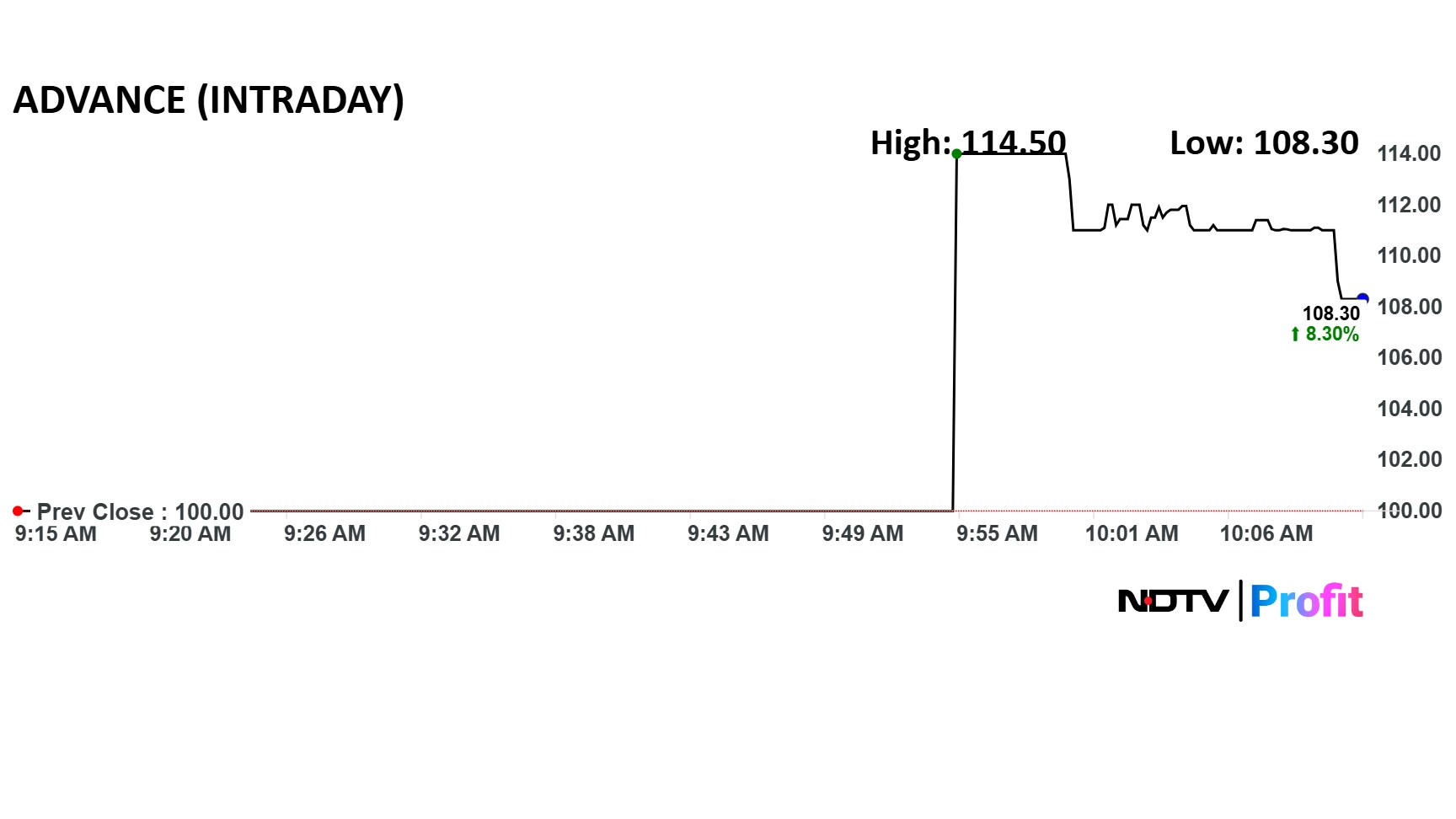

Shares of Advance Agrolife Ltd. listed at premium of 14% over the IPO price on Wednesday. The scrip opened at Rs 114 on the NSE and Rs 113 on the BSE, compared to the issue price of Rs 100.

The Rs 192.86-crore IPO received bids for 76,80,36,900 shares against 1,35,09,004 shares on offer, as per BSE data. The mainboard issue was oversubscribed 56.85 times on the last day, helped by strong participation from Non-institutional buyers (175.30 times). Retail investors placed bids of 23.6 times the offer, and institutional investors (QIB) subscribed 27.31 times.

The issue was entirely a fresh issue of 1.93 crore shares. The company raised Rs 57.77 crore from anchor investors.

The unlisted shares of Advance Agrolife were trading at a premium in the private market, indicating a potential gain of up to 13% when the shares debut on the market.

The company will use proceeds from the IPO to fund working capital requirements and for general corporate purposes.

Advance Agrolife manufactures a wide range of both technical and formulation-grade agrochemical products. The products are designed for use in the cultivation of major cereals, vegetables, and horticultural crops across both agri seasons (Kharif and Rabi) in India. The major product portfolio includes insecticides, herbicides, fungicides, and plant growth regulators.

The company has 404 generic registrations comprising 376 Formulation Grade registrations and 28 Technical Grade registrations for the agrochemicals.

It exports to seven countries, including the UAE, Bangladesh, China (including Hong Kong), Turkey, Egypt, Kenya and Nepal.

Advance Agrolife reported a revenue from operations of Rs 502 crore in the financial year 2025. Net profit was Rs 25.6 crore. On the operating level, Ebitda margin stood at 9.6%.

The company applied for IPO with SEBI in April this year. Choice Capital Advisors Pvt. is the sole merchant bank for the IPO.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.