Jefferies has maintained a 'buy' rating with a target price of Rs 1,700 for Adani Ports and Special Economic Zone Ltd., noting a strong balance sheet and healthy cash flows.

The brokerage highlighted Adani Port's aspirations to be among the world's largest integrated transport utility companies by 2030, with a focus on ports, logistics, and marine business. "ADSEZ targets 2x Ebitda rise over FY25-29E, led by ports, logistics and marine."

If Adani Ports leverages back to 2.2-2.5 times net debt to Ebitda ratio target by FY29E, it will have Rs 25,000 crore funds over FY26E-29E for acquisitions/equity actions, Jefferies said.

"As highlighted in our April 2025 note, domestic ports growth will largely be organic as ADSEZ already caters to 90% of the hinterland. Potential acquisition targets can be in International Ports, Marine and Logistics," it said.

The brokerage estimates 12% compound annual growth rate over FY25-30, owing to organic growth in domestic ports and sharp rise in international volumes on a low base.

The annual reports of the company reiterate its focus on having a strong presence in South East Asia-India-Middle East-Africa corridor, Jefferies noted.

Incremental negative news flow on group leverage, non-core expansions/disappointing market share gains at acquired ports, weak industry growth, and delay in profitable ramp-up of international/logistics business are some key risks, according to it.

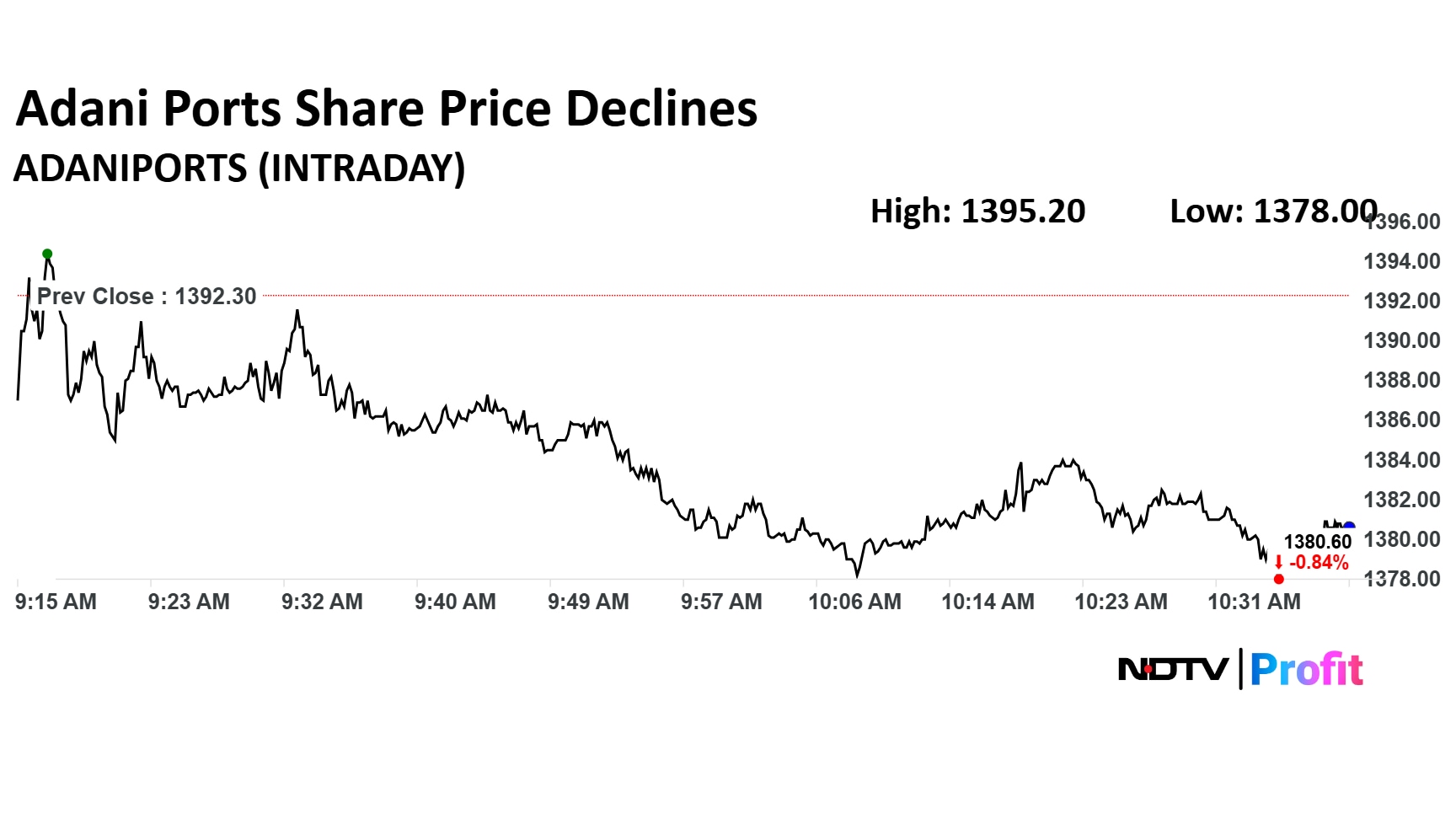

Adani Ports Share Price Today

Shares of the Adani Group company fell as much as 1.03% to Rs 1,378 apiece, the lowest level since June 16, 2025. They pared losses to trade 0.88% lower at Rs 1,380 apiece, as of 10:45 a.m. This compares to a 0.02% advance in the NSE Nifty 50.

The stock has risen 12.05% on a year-to-date basis, and is down 4.50% in the last 12 months. The relative strength index was at 53.23.

All 18 analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 17.7%.

Disclaimer: NDTV Profit is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.