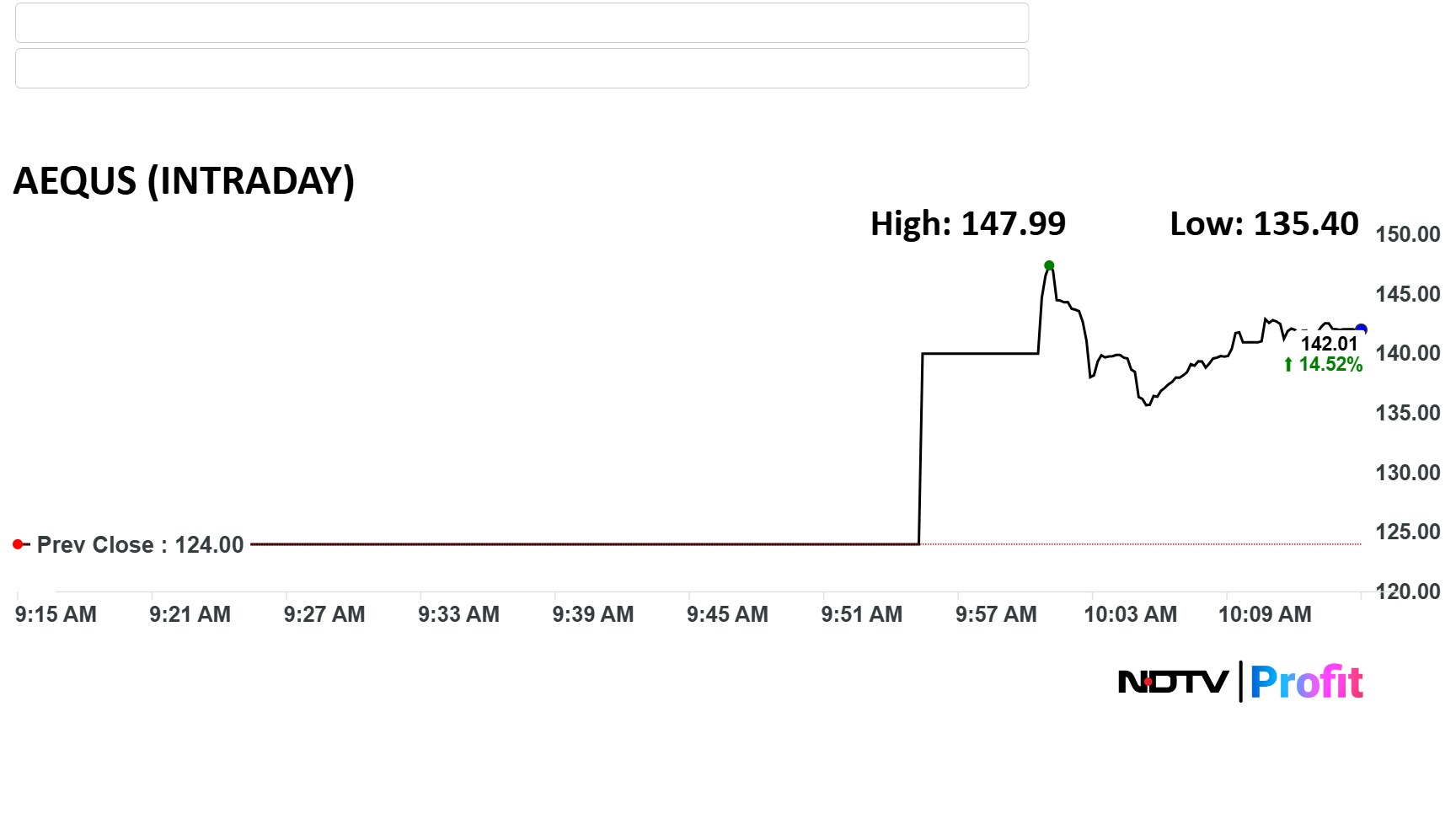

Shares of Aequs Ltd. made their debut on Wednesday, Dec.10, listing at Rs 140 per share and rose to Rs 147.99 apiece at 10:00 a.m.

Aequs shares listed at a 12.9% premium to the Rs 124 IPO price. The aerospace firm's debut propelled its market cap to around Rs 9,400 crore with robust market entry.

This follows the Rs 921.8 crore IPO's overwhelming success, subscribed nearly 102 times overall from December 3-5, driven by fervent retail and non-institutional demand.

Aequs primarily operates in the aerospace segment, but over the years, it has expanded its product portfolio to consumer electronics, plastics, and consumer durables.

Its consumer products include cookware and small home appliances, while its plastics offerings include outdoor toys, figurines, toy vehicles, and components for consumer electronics such as portable computers and smart devices.

Aequs Share Price Today

The scrip rose to Rs 147.99 apiece. It pared gains to trade 14.52% higher at Rs 142.01 apiece, as of 10.15 a.m.

This compares to a 0.34% gain in the NSE Nifty 50 index.

Aequs IPO Subscription

The initial public offer of Aequs Ltd received 101.63 times subscription on the closing day of share sale on Dec 5.

The category for qualified institutional buyers (QIBs) fetched 120.92 times subscription, while the quota for non-institutional investors got subscribed 80.62 times. The portion meant for retail individual investors (RIIs) received 78.05 times subscription.

The price band was fixed at Rs 118-124 per share for the issue.

Last month, Aequs raised around Rs 144 crore from SBI Funds Management, DSP India Fund and Think India Opportunities Fund as a part of a pre-IPO funding round. Aequs initially filed confidential draft papers with Sebi in June and secured approval in September to launch the IPO.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.