Adani Group's new businesses are now set for the next phase of growth, making them potentially ripe for unlocking value.

Emerging businesses, including airports, solar and wind energy, roads and real estate, are growing in size and focus areas. Billionaire Gautam Adani-controlled conglomerate has already chalked out aggressive investment plans for each of these segments as part of its vision to invest $100 billion over the next 10 years.

According to Jefferies, the new businesses under Adani Enterprises will emerge as industry leaders. The brokerage, in a note last month while initiating coverage on Adani Enterprises, identified airports, green hydrogen, roads, data centres, copper, aerospace and defence, PVC, and water infrastructure as the next set of strategic segments.

Cantor Fitzgerald sees airports as the next business that will be demerged from the group.

The brokerages' optimism is rooted in Adani's track record of building successful businesses like Adani Ports, Adani Power and Adani Energy Solutions (formerly Adani Transmission). Since the early 2000s, the group has successfully incubated new businesses, helped them grow for years and then taken them public.

Adani Energy Solutions, which was listed in 2001, started as a long-range power transmission and distribution business. Over the years, it added local distribution in Mumbai and Mundra, and now the licences for Navi Mumbai and Gautam Buddha Nagar are under approval. The company has forayed into smart metering and has an order book of 2 crore metres from BEST and Maharashtra distribution companies. It targets a 25% market share in the segment.

Adani Ports, listed in November 2007, started with Mundra Port and acquired a string of ports along India's east and west coasts. The company now has the largest port handling capacity in India, with 13 strategic ports.

Adani Power, which was listed during the 2008 crisis, is not the largest private thermal power producer with a 16.85 gigwatt capacity and operational assets of 15.25 GW. It plans to add 5.5 GW more.

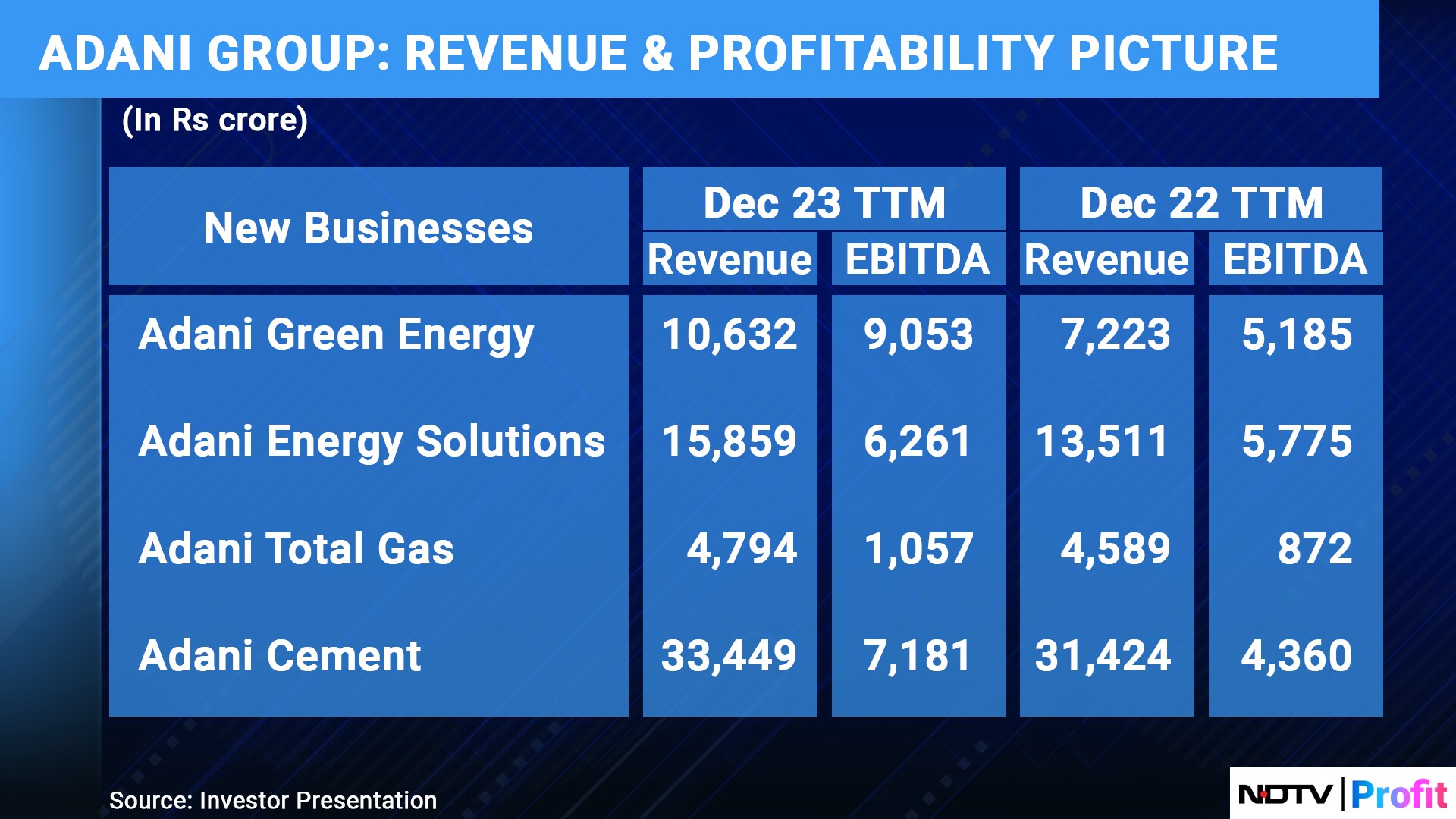

The revenue from the group's three legacy businesses—power, ports and transmission—has more than doubled to nearly Rs 73,000 crore since FY16.

Growing Share Of New Businesses

The group has now committed investments in Adani Green, Adani Total Gas, besides acquiring ACC Ltd. and Ambuja Cements Ltd. to become India's second-largest cement maker by capacity.

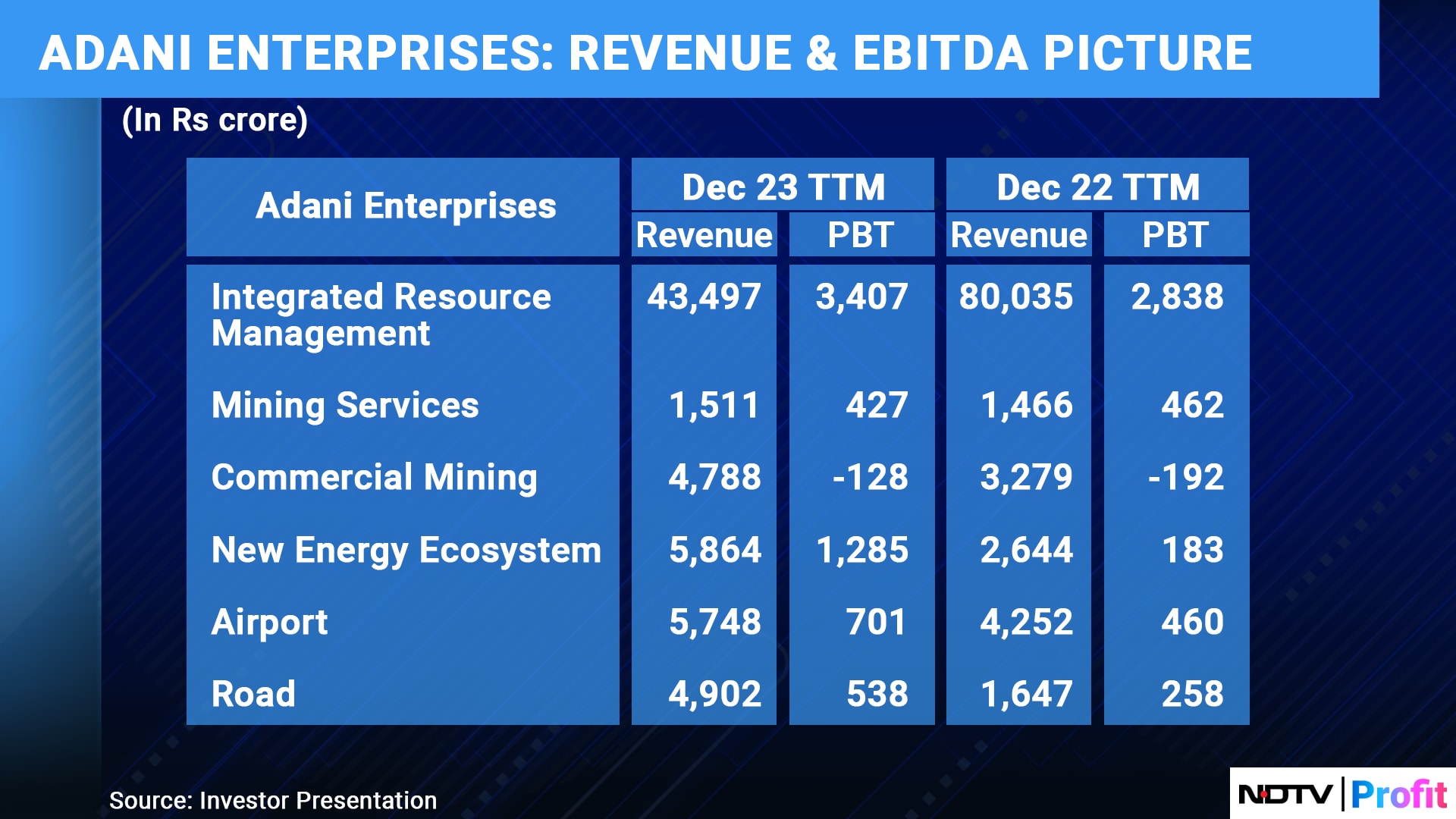

New businesses are growing fast, boosting the group's operating income. Most new segments under Adani Enterprises including commercial mining, new energy ecosystem, airport and roads crossed Rs 3,000-4,000 crore in 12 months through December 2023.

Mining services is the only segment that trailed, reporting Rs 1,511 crore revenue during the period.

Currently, green hydrogen ecosystem, airports and roads contribute 45% of the overall Ebitda of Adani Enterprises, according to the company's investor presentation.

Airports

The airport business has 65.7 million passenger movements over nine months ended December, growing 23% year-on-year. That compares with 74 million passenger movement full FY23. It added 19 new routes with nine new airlines and five new flights in the third quarter.

The Navi Mumbai project progress is on schedule and will be a key addition to the current seven operational airports. Along with Adani-owned Chhatrapati Shivaji Maharaj International Airport, it will not only reduce congestion but also enhance international traffic to India's financial capital, according to Jefferies.

New Energy

New energy ecosystem (under Adani New Industries Ltd. or ANIL) revenue has more than doubled from April to December 2023. With Adani New Industries Ltd., the solar manufacturing segment's module sales doubled to 1.9 GW, with operational module capacity at 4 GW. Adani New Industries has seen module volumes grow to 1,882 MW in nine months ended December from 1,275 MW a year earlier.

Wind turbine has seen an order book for 142 sets and supplied seven sets of generators the quarter ended December. The company is establishing a technology and development centre in Germany.

For electrolyser manufacturing, the company has gotten a letter of award to set up manufacturing capacity of 198 MW from Solar Energy Corp. of India. This was part of the 1.5-GW tenders issued by Solar Energy Corp. Of India in 2023.

Roads And Mining

The roads vertical has seen twofold revenue growth in the nine-month ended December, with close to 5,000 lane kms operational and under construction. The company has also secured some key projects, like Ganga Expressway and sections of the government's Bharatmala Project.

Mining production has crossed 21 MMT in the April-December 2023- against 29MT in FY23, with nine mining service contracts. Commercial mining coal production at Carmichael mine in Australia rose 46% in the first nine months of the fiscal to 8.3 MMT.

Its vertical that sources coal was impacted as prices of the fossil fuel fell but Ebitda rose 21%.

New Bets: Data Centres, Realty And Copper

The next generation of investments includes expansion of the company's copper segment. Its copper plant currently has a capacity of 500 kilotonne per annum and plans to increase this to 1,000 ktpa.

Adani Connex, the data center subsidiary, has centers coming in Noida and Hyderabad, with close to 60 MW under construction and an order book of 112MW.

Chennai has already become operational with 17MW capacity and Pune preconstruction work is done. Adani Enterprises aims to reach 1 GW capacity in the long term.

The realty business has secured projects too, winning a bid for Rs 30,000 crore to redevelop in Bandra Reclamation. The company also secured the Rs 5,000 crore Dharavi Redevelopment project.

Disclaimer: NDTV Profit is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.